Connecting state and local government leaders

Cuts in services may be the only answer, though activists hope to amend the constitution.

California residents attending the University of California got some good news this month when Gov. Jerry Brown unveiled his $115 billion budget plan: they will not see tuition increases over the next two years.

This was the denouement of a bitter dispute between Brown and UC President Janet Napolitano, who had announced a five-year program of 5 percent tuition hikes to defray rising costs in the system.

Brown agreed to a 4 percent-a-year increase in state funding of the university system for the next four years if Napolitano would back down on a tuition proposal that had produced large protests across UC’s 10 campuses.

Neither teachers’ salaries nor athletics nor administrative expenses were to blame for the funding debacle. Instead, the escalating costs of funding pensions for current and future retirees were at the root of the problem.

As part of the settlement with Napolitano, Brown agreed to provide $436 million toward paying down UC’s pension obligations, and he insisted on reforms that would significantly cut pension costs for new employees. Pension payouts would be capped at $117,000, down sharply from the current cap of $265,000.

This high-profile case highlighted a problem that is shared by many public institutions in California—thousands of municipalities and special-purpose entities, many more colleges and universities and the state government itself.

Together, California public entities have unfunded pension obligations that exceed $575 billion, according to independent analysts. In stark contrast, California government officials peg the total at $158 billion, which they concede will fund less than 80 percent of monies that are due to pensioners.

A book scheduled for release on May 29 by Lawrence J. McQuillan of the Independent Institute makes a detailed case that “pension officials and politicians of both political parties deliberately low-balled the contributions, increased the benefits, and underfunded pensions on a massive scale.” The book, titled “California Dreaming: Lessons on How to Resolve America’s Public Pension Crisis,” goes on to say that “true unfunded liabilities are up to nearly four times larger than official government estimates: nearly $15,000 per Californian.”

McQuillan observed in an interview that the contribution Brown agreed to make toward the unfunded liability of the University of California Retirement Plan (UCRP) is "really only a drop in the bucket of a system whose own actuary says $1 billion more needs to be contributed each year for 20 years or so to pay off the pension debt."

The problem is that governments at the state and local levels are now paying the price of profligacy: they are cutting staff and services, even in good times, to pay for their promises over the years to provide employees with generous retirement benefits.

Some cities are declaring bankruptcy: San Bernardino’s recent bankruptcy filing followed those of Mammoth Lakes, Stockton and Vallejo. Placentia and Desert Hot Springs are reportedly mulling bankruptcy as well. San Bernardino’s bankruptcy plan would wipe out 99 percent of banks’ investment in pension obligation bonds but would not reduce the city’s contributions to fully fund retiree benefits.

In the event of another economic downturn, other cities would certainly choose the bankruptcy path.

Bankruptcy may rarely allow impairment of promised pensions, as in Detroit, but the so-called California Rule—established by court rulings going back decades—guarantees that neither retirees nor people currently working for governments in the state can have retirement benefits they have earned impaired by legislative or executive action.

Echoing the California Rule, courts in both Oregon and Illinois this month invalidated laws designed to cut pension benefits already earned. A similar case is pending in New Jersey.

Soon to be unveiled is a proposed ballot initiative for 2016 that would make it easier for local governments in California to address their pension problem. Sponsored by Democrat Chuck Reed, former mayor of San Jose, and Republican Carl DeMaio, a former San Diego city councilman, the measure will seek to amend the state constitution—perhaps to vitiate the California Rule or to allow more flexibility in designing future benefit packages.

Organized labor will fight the proposal as if it were “World War III,” said one union official, with spending on both sides likely to exceed $100 million if the measure reaches the ballot.

Without a doubt, officials in other states will be watching what happens in California. Connecticut, Florida, Illinois, New Jersey, New York, Ohio, Pennsylvania, and West Virginia are among states with huge public pension problems, as are major cities like Chicago, Los Angeles, New York and Philadelphia.

Big Three Plus

California has six statewide defined-benefit pension plans—plans that promise benefit levels based on longevity and other factors and offer cost-of-living increases. By contrast, defined contribution plans like private-sector 401(k) systems collect money that earns tax-free returns in stock and bond markets but do not guarantee returns or annuities or cost of living adjustments.

Two small systems serve retired judicial officials, and one serves legislative officials, but the big three are CalPERS, CalSTRS and UCRP.

The largest, the California Public Employees Retirement System, serves 1.68 million current and former state and local government employees and their families. More than 3,000 public-sector employers participate.

