Senate Tax Plan Would Completely Scrap State and Local Deduction

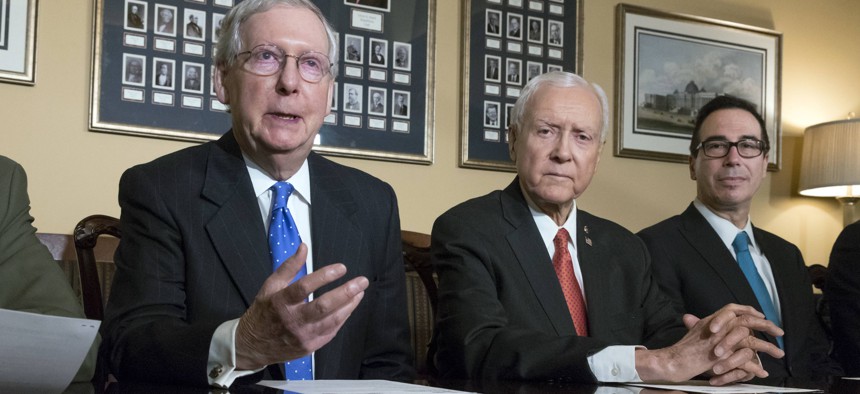

From left, Senate Majority Leader Mitch McConnell, R-Ky., Senate Finance Committee Chairman Orrin Hatch, R-Utah, and Treasury Secretary Steven Mnuchin, make statements to reporters as work gets underway on the Senate's version of the GOP tax reform bill. AP Photo/J. Scott Applewhite

Connecting state and local government leaders

Republicans in the chamber unveiled a tax overhaul proposal that deviates from House legislation in other areas as well.

WASHINGTON — U.S. Senate Republicans released a tax proposal Thursday night that differs from a House bill in significant ways when it comes to tax policy that could affect state and local governments.

The Senate plan would eliminate the federal deduction for certain state and local taxes individuals pay. This is opposed to the House measure, which would scrap the deduction for state and local income and sales taxes, while capping it at $10,000 for real estate property tax.

House Republicans passed their tax bill out of the Ways and Means Committee Thursday, without Democratic support, in a 24-16 vote.

Preserving the state and local tax, or SALT, deduction has been a priority for many state and local officials as congressional lawmakers and the White House push to overhaul the tax code.

"We vehemently oppose eliminating SALT in any tax reform plan," Americans Against Double Taxation, a coalition that represents governors, mayors, counties and cities, said in a statement Thursday.

The Senate proposal is what's known as a "chairman's mark." Finance Committee Chairman Orrin Hatch, of Utah, led-up the effort to draft the plan. A markup of it is scheduled to begin Monday.

Beyond the SALT deduction there are a number of other areas with implications for state and local governments where the Senate plan and the House bill diverge.

The Senate measure would leave the mortgage interest deduction in place for existing mortgages and newly purchased homes. In contrast, the House bill lowers the amount of mortgage debt eligible for the interest deduction to $500,000 from the current $1 million level.

Some analysts have suggested that the combined effect of rolling back the state and local tax deduction and chopping the mortgage interest deduction could drag down home values and limit new construction—especially in higher-priced areas.

The House bill caused a stir among some in the state and local finance arena with proposals to eliminate income tax exemptions for interest earned on private activity bonds and advance refunding bonds.

Private activity bonds are used in some public-private partnership deals, and states and localities can also issue them on behalf of 501(c)(3) nonprofits, including institutions like hospitals and universities.

In some situations, state and local governments can use advance refunding bonds to refinance debt and save on borrowing costs.

Investors buying tax exempt debt are willing to accept lower interest rates compared to taxable bonds. This tends to keep debt service costs down for municipal borrowers.

Hatch's plan appears to preserve the exemption for private activity bonds, while nixing it for advance refunding bonds issued after 2017.

Two tax credit programs economic development experts point to as important for poor communities and places that have seen industrial declines also seem to fare better in the Senate, compared to the House.

The House bill would phase out the New Markets Tax Credit program, which is designed to draw investment toward economically distressed areas. It would also ax a historic rehabilitation tax credit commonly used to help finance the restoration of old buildings.

The plan from the Senate does not mention the New Markets Tax Credit program. But provisions in it would make the historic rehabilitation credit less generous, repealing a 10 percent tax credit for pre-1936 buildings and lowering to 10 percent, from 20 percent, a credit for structures that meet certain certification requirements.

This post has been updated throughout with additional information about the Senate tax proposal.

Bill Lucia is a Senior Reporter for Government Executive's Route Fifty and is based in Washington, D.C.

NEXT STORY: Push to Restore State and Local Deduction in Tax Bill Is Defeated