Connecting state and local government leaders

Working with former U.S. Comptroller General David Walker, a new PwC assessment examines the fiscal health and “competitive posture” of the U.S. state governments. And Illinois and Connecticut don’t fare well.

In their increasingly intense competition to attract businesses and wealthy individuals, states have gained a new tool: an index of their relative financial health and overall competitiveness developed by former U.S. Comptroller General David M. Walker.

It documents trends that show high-tax states with underfunded public retirement systems losing people to low-tax Sunbelt states, and also concludes that these states, many in the Northeast, are ranked relatively poorly as places to do business.

Walker, now senior strategic adviser to PwC, the worldwide professional services firm, accounting and consulting firm, has been working with PwC colleagues for about six months to develop the index.

It serves to quantify the magnitude of challenges facing states with fiscal difficulties and out-migration of businesses and wealthy taxpayers. One of these is Connecticut, where General Electric and other major employers threatened earlier this year to pick up and move operations to other states if the governor and the legislature carried through with what the companies viewed as excessive tax increases. Walker, a resident and former candidate for lieutenant governor in Connecticut, built on his close study of that state’s economic challenges to construct the larger 50-state study released this week.

Finances and Competitiveness

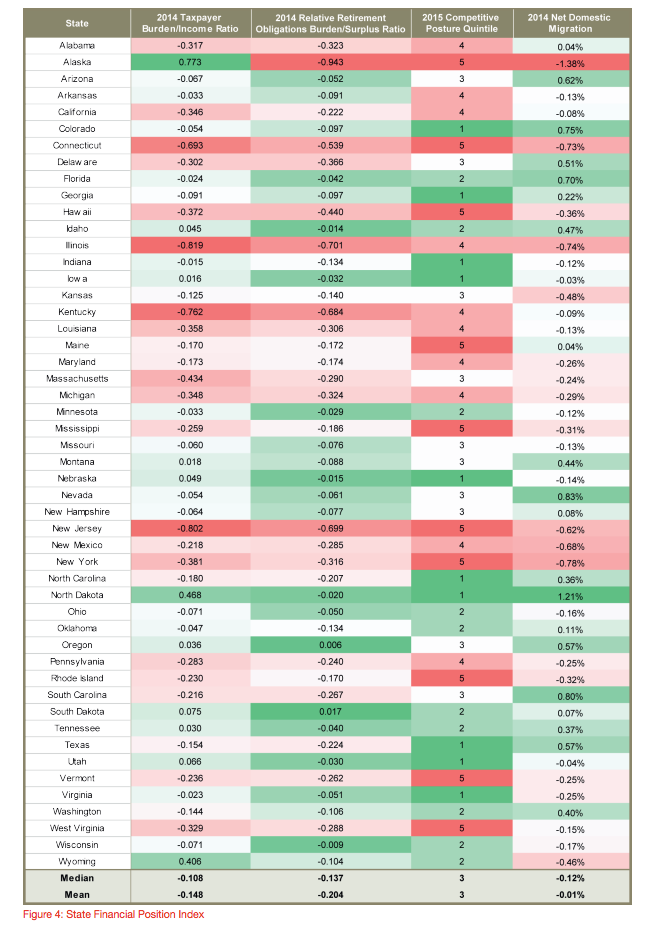

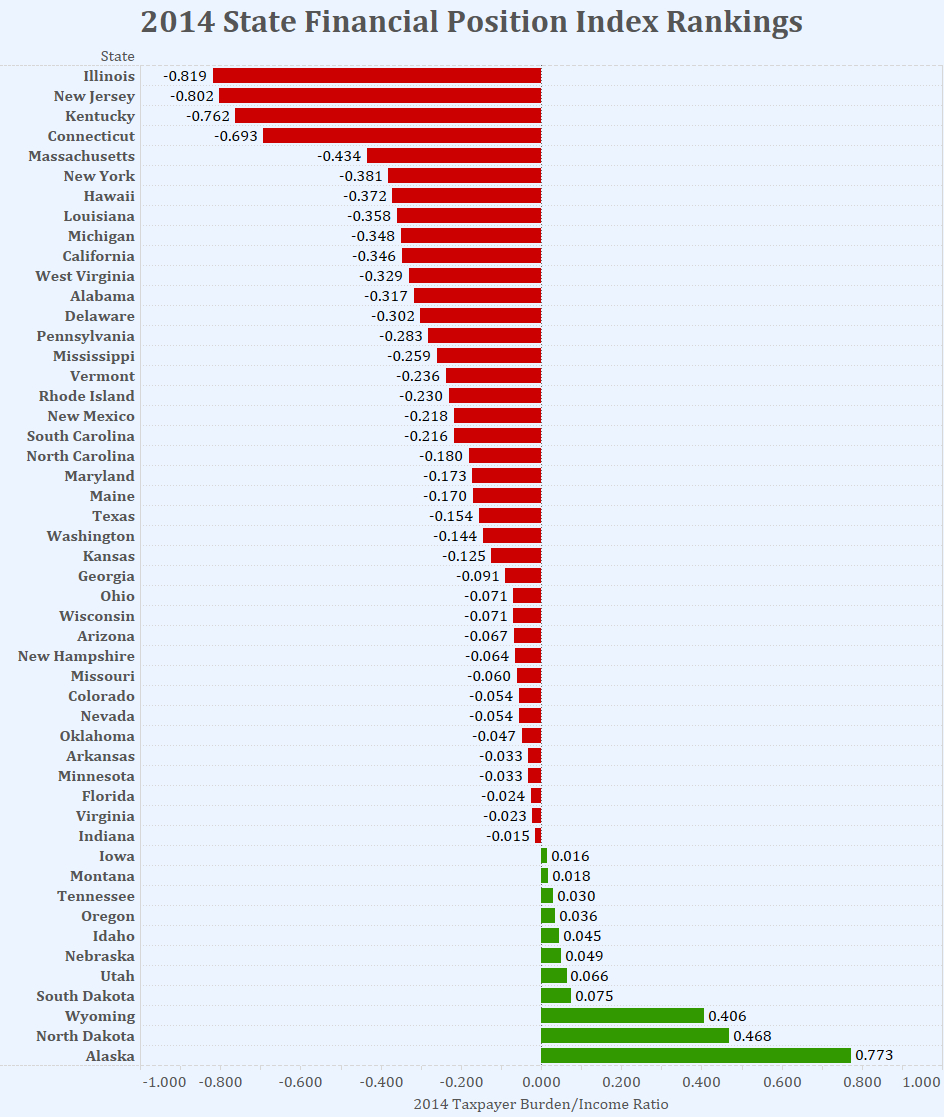

The PwC study’s innovative “State Financial Position Index” uses the latest data sets to rank the 50 states in four categories: taxpayer burden, unfunded public retirement obligations, “competitive posture,” and domestic out- or in-migration.

