Connecting state and local government leaders

Government business intelligence provider Onvia conducted a survey that’s reason for optimism.

SEATTLE — Government contractors in the state, local and education, or SLED, market largely expect higher sales in 2015, after a year where only about 47 percent saw growth, according to a recent survey by government business intelligence provider Onvia.

Of the 188 contractors that responded, 69 percent expect higher sales this year, while 19 percent reported a decline in 2014.

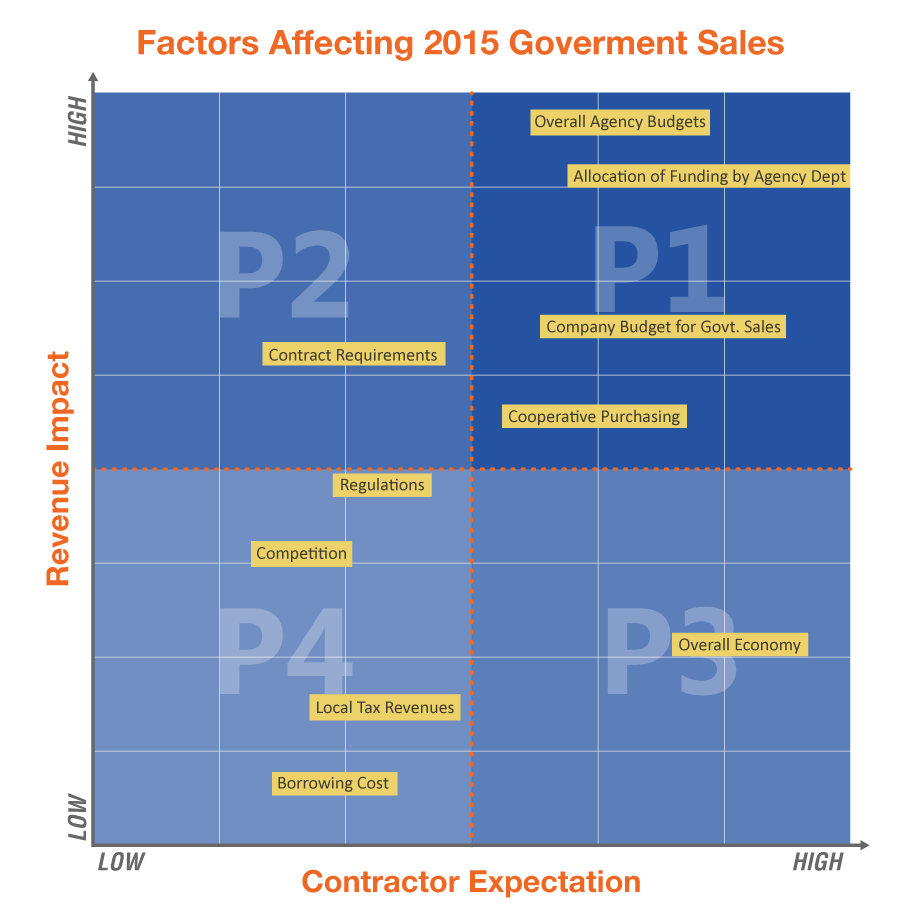

The survey asked a variety of questions to find out what was expected to impact SLED market sales for the year ahead based on 10 factors.

Which of These Factors Have the Most Actual Impact on SLED Sales?

In celebration of Route Fifty’s launch week, Onvia’s market analysis team wanted to provide readers with some further analysis of these factors.

That analysis compares how contractors perceive the importance of these factors with how much the factors actually influence government sales revenue.

Note: “Contractor Expectation” (x-axis) describes the level of contractor confidence that the factor will positively affect their government sales. “Revenue Impact” (y-axis) describes the relationship between the factor and the vendor’s expectation of government sales in the year ahead.

Which Factors Matter the Most: Using This Chart as a Tool

Here’s a useful tool for anyone who sells into the SLED market to help them prioritize their efforts with an outline of the areas that contractors should focus on, from the top priorities to the lowest priorities.

Priority 1 (P1) Areas

Factors falling into the P1 quadrant represent the highest alignment between the percentage of contractors that feel these factors will have a positive effect on 2015 sales and the impact of these factors on revenue.

These factors should be regarded as statistically proven drivers of sales, and vendors who are looking to grow SLED sales in the year ahead should be very aware of them.

“Cooperative purchasing” is one particularly recommended focus area that could positively impact 2015 sales growth, and we’ll see why later.

Priority 2 (P2) Areas

Factors that fall in the P2 quadrant represent the second highest alignment and have an above average impact on SLED sales revenues.

Only 24 percent of firms expect “contract requirements” to have a positive impact on sales over the next year. The average for the 10 factors was 31.8 percent.

However, an above-average impact on revenue suggests that contract requirements play a more significant role in determining sales outcomes than contractors expect.

Onvia’s recommendation is that contractors should actively ensure that they are on the appropriate set-aside roster or rosters for their business.

Important to note is that while federal set-aside guidelines are clear, many state governments set unique requirements for set-asides.

For IT vendors, FedRAMP certification is one particularly important area to focus on in order to ensure ability to compete.