The California State Teachers’ Retirement System serves 868,000 current and retired K-12 and community college public school teachers and their families.

UCRP serves 253,000 active, inactive and retired employees of the UC system and their families, not only from its 10 campuses but also from five medical centers, national labs like Lawrence Berkeley and one law school.

Together the pension obligations of these systems totaled a massive $643 billion in fiscal 2013. Meanwhile, their assets were said to be $473 billion, according to U.S. Census Bureau records.

The big three, according to the latest available fiscal 2011 data, reported deficits totaling $143 billion. They claimed that their funding ratio, assets compared to liabilities, were in the 72 percent range for CalPERS and CalSTRS and 85 percent for the smaller UCRP.

But, as McQuillan’s book relates, independent estimates by the Stanford Institute for Economic Policy Research and the “Little Hoover Commission,” a state oversight agency, put the funding ratios much lower—in the 60 percent range for the giant CalPERS ($295 billion in assets late last year), and also for CalSTRS ($181 billion) and around 72 percent for UCRP ($53 billion). At 80 percent funding, private pension plans are deemed “at risk,” and at 60 percent they must freeze benefit payments.

Stanford’s economists put the Big Three’s unfunded liabilities at $290 billion, or $23,800 per California household.

The difference in these estimates has to do with key assumptions, notably the “discount rate” anticipating the expected rates of return on assets. With higher discount rates than private plans assume, the long-range funding ratios appear better.

And other assumptions have driven public pension plans into the hole. For example, many didn’t anticipate that generous plans for police and firemen would cause many of them to retire and begin collecting benefits in their fifties.

The six statewide pension plans don’t tell the whole story of California’s public pension “mess,” as Gov. Brown once put it, for many local governments and districts operate their own pension plans. Together, these independent systems hold more than $150 billion in assets.

Of 24 systems that comprise nearly all these assets, 21 report funding ratios of below 60 percent. The Los Angeles City Employees’ Retirement System, for one, was at 46 percent in 2013. That year, then-Mayor Richard Riordan said these pension costs could send the city into bankruptcy by 2017.

In 2013, Moody’s Investors Service, which rates the creditworthiness of state and local governments, lowered the discount rate and made other adjustments that would produce more realistic estimates of pension liabilities.That, according to a study by the California Public Policy Center quoted by McQuillan, put total unfunded liabilities for all of the state’s public pension plans at $328 billion—still some $250 billion short of reality in his view.

These are debts that will be mainly borne by people who are young today—transferring their own wealth, in the form of higher taxes, to earlier generations.

Impacts Today

But all Californians today are seeing the effects of pension overhang, as public institutions cut staff and services while paying their obligations to CalPERS and other systems.

Tuitions in the public universities have been gradually increasing and doubtless will again as state subventions come under further pressure when today’s good times turn to bad.

Effects are seen particularly among local governments, which are of course also still recovering from the effects of the Great Recession. From 2008-2012, these governments’ own-source revenue grew by 4 percent while their spending on pensions jumped by 17 percent, according to calculations by Stephen Eide of the Manhattan Institute for Policy Research.

In a paper published last month, Eide explored the present and likely future effects of rising pension payments on city programs. Titled “California Crowd-Out: How Rising Retirement Benefit Costs Threaten Municipal Services,” the paper found examples of crowd-out in “every variety of California Municipality: city, county, transit agency, school district, high income, low income and throughout all regions.”

What’s now being crowded out are services that these jurisdictions undertook and expanded in flush times, when stock market returns in the pension plans were strong and many declared contribution “holidays” that lasted for years.

Nonetheless, the reductions now seem harsh to many—especially to people who have lost their jobs. Despite hiring in recent times, local governments were employing 146,000 fewer people in December than they had seven years earlier when the recession began. That’s an 8 percent decline, in contrast to a 2.4 percent gain in the private sector over the seven-year period.

Direct causality is difficult to establish, but Eide paints a convincing picture when he compares localities’ spending on pensions to their funding of services that are locally financed: police, fire protection, parks and recreation and libraries.

While pension contributions were growing 17 percent from 2008-2012, he found police funding down by 0.8 percent, fire protection by 1.6 percent, parks and recreation by 13.6 percent and libraries by 6 percent. Police staffing is lean in comparison to eastern cities, with New York, Chicago and Philadelphia running at around 4.3 uniformed cops per 1,000 residents, as compared to San Francisco and Los Angeles (2.6), San Diego (1.4) and San Jose (1.1).