One finding is that taxpayer burden tends to be the highest in states that have large obligations to fund pension and retiree health-care systems for public employees. Connecticut is an example: Its public retirement obligations rank second-highest among the states (behind Illinois), amounting to 53.9 percent of median household income in the state. In turn, Connecticut’s taxpayer burden amounts to 69 percent of median household income. Obviously, most of the burden is carried by relatively affluent taxpayers. Connecticut also has experienced one of the highest rates of out-migration, amounting to nearly one-percent (0.73 percent) of the state’s population in 2014.

The Illinois figures are worse: The retirement burden in the Land of Lincoln amounts to 70 percent of median household income, its tax burden is at 82 percent of median household income and it suffered net out-migration of 0.74% of its considerably larger population.

Illinois and Connecticut are among five states the study singles out as needing to improve their relative financial condition, principally by lowering taxpayer burden. The others are New Jersey, Kentucky and Massachusetts—as is shown in the first column of the accompanying chart.

The strongest financial positions are found in energy- and mineral-rich states west of the Mississippi River: Alaska, North Dakota, Wyoming, South Dakota and Utah.

As the next column in the chart demonstrates, states with high taxpayer burdens also have high levels of unfunded retirement obligations in their public employee benefit systems. One, it seems, leads to the other.

(Walker believes, he said in an interview, that credit rating agencies “do a poor job” of rating government obligations because they don’t adequately consider “off-balance sheet obligations,” principally the underfunded pension and health programs.)

