Connecting state and local government leaders

While federal income taxes are calculated in a series of steps and most states link to one or more of those, a few states are connected to federal policy in a way that does not involve conformity to specific provisions.

This article by Anne Stauffer and Mark Robyn was originally published as part of The Pew Charitable Trusts' Fiscal Federalism Initiative.

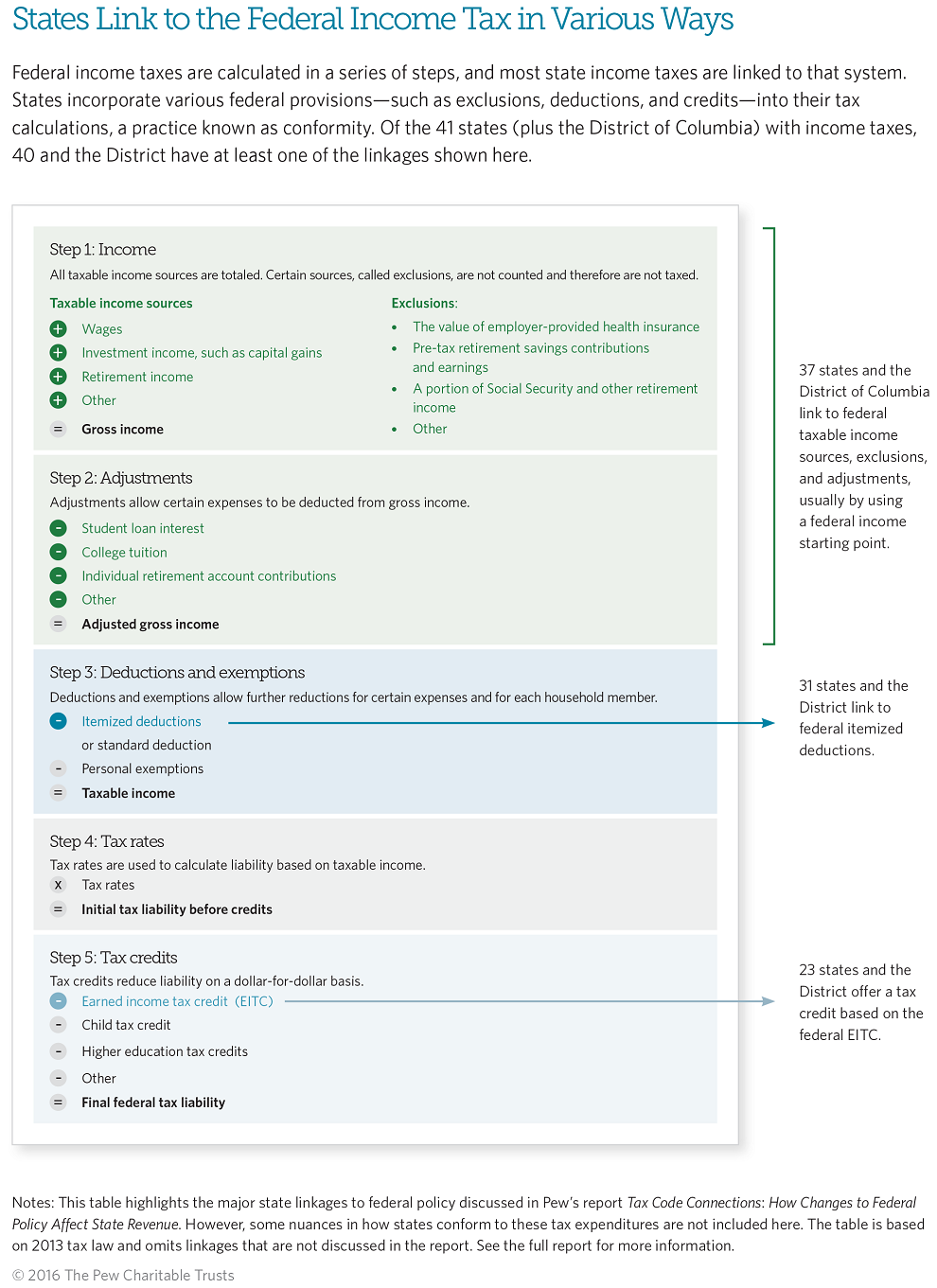

Of the 41 states plus the District of Columbia with broad-based personal income taxes, 40 and the District link to the federal tax system by incorporating a range of federal tax expenditures—exclusions, deductions, and credits—into their tax codes. These connections, also known as conformity, mean that changes at the federal level can affect states’ tax systems and revenue, and understanding them is important for policymakers at both levels of government when evaluating federal revisions or reforms. Federal policymakers should realize that changes can affect state revenue, requiring states to decide whether to revise their own tax policies, and state leaders need to weigh the trade-offs of linking to federal tax expenditures.