Eide focuses on library hours as a sound “proxy for quality-of-life services delivered at the municipal level.” Data show that between 2009 and 2012 library hours in California municipalities were cut by about 10 percent.

Eide also makes a case that pension burdens have crowded out infrastructure spending. California now has the fourth-worst highway system, with crumbling roads, bridges and tunnels, according to one study. And money for classroom instruction has been on the wane.

In a February report on the Golden State’s public sector titled “Sunny Skies Ahead for California,” Moody’s Investors Service spied one cloud on the horizon—retirement costs—but said its analysts believe the problem will be manageable over the next five years for the state and the vast majority of rated local governments because they have options such as these:

- negotiating increased employee contributions for retiree healthcare benefits

- service level cuts

- reducing staff through attrition or layoffs

- contracting out services

- implementing pay freezes

- setting aside funds for retirement liabilities when revenues are strong

- cuts in retiree healthcare benefits

- furlough days

Solutions?

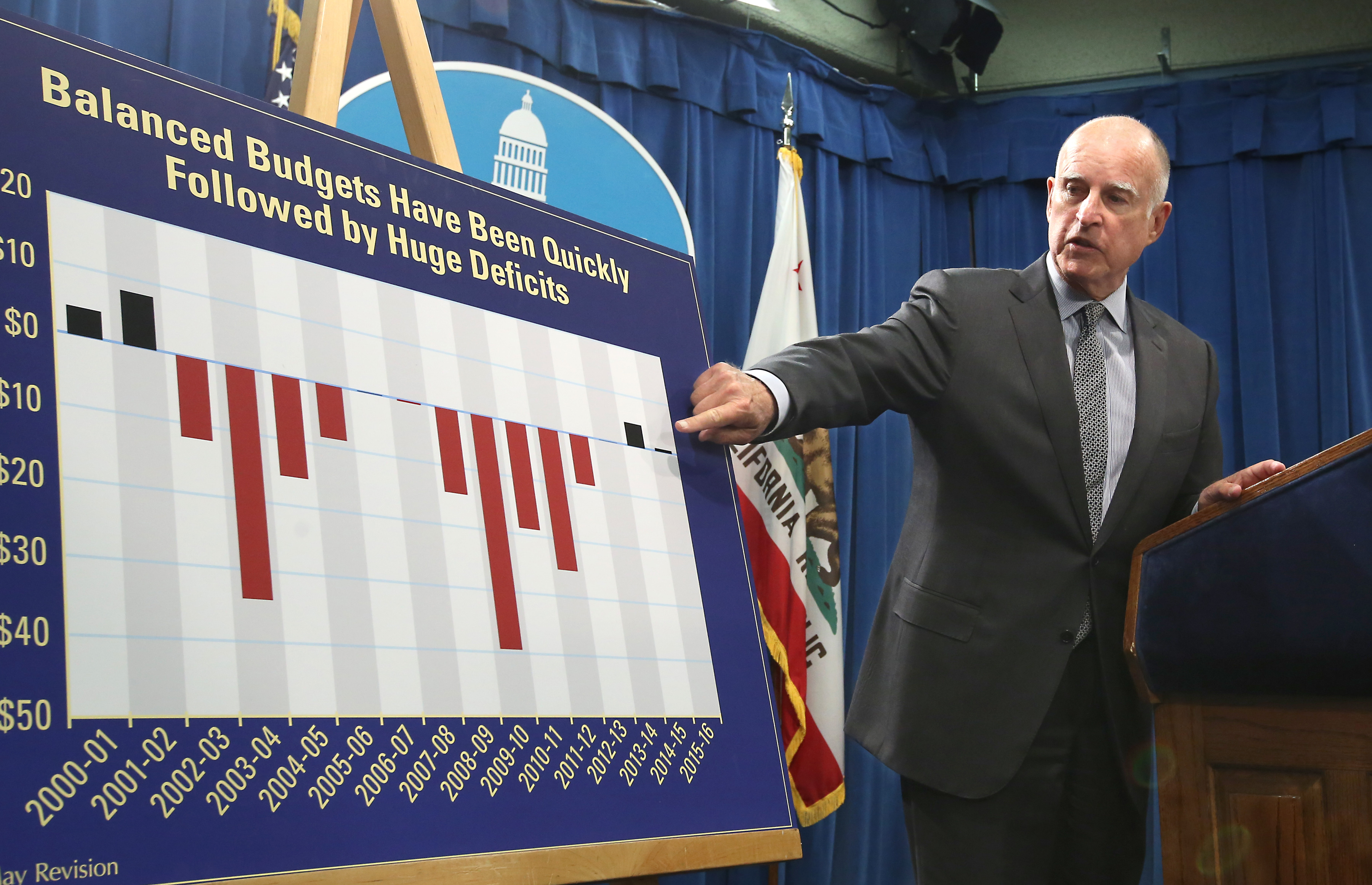

Back in 2011, Gov. Brown offered one solution to the retirement funding challenge.

