Connecting state and local government leaders

"It is crass, it is ugly, it is divisive, it is partisan legislating, it is an economic civil war," Cuomo said of the tax rewrite.

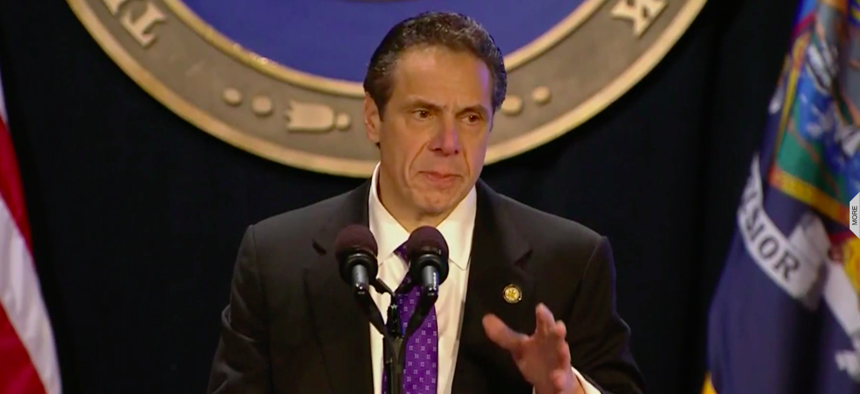

Gov. Andrew Cuomo during his State of the State address on Wednesday said New York would fight the federal government in court over the tax legislation President Trump signed into law last month.

The governor also outlined rough plans for reworking the state's tax system in response to the sweeping federal tax code rewrite, which Republicans in Congress passed without Democratic support. Cuomo, a Democrat, said more details about this restructuring plan would be revealed in his forthcoming budget proposal.

Included in the federal tax overhaul is a new $10,000 cap on the deduction individual taxpayers can claim federally for the cost of state and local property, income and sales taxes they pay.

The newly imposed restriction on the so-called SALT deduction threatens to create new burdens for some taxpayers, and fiscal pressures for government budgets, in higher-tax states like New York, California and New Jersey, according to experts.

"We will challenge it in court as unconstitutional, the first federal double taxation in history, violative of state's rights and the principle of equal protection," Cuomo said as he discussed the tax measure.

Cuomo's office did not respond to an inquiry seeking additional information about the possible lawsuit the governor described.

The equal protection clause, part of the 14th Amendment of the U.S. Constitution, calls for states to treat individuals in the same way as other people in similar conditions and circumstances.

Under the due process clause of the Fifth Amendment, the federal government is held to a comparable standard.

Amy Spitalnick, press secretary for New York's attorney general, Eric Schneiderman, said by email Wednesday that "we are working with the administration on a legal response to Washington’s assault on New York taxpayers." But she declined to answer questions about the specific claims a lawsuit would make, or when it could be filed.

Daniel Hemel, a law professor at University of Chicago Law School whose research covers tax law, was skeptical a constitutional court challenge over the tax bill would be successful. "So far, I haven't seen a credible argument as to why it would be unconstitutional for the federal government to limit state and local tax deductions," he said.

But he said the ideas the governor referred to for restructuring the state's tax code are more promising.

Cuomo said his administration is working on plans to move the state's tax system away from income taxes on individual taxpayers and toward payroll taxes, which are paid by employers.

Employer-side payroll taxes remain deductible.

So a state could give income tax relief to workers, possibly in the form of a tax credit, but impose a payroll tax on employers in order to maintain state tax revenues. The employer would pay employees less to make up for the cost of the payroll tax. But, the thinking goes, the employee, after the income tax break, would take home an amount comparable to their after-tax pay with the full SALT deduction in place.

Cuomo also mentioned creating new charitable organizations that people could make tax-deductible contributions to.

Hemel said he assumed the governor was referring to programs like those that exist in other states where a person can give money to entities like state universities, homeless shelters, or food pantries and then claim a state tax credit for some or all of that amount.

"New York could structure this in a way that you are satisfying your state tax liability by giving to a state-affiliated charity," Hemel said. And, unlike state and local taxes, charitable contributions remain fully deductible under the newly enacted federal tax bill.

Much of the SALT rollback depends on factors like what's labeled an “income tax,” rather than a “payroll tax,” Hemel said. Or what's labeled “a tax” rather than a “charitable contribution.”

"States have a lot of freedom to change the labels there," he added.

New Jersey's governor-elect, Phil Murphy, a Democrat, has indicated that he, too, may look for ways to shield his state from some of the less desirable effects of the tax measure.

Daniel Bryan, a spokesman for Murphy, would only say Wednesday that "everything is on the table," with regards to the law. "He's going to fight against it," he added. "It's a disaster for our state."

A spokesperson for California Gov. Jerry Brown, a Democrat, said there were "no updates" on whether the Golden State might take legal action over the tax code revamp.

California Attorney General Xavier Becerra's office offered an emailed statement: "The end-of-year tax measure was hastily enacted without legislative transparency or any effort at meaningful oversight and review. In order to protect the rights and interests of California's taxpayers, our office is looking closely into this matter."

Cuomo characterized the tax law as "robbing the blue states to pay for the red states," a reference to the fact that New York and other states in line to be heavily affected by the limited SALT deduction tend to lean Democratic. "It is crass, it is ugly, it is divisive, it is partisan legislating, it is an economic civil war," he added.

The governor also stressed what he sees as the need to lower local government property taxes and costs.

Cuomo said property tax levels in New York state have long been an obstacle to growth there, and that with the cap on the SALT deduction they amount to what he described as an "economic cancer."

A common grievance among county officials in New York is that their jurisdictions are stuck paying state-mandated expenses for Medicaid and other services, like child welfare and preschool special education.

The New York State Association of Counties released figures last year that showed in 2016 county Medicaid costs alone were equal to about 46 percent of the total county property tax levied in the state.

Bill Lucia is a Senior Reporter for Government Executive's Route Fifty and is based in Washington, D.C.

NEXT STORY: A Bit of Good News in a County That Closed All Its Libraries