Use of State Education Savings Plans Rising—Along With Revenue Impact

University of California at Berkeley -- California has estimated the forgone state revenue from 529 plans at $57.5 million in fiscal 2019, up 109 percent in real terms from the $27.5 million projected for fiscal 2011. Shutterstock

Connecting state and local government leaders

Trend that started before the 529 program’s 2017 expansion could affect federal and state costs

This report by The Pew Charitable Trusts' fiscal federalism initiative was written by Phillip Oliff, Laura Pontari & Rebecca Thiess.

Recent policy debates about overhauling the federal tax code have propelled 529 education savings plans into the spotlight. These plans allow post-tax contributions to grow and be withdrawn tax free as long as the proceeds are used to pay for qualified education expenses. The Tax Cuts and Jobs Act, enacted in late 2017, expanded the use of these accounts by allowing them to cover certain K-12 expenses. Now proposals are being floated for a second round of federal tax changes that could allow 529 plans to be used to pay for home schooling and apprenticeships, and to pay down student loans.

These kinds of changes have the potential to affect federal and state revenue because of the way the tax codes and laws related to 529 plans intersect. As policymakers consider the implications of changes both enacted and proposed, they should be aware that the costs—meaning the forgone revenue—of 529 plans were already rising. This spending through the tax code has historically been a small part of the total federal support for higher education, but the costs related to 529 plans have grown in recent years along with participation.

Research by The Pew Charitable Trusts finds that some states also have experienced cost increases related to 529 plans, although information on this forgone revenue is limited. Analyzing what is known about 529 plan costs and how they have changed can help policymakers understand the potential impact of the changes made by the tax bill, and others yet to be enacted.

529 plans a small but growing part of federal education support

529 plans are savings accounts intended to help Americans save for the education of a beneficiary such as a child or grandchild. They are typically administered by states and provide tax benefits at both the state and federal levels.

Post-tax contributions can grow and be withdrawn tax free as long as the proceeds are used to pay for qualified expenses. Before enactment of the 2017 federal tax law, those expenses included tuition, fees, books, room and board (if a student enrolls at least half time), and technology and equipment expenses at institutions of higher education. The new law expanded the definition of qualified expenses to include tuition at K-12 private schools but limited withdrawals for this purpose to $10,000 a year per child; there are no limits on withdrawals for approved college expenses.

To date, the forgone federal revenue from 529 plans has been modest compared with other forms of federal support for higher education. In 2017, the costs totaled $2 billion, about 6 percent of all federal tax expenditures on higher education. But these costs have grown, rising by about $389 million—nearly 25 percent—since 2010, after adjusting for inflation. The Treasury Department projects that by 2027, the total will more than double to $4.1 billion in nominal terms and rise to 10 percent of higher education tax benefits. The department made those estimates before Congress expanded 529s to allow for certain K-12 expenses; the projection reflects the law as of July 2017.

