Connecting state and local government leaders

Businesses that sell to government are bullish—buoyed by an uptick in voter-approved infrastructure spending, as well as an increase in bids and RFPs.

SEATTLE — These days, change and uncertainty seem to be the one constant in the world of government and business. As we move into the middle of the year, it’s hard not to be affected by the constant reminders of risk and uncertainty all around us with a slow-growing economy, political gridlock, skepticism in government and heightened tensions around the world. But as we measured the collective “mood” of government contractors in our recent survey of contractor sales expectations, a very different perspective emerged. Contractors, vendors and suppliers are betting that the economy will continue to grow, agency budgets and spending will continue to improve, and that the “wait and see” type of caution that characterized many government contracting decisions prior to the November elections will transition to an “invest and grow” mentality in vital areas like infrastructure and technology. In short, rather than limping along in a defensive posture, the government contracting marketplace is expected to be on its front foot in the coming year - a bright spot on the landscape.

Contractor Survey Results

A total of 424 companies participated in this year’s survey and their responses revealed a finding that some might consider surprising. Businesses that sell to the government were generally upbeat about their prospects for growth in revenue from the public sector, and their sentiment had actually grown more bullish since last year rather than less. What do we mean by bullish? For starters, a full 61 percent of these contractors expect to grow their government sales in the coming year while only 7.5 percent expect a decline. These levels are improved from last year’s results. Confidence among government contractors is now at the highest point in the last three years. The index of contractor confidence has grown from 135.1 in the first year of the survey (2015) to 129.4 last year during the months leading up to the election. Finally, since this time last year it has risen by 5 percent to its current level of 135.8.