The competitiveness index, in the next column, is derived by combining rankings done by business news organizations: CEO magazine, CNBC and Forbes magazine. CEO magazine surveys more than 500 CEOs on the best and worst states for doing business, for example. CNBC analyzes 56 measures of competitiveness, including the states’ education systems and cost of living. Walker’s study produces a composite picture of the states’ business climate, and he groups them in five quintiles.

Again, most of the states in the fifth, or bottom, quintile are found in the Northeast. States with the strongest competitive positions include Texas, North Carolina, Utah, Colorado and Georgia.

Voting With Their Feet

The final column, showing net domestic migration in 2014, can be seen “as a proxy for whether individuals are ‘voting with their feet’ based on the state’s current financial position, competitiveness posture, and other factors,” the report says. New York, Illinois, Connecticut, New Mexico and Alaska are shown as having the largest percentages of their population depart. Net inflows were strongest in sunny Florida, South Carolina, Colorado and Nevada, and also North Dakota, which benefited last year from the domestic energy production boom.

People with good incomes and/or strong net worth are those most able to vote with their feet. If high-income taxpayers are leaving the troubled states, that can only serve to dig their holes deeper. This seems to be happening, as analysts at the non-partisan Tax Foundation have observed. Writing on the foundation’s website in February 2013, Kyle Pomerlau reports:

It is no coincidence that the states that are famous for their “millionaire taxes” are also famous for their overall high tax burden. These tax burdens have persisted for decades in some states. New York, New Jersey, and California, with high personal and corporate income tax rates, have routinely been among the states with the highest overall tax burdens on businesses and individuals. Small changes to the top marginal income tax rate may not be the biggest factor in a person’s move. However, when it comes time to move for retirement, or to relocate a business, high tax states are much less desirable compared to states such as Nevada and Wyoming with no personal or corporate income tax.

A recent report from Americans for Tax Reform, the conservative think tank run by anti-tax activist Grover Norquist, put a political overlay on the trend. It used IRS data to show that, in 2013, 226,773 taxpayers deserted states with Democratic governors for states under GOP control. The top five “losers” were New York, Illinois, California, Connecticut and Massachusetts. Winners were Texas, Florida, South Carolina, North Carolina and Arizona. New York lost 114,929 taxpayers representing $5.7 billion in adjusted gross income, while Texas gained 152,912 taxpayers with $6 billion in AGI.

Fiscal Trends

In the introduction to the PwC study, Walker revisits his longtime concerns about the state of the federal budget, whose long-term deficits and consequent accumulation of government debt, he has worked to highlight as Comptroller General and in the years since he left that office.

He mentions the role of federal grants in aid—which the Office of Management and Budget has estimated would amount to about $640 billion in 2015. Independent analysts have calculated that in 2012, these grants accounted for a third of the revenues flowing into state coffers. Route Fifty explored the states’ high dependence on these grants, and what the future might hold as federal budgets tightened, in a story early last year.

Wallethub, a financial analysis website, has ranked the states as to their dependence on federal spending—not only grants, but also on income from military installations and other government facilities. Among the least dependent are New Jersey, Illinois, Kansas, California, Connecticut, Massachusetts and Ohio. These states rank toward the top of the PwC fiscal stress index—but their relatively low dependence on Uncle Sam constitutes a rare bit of decent financial news.

Although federal pursestrings have loosened a bit with the big budget deal announced last week, there seems little question that cutbacks lie in the future. Tax increases will not suffice to stem the explosion of federal debt forecast during the next generation.

As the report says:

Major tax and spending reforms, including reforms relating to tax preferences, mandatory spending programs, and grants to states, will need to be considered to restore fiscal sustainability.

The PwC report allows states to see how they rank against each other on measures affecting their economic prospects—and suggests three categories of actions, ranging from wide-ranging fiscal reforms to relatively routine operational improvements. For states whose severe economic challenges place them in the first category, the PwC assessments will come as sobering news.

Timothy B. Clark is Editor at Large at Government Executive’s Route Fifty.

NEXT STORY: State Governments Hit Post-Recession Revenue Milestone