Connecting state and local government leaders

GOP leaders in the House and Senate have voiced an openness to including a limited deduction for state and local income taxes as they move toward finalizing their tax code rewrite.

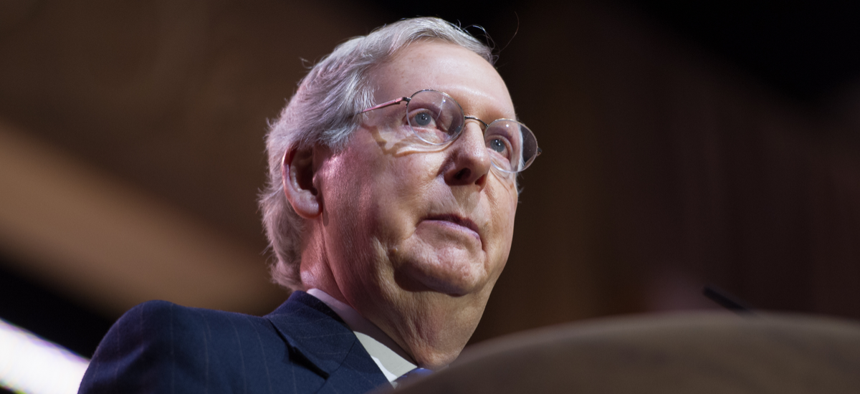

WASHINGTON — Senate Majority Leader Mitch McConnell and other Republicans are indicating that the limited state and local deduction currently in GOP tax legislation could be expanded to include income taxes.

"We put the $10,000 deduction in the Senate bill," McConnell said Wednesday during an interview with radio host Hugh Hewitt, referring to a $10,000 deduction for state and local property taxes the Senate added to its tax bill before passing it on Saturday.

"There’s some in the House who would like to see that applied not just to property, but to income tax, you know, where you can sort of pick which state and local tax you want to deduct," he added. "That sounds like a kind of reasonable idea."

But McConnell also cautioned that it is difficult to predict at this point how the GOP tax revamp could unfold as it nears the finish line.

Route Fifty asked Sen. John Thune about the odds a limited deduction for state and local income taxes could end up in a final tax bill."We're in discussions with the House about that," the South Dakota Republican replied. "We'll see where it ends up."

"Obviously we have to figure out how to get the votes on both sides," he added. "That's an issue that's important to them."

As for whether he'd support a limited income tax deduction, Thune said he'd "think about it."

The next major step in the tax overhaul process will involve House and Senate lawmakers negotiating in a conference committee to come up with a final version of the bill.

Under current law, individual taxpayers can fully deduct state and local property taxes and either income or sales taxes on their federal tax returns. Both the House and Senate tax bills would restrict the deduction to $10,000 for property taxes.

House Republican leaders indicated on Tuesday, according to The Washington Post, that they may be open to a plan that is akin to what McConnell described—including a deduction of some sort for state and local income taxes.

Meanwhile, a pair of New Jersey lawmakers Reps. Josh Gottheimer, a Democrat, and Leonard Lance, a Republican, put forward what promises to be a long-shot proposal to entirely preserve the state and local tax, or SALT, deduction.

"We hope that the conferees will look at it favorably," Lance said during an interview. He noted that the proposal from him and Gottheimer includes elements that make it not only "revenue neutral," but that would also lower the 10-year cost of the tax revamp.

Lance cast one of 13 Republican "no" votes on the House tax legislation last month. Analyses have indicated that eliminating the SALT deduction for individuals would hit taxpayers especially hard in high-tax states like New Jersey.

The congressman said he'd heard discussions "on the floor and in the cloakroom" that the SALT provisions in the bill could shift during the conference process, perhaps to allow people to claim capped deductions for either property taxes, or income taxes, on their federal returns. But he stressed that this was speculative.

He also said he did not believe he would be able to support a final bill that does not retain the existing, full state and local deduction.

"I do think we need tax reform," Lance added. "I do think we need to lower business rates. I do think that we should lower rates on individuals. But I would have approached it in a bipartisan way."

Compromise proposals on the SALT deduction fall short of what groups advocating on behalf of state and local governments are looking for.

"We continue to push for fully preserving the SALT deduction because it’s good for counties, state and local decision-making and services and middle-income homeowners," Brian Namey, a spokesperson for the National Association of Counties said in an email Wednesday.

Americans Against Double Taxation, a coalition that includes groups such as the National Governors Association, the National League of Cities and the U.S. Conference of Mayors also rejected the types of SALT compromises that appeared to be percolating on Capitol Hill.

"They don’t work and they will cause millions of middle-class taxpayers, particularly in high cost-of-living states like California, to lose all of their itemized deductions and pay higher taxes,” the coalition's co-director, Bob Chlopak, said in a statement.

Broadening the SALT provisions in the legislation would be a difficult balancing act. Republicans are seeking to permanently slash the corporate tax rate to 20 percent, from the current top rate of 35 percent, while also providing tax cuts to individuals.

Allowing for additional deductions would result in lost federal revenue. Lawmakers are seeking to limit the cost of their bill so that it does not add more than $1.5 trillion to federal deficits over a decade.

A frequent GOP criticism of the SALT deduction is that it amounts to a federal subsidy for states with higher taxes.

Lance disputed this notion.

"New Jersey subsidizes the rest of the nation," he said. "I am perfectly willing to have a conversation about who subsidizes whom. I am confident that I would win that argument."

Aside from SALT, people involved in state and local government are concerned about other aspects of the House and Senate tax bills, such as provisions that would end tax exemptions for some kinds of municipal bonds, and that would phase out or scale back tax credits used to redevelop historic buildings and to attract investment in low-income areas.

Rep. Dan Kildee, a Michigan Democrat who co-chairs the Congressional Urban Caucus, characterized the tax overhaul as it stands as "terrible for cities." He pointed to the tax credit proposals as especially problematic. "It's really anti city," Kildee said Wednesday following a forum he hosted on municipal water infrastructure.

"Particularly the House bill," he added. "A lot of the financing tools that cities use would be taken away."

This post has been updated throughout with additional comments.

Bill Lucia is a Senior Reporter for Government Executive's Route Fifty and is based in Washington, D.C.

NEXT STORY: Why It’s Getting Easier for Marijuana Companies to Open Bank Accounts