Index Illustrates Shift in Contractor Confidence

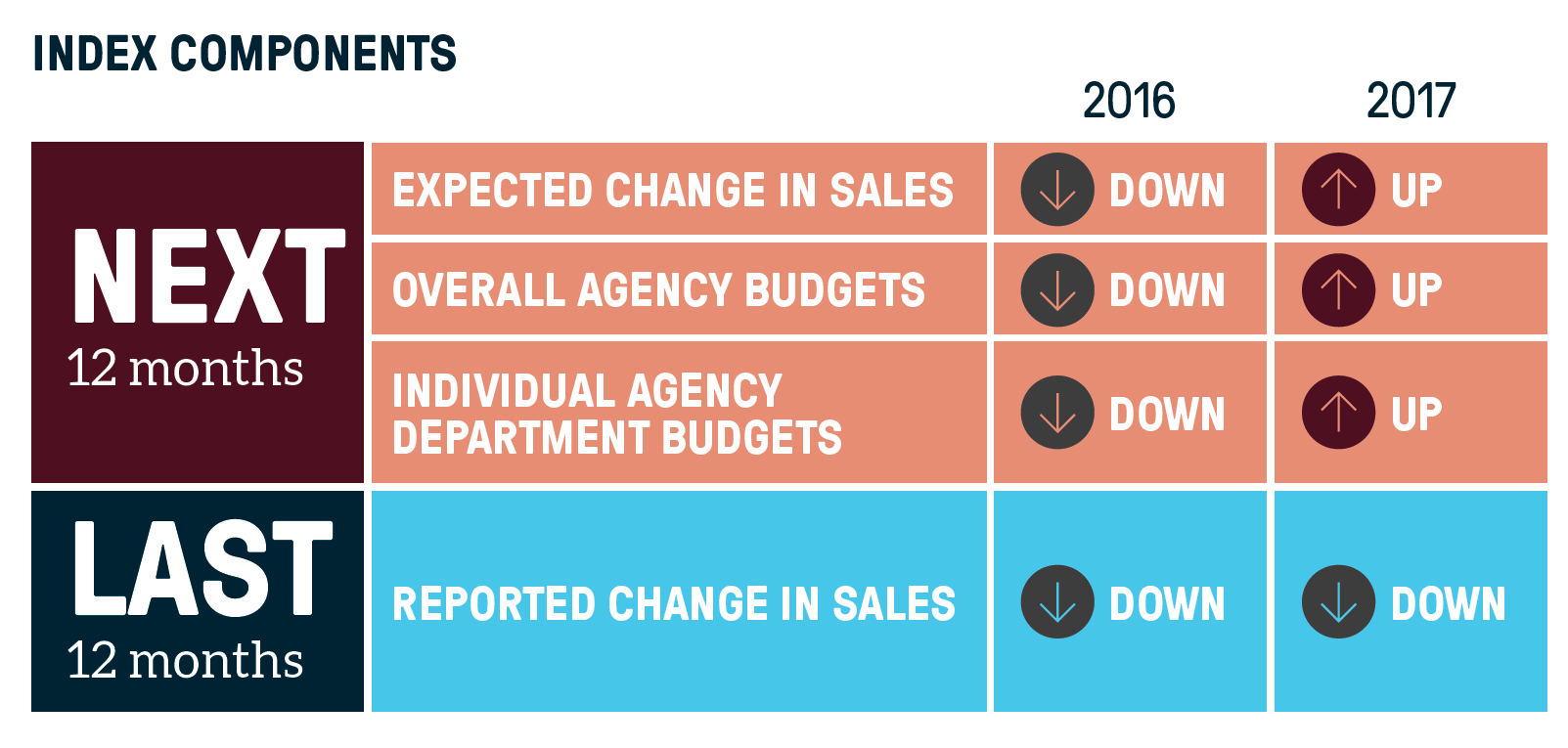

The shift in market confidence between the 5 percent improvement in the index this year and the 4 percent decline last year can be better understood by examining the number of index components that increased or decreased. This year, three out of the four components went up, compared to this time last year when all four components were in decline.

The only component to show a decrease in value this year measures changes in reported or actual sales over the past 12 months (up/down/same). While there continues to be a much higher percentage of contractors that actually grew versus those that declined in recent sales, that gap has narrowed slightly since the previous survey. In other words, while the overall rate of growth of this market continues to be positive overall, that rate has been slightly declining. At the same time, the lift in confidence in the future of government sales points to a likely reversal of this downward shift—with the entire marketplace experiencing higher rates of growth over the next 12 months.

Confidence in the Economy Drives Outlook

When other survey questions were examined, the overall picture that surfaced was of a government market that was emerging from the uncertainties of a tumultuous election year and finding a better outlook about the future. It can be argued that some agencies had a more cautious mentality until after the elections when they had better visibility into where the economy and their revenue was headed. Companies selling to the public sector appear to have a greater optimism and certainty now about the direction of the marketplace, even in the face of the persistent business risks mentioned earlier such as a slow economy. As an example, the percentage of companies expecting a positive impact on their government sales from the economy rose from just 33 percent last year to 60 percent currently (it was at 51 percent in the 2015 survey). As one vendor explained:

“While there is certainly uncertainty in the air, overall there is a sense of confidence in the economy, that I believe will translate into more tax revenue and larger budgets.”

— Office supplies vendor

Contractors Have Increased Willingness to Invest in Sales and Marketing

Many of the verbatim comments given by these companies suggested a greater willingness on the part of their executives to invest in improved sales and marketing efforts to capture more government business than last year:

"We are aggressively marketing our services to additional agencies." — Call center provider

"We have increased our sales staff for this segment of the market.” — Industrial supplies company

“We are expanding territory coverage.” — Education services vendor

Other Points Supporting a Positive Market Outlook

Survey results have their limitations but can be very useful for understanding the mentality of the businesses directly involved. Where possible, it is always good to compare a survey’s findings with those of more objective data sets that are collected for the entire market.

- New Voter-Approved Infrastructure. A review of state and local agency tax initiatives on the ballot in November revealed that $200 billion in new infrastructure projects were approved by voters. One of the drivers of optimism in the survey is a stronger focus by agencies, or commitment to spend, on infrastructure. A number of comments were made related to growth in contracting for construction or infrastructure projects. The possibilities for a federal stimulus in this area on a longer-term basis have also helped, but state and local agencies had already been ramping up their bid volume in these areas since the elections.

- Uptick in Bids and RFPs. A second independent data point that helps support the optimism of contractors is the recent increase in bids and RFPs issued nationwide by state and local governments. We noted strong growth of 4.9 percent in Q1 2017 on a year-over-year basis, following several quarters of generally flat bid volumes. This improvement wasn’t limited to infrastructure but affected a wide range of goods and services. It is possible that with the election year over, many governments are seeing things in much the same way as the contractors: Finding reasons to believe that the case for upside potential in economic growth and revenue outweighs the case for contraction or further slowing. At least in Q1, agencies appear to be moving forward and no longer holding back.

Conclusion

Government contracting is an important area of the economy, estimated to be worth $2 trillion annually between federal, state, local and education markets. It is also one that appears to be growing at a healthy pace, based on the collective perceptions of those directly involved as well as the more objective data of bid and RFP counts. Whether the expectations of the companies surveyed are fully realized will depend on the ability of the economy and agency revenue streams to continue growing as believed. While voter-approved infrastructure can actually continue to be funded at a high level if general tax revenue dips, other funding for contracts can be negatively impacted in a downturn. However, because agencies continue to need goods and services based on population size, it has been argued that the government market has the potential to offer more stability than many B2C or B2B markets if an actual recession were to happen.

Paul Irby is a Market Analyst at Onvia, a Seattle-based business-to-government sales intelligence company.

NEXT STORY: State and Local Pension Plans Shift Toward ‘Alternative’ Investments