“There is no doubt that we are going to have to adjust our pensions so that money coming in is going to be equal to what we can expect what the money going out will be,” he said. “It’s not even a matter of higher math. It’s fifth grade arithmetic.”

That formulation may be simple but, like the Moody’s options, it does not directly address the longer-term unfunded liabilities for people who have already retired, or for current workers who, under the California Rule, have legally unassailable contracts to receive already defined future benefits.

With little public enthusiasm for higher taxes, perhaps the only way to resolve such a large problem so long in the making is to continue gradual reductions in government services.

“We are headed for service delivery insolvency and a diminished quality of life,” says McQuillan in an interview.

But McQuillan, DeMaio and other reformers would like to see reforms enacted in the near term to help governments deal with pension pressures—at least those arising in the future.

McQuillan offers six fixes in his book:

- Require financial integrity, by means of more honest accounting;

- Require public pensions to make the so-called “annual required contribution” each year, as determined by actuarial projections;

- Ban pension obligation bonds of the kind issued (and now repudiated) by San Bernardino;

- Abolish the California Rule “to give state and local governments authority to modify pension benefits that current employees will earn in the future;”

- Switch to “reasonably priced” defined contribution plans

The federal government’s transition to a defined contribution plan, the Thrift Savings Plan, offers a path California and other states might follow. The federal retirement system is now a hybrid—offering modest defined benefits, as well as the defined contribution system.

Alaska and Michigan have led the way among state governments, each having switched entirely to a mandatory defined-contribution plan for state employees.

Several of McQuillan’s fixes would require amending the state constitution. That is a high hurdle to leap, but pension reformers are hoping they can manage to get a proposal on the ballot for the 2016 elections.

DeMaio and Reed, working toward a mid-July deadline for filing their proposal for amendments, are carefully consulting lawyers from both conservative and liberal camps as they fashion their measure. They are seeking to learn from a similar effort, by another group, that failed to secure a ballot spot in 2014.

Once they file their proposal, they will need to gather about 585,000 signatures. They hope to recruit business groups as supporters and to reach across partisan divides to enlist people who are concerned with the state’s fiscal and economic future.

But public sector unions will be fighting them tooth and nail: DeMaio says he may raise $20 million in his campaign but that he expects to be outspent five-to-one.

DeMaio is a veteran of pension reform battles in San Diego, where he was a councilman and activist reformer. One initiative, in 2012, instituted a requirement that any proposal to burden taxpayers with added public employee retirement costs would need to be approved by two-thirds of San Diego voters.

In this, DeMaio drew on the experience of San Francisco and other chartered cities in California, where similar citizen-approval requirements have effectively avoided the pension funding problems other cities face.

Another initiative curbed pension increases by stipulating that any wage increases city workers received would not count toward their expected pensions. DeMaio cites this concept of “pensionable pay” as the kind of incremental, small-step approach that may be needed to reform the statewide pension funding challenge.

Just what he and Reed will propose will not be known for a few more weeks.

Once they do file their proposal, they will watch with anticipation as the office of California Attorney General Kamala Harris drafts the title and summary of the measure—the language that will appear most prominently on the ballot, influencing the views of voters who may not read on into the fine print. Sponsors of the 2014 effort withdrew their proposal after concluding that Harris’ description of it would doom its prospects.

But DeMaio says he and Reed will go to court if they do not believe Harris’s language is fair.

Constitutional amendments are a long shot in most states, and DeMaio, playing the long game, envisions more than one.

And, indeed, pension funding liabilities that have taken decades to create will certainly take decades to resolve.

Editor's Note: This article has been updated to clarify that the "California Rule" was not a legal precedent used by courts in other states.

NEXT STORY: Budget Simulator Puts Citizens in Control of Government’s ‘Fiscal Spigot’