For infrastructure and construction vendors, holding the right insurance plan or plans that are most commonly required to win contracts in their industry is a key area of focus.

Priority 3 (P3) Areas

Factors that fall in the P3 quadrant represent those that have a statistically lower impact on government sales revenue but were above average in expected influence.

While 50.8 percent of contractors reported high expectations of influence on 2015 sales for the “overall economy” factor, the data shows that even though the economy is top of mind for contractors, it isn't a major driver of impact on revenue.

Two of the highest correlating factors, “allocation of funding by agency department” and “overall agency budgets,” both located in P1, can help provide the answer as to why the overall economy matters less.

These results suggest that firms should be more concerned with how government agencies react to economic shifts rather than the economy in general.

The overall economy may play more of an indirect role in the year ahead, outranked by the stronger, more direct impact of “individual agency budgets” and “departmental funding.”

Priority 4 (P4) Areas

Factors that fall into the P4 quadrant represent those that have the lowest expectation of positive impact on 2015 sales as well as the statistically lowest impact on revenues.

These factors are still important to pay attention to, but the impact they have on sales revenue is minimal and should therefore be a lower priority.

Conclusion: Using This Intelligence to Grow SLED Sales

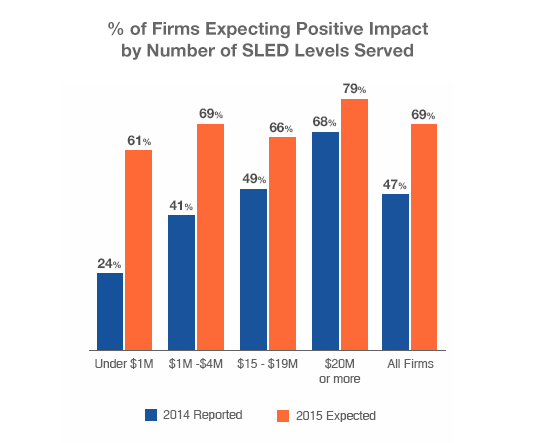

Results from the survey revealed descriptive profiles of which contractors appeared the most confident and successful in the SLED market.

By taking those profiles into account, along with the findings from the quadrant chart above, we’ve listed a few best practices for contractors who are looking to grow SLED sales in 2015.

1. Expand Business Into Additional Levels of SLED Government

Survey results show that expectations of growth vary greatly based on how many levels of the SLED market a firm targets. Contractors who pursued sales in just one or two levels of SLED government had a statistically lower expectation of growth at 56 percent.

On the other hand, contractors who serve all five levels—state, county, city, education, and special districts—had an 86 percent expectation of growth in sales.

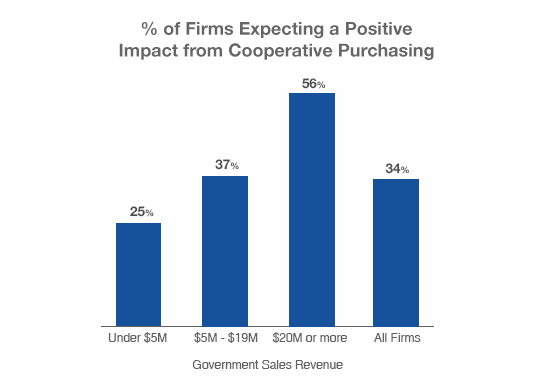

2. Consider participating in cooperative purchasing

Contractors who reported at least $20 million in government revenue also expected generally positive sales impacts by participation in cooperative purchasing, compared to only one in four of the smallest firms.

While larger firms may have more resources to participate in national purchasing cooperatives, smaller firms not yet pursuing cooperatives should seek out local or regional associations to test the market, prove capability and possibly increase their win-rate.

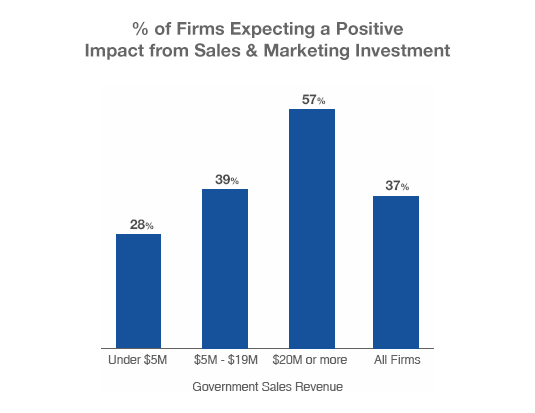

3. Invest Resources in Sales and Marketing

Of responding contractors with at least $20 million in government sales, 57 percent expected investments into their sales and marketing efforts to help grow their SLED market business for 2015.

Only 39 percent of mid-tier firms and 28 percent of smaller firms had the same expectation.

Even though this may be a riskier strategy for mid-tier and smaller firms with tighter budgets, investing in sales and marketing in order to build relationships and influence agency decision-makers is a proven business-to-government, or B2G, strategy.

Executives at firms who consider the SLED market to be a key part of their revenue stream and who want to better understand how to win more business are encouraged to download Onvia’s 2015 Government Contractors Survey Results: Selling into the B2G Market here.

NEXT STORY: Planning for Next Rainy Day, States Look at Revenue Volatility to Guide Savings Strategies