Cost growth is consistent with rising 529 use

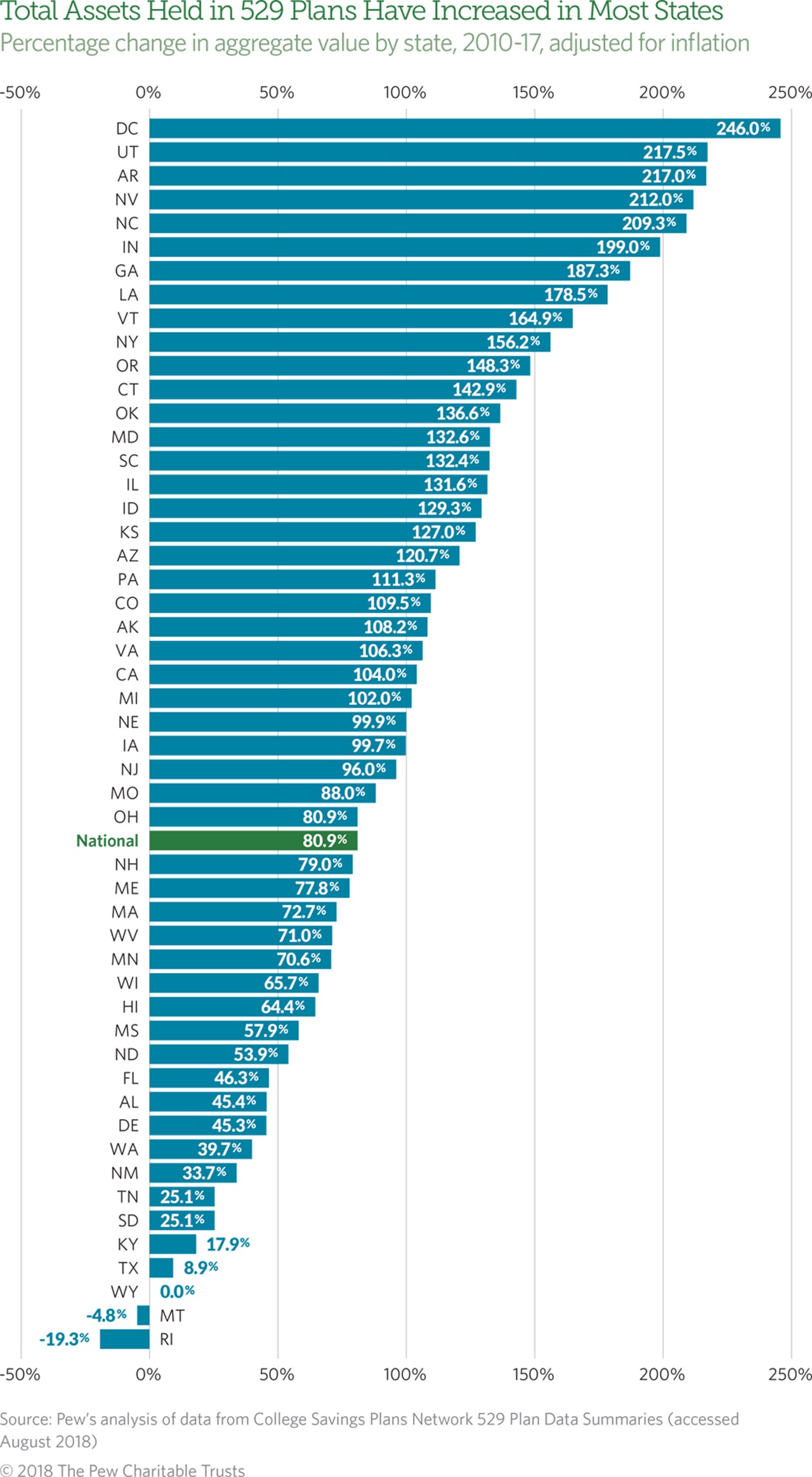

This pattern of rising costs mirrors growing use of 529 plans. Nationally, total assets held in state-sponsored plans grew from an inflation-adjusted $176.2 billion in 2010 to $318.7 billion in 2017, an increase of 81 percent. The analysis includes information from the College Savings Plans Network and includes only data from state-sponsored 529 plans. It does not include 529 plans operated by private firms. Assets in 529 plans increased in all but three states; 38 plus the District of Columbia recorded increases of greater than 50 percent.

This growth reflects two key trends:

- The number of accounts rose from about 10 million in 2010 to 13 million in 2017, an increase of 30 percent. This jump occurred as the population under 18 remained fairly flat, dropping slightly from 74.2 to 73.7 million, a decline of 0.7 percent.

- The average account size also grew, rising by 39 percent in real terms from 2010 to 2017 to an all-time high of $24,057. Increased contributions and growth in existing assets probably contributed to this trend, but data limitations preclude breaking out how much is attributable to each.

Plans affect state tax revenue, but information is limited

Increased use of 529 accounts may also have an impact on state-level tax benefits related to the plans. Previous research by Pew found that all 41 states and DC that levied a personal income tax in 2014 followed the federal government in allowing 529 plan earnings to grow tax free as long as the money is used for qualified higher educational expenses. These states typically begin their tax calculations with a federal definition of income—the adjusted gross income or taxable income—that excludes these earnings. In addition, 33 states and the District provided income tax deductions or credits for 529 contributions as of 2014. There are no additional tax deductions for contributions to 529 plans at the federal level.

Information on the state costs of 529 tax benefits—tax deductions or credits for contributions as well as the tax exemption granted on investment returns—is limited. In prior research, Pew was able to obtain at least partial cost estimates for only about half the states that provided these tax benefits in 2014. Still, in at least some states where cost information is available, the lost revenue appears to mirror patterns at the federal level. For example:

- California has estimated the forgone state revenue from the plans at $57.5 million in fiscal 2019, up 109 percent in real terms from the $27.5 million projected for fiscal 2011 (both numbers are adjusted for inflation.) By comparison, California spent $1.9 billion on financial aid in fiscal 2016. California does not provide a deduction or credit for contributions to 529 plans. That means the loss in revenue comes exclusively from account growth that is not taxable.

- Pennsylvania has estimated the forgone state revenue from 529 plans at $32 million in fiscal 2019, an increase of 45 percent in real terms over the $22 million in forgone revenue for fiscal 2010 (both numbers are adjusted for inflation). By comparison, Pennsylvania spent $449 million on financial aid in fiscal 2016. In addition to tax-exempt withdrawals, Pennsylvanians can deduct up to $14,000 annually for contributions to 529 plans.

States should consider future costs of 529 plans

To ensure that policymakers are deploying resources effectively, those considering the implications of recently enacted and proposed 529 expansions should pay close attention to the overall costs and how they fit within their states’ broader systems of education investments. Forgone revenue from 529 plans is a moving target because of uncertainty about participation and investment returns, among other factors, which means lawmakers need to comprehensively track these costs over time. Increased awareness of and participation in these plans could mean greater forgone revenue in coming years.

States also need to close the information gap on publicly available estimates of the forgone revenue associated with 529 plans. These actions could help policymakers better understand the overall costs and the relationships between the state and federal programs that support education. With solid data, they will be better prepared to assess the best use of education dollars to achieve key policy goals.

Phil Oliff is a senior manager, Laura Pontari is an associate, and Rebecca Thiess is an associate manager with The Pew Charitable Trusts’ fiscal federalism initiative.

NEXT STORY: The Soybean-Producing States at Risk in the Trade War With China