Federal income taxes are calculated in a series of steps, and most states link to one or more of those. This analysis provides a summary of this process based on findings from Pew’s report Tax Code Connections: How Changes to Federal Policy Affect State Revenue, which provided an in-depth exploration of state conformity as of 2013.(1)

Step 1: Income

When completing their federal returns, tax filers first add up their taxable sources of income such as wages, investments, and retirement disbursements to calculate their gross or total income. Certain types of income are excluded from gross income, including employer-paid health insurance premiums, tax-deferred contributions and earnings for retirement plans such as 401(k)s, and the nontaxable portion of Social Security.

Step 2: Adjustments

Filers may then subtract from their federal gross income certain expenses, sometimes called adjustments, such as interest payments on student loans, college tuition, and contributions to individual retirement accounts. The remaining income is their adjusted gross income, or AGI.

Most states with an income tax use federal AGI as the starting point for their tax calculations and thus conform to the federal exclusions and adjustments listed above. However, six link to the final federal figure called taxable income: the income remaining after not only exclusions and adjustments but also deductions and exemptions are subtracted. (See Step 3 below.) In both cases, exceptions occur when states selectively choose to decouple from—not link to—individual federal exclusions, adjustments, or deductions by adding those amounts back into income. In all, 37 states and the District generally followed federal exclusions and adjustments in 2013.

Step 3: Deductions and Exemptions

Federal filers then further reduce their AGI by taking additional deductions. Filers choose either to take the standard deduction—a predetermined amount based on filing status—or to itemize their deductions for specific expenses. In 2013, 23 states and the District allowed filers to claim itemized deductions based on the federal versions. Two other states had tax credits based on federal itemized deductions. In addition to the standard or itemized deductions, filers may also subtract fixed personal exemption amounts for each member of their household. The final income figure generated by these calculations is federal taxable income.

Six states used federal taxable income as their starting point and so conformed to federal itemized deductions, standard deductions, and personal exemptions in addition to the exclusions and adjustments allowed in calculating federal AGI. When these states are added to the list of those that directly linked to or offered a credit for federal itemized deductions, the total number of such states was 31 plus the District in 2013.

Step 4: Tax Rates

The next step in the federal income tax calculation is to apply the tax rate schedule to taxable income to determine the initial amount of taxes owed before credits. States do not conform to this step of the federal calculations because each state has its own tax rate schedule.

Step 5: Tax Credits

Filers then subtract any available credits to determine their final federal tax liability. In contrast to deductions, which reduce taxable income, credits directly decrease taxes owed. Some credits—known as nonrefundable credits—cannot reduce a filer’s tax liability below zero, but others—called refundable credits—can result in a negative liability or payment to the filer.

Federal tax credits are available for different purposes, such as offsetting child care expenses or supplementing the earnings of low-income workers. States also provide many different types of credits, some of which are linked to federal counterparts. The most significant such connection is to the federal earned income tax credit. In 2013, 23 states and the District offered a version of it, calculated as a percentage of the federal credit.

State Deductions for Federal Taxes Paid

A few states are connected to federal policy in a way that does not involve conformity to specific provisions. Six states permit filers to deduct all or a portion of their final federal tax liability from their state taxable income. For individual filers, this has the effect of partly offsetting a federal tax increase or decrease: A federal increase would result in a larger deduction on their state returns and lower state liability (all else being equal), while a federal cut would result in higher state taxes. Because of this link, these six states can be affected by any policy change that alters total federal tax liability, including rate changes.

DOWNLOAD: States Link to the Federal Income Tax in Various Ways (PDF)

Footnote: (1) For simplicity, this analysis focuses on broad areas of state conformity, and some nuances in federal and state law are not included.

Anne Stauffer directs and Mark Robyn is an officer for Pew’s research on fiscal federalism.

NEXT STORY: Public-Private Partnerships Offer School Kitchen Grants to More Districts