Connecting state and local government leaders

Washington and Oregon voters will decide on measures that would prohibit certain taxes on sugary drinks and grocery businesses.

Major soft drink companies and large grocery firms have pumped millions of dollars into campaigns for two ballot measures in the Pacific Northwest that would block future increases in state and local taxes that could affect their lines of business.

The state initiatives, one in Washington and the other in Oregon, are on the Nov. 6 ballot.

Both are framed as efforts to protect consumers. But there are currently no immediate plans to impose widespread taxes on most grocery items in either state, and critics portray the measures as largely attempts by corporations to secure favorable tax treatment.

While the initiatives are similar, they differ in key ways.

The Washington measure would create a state law to prohibit local governments from enacting a range of taxes on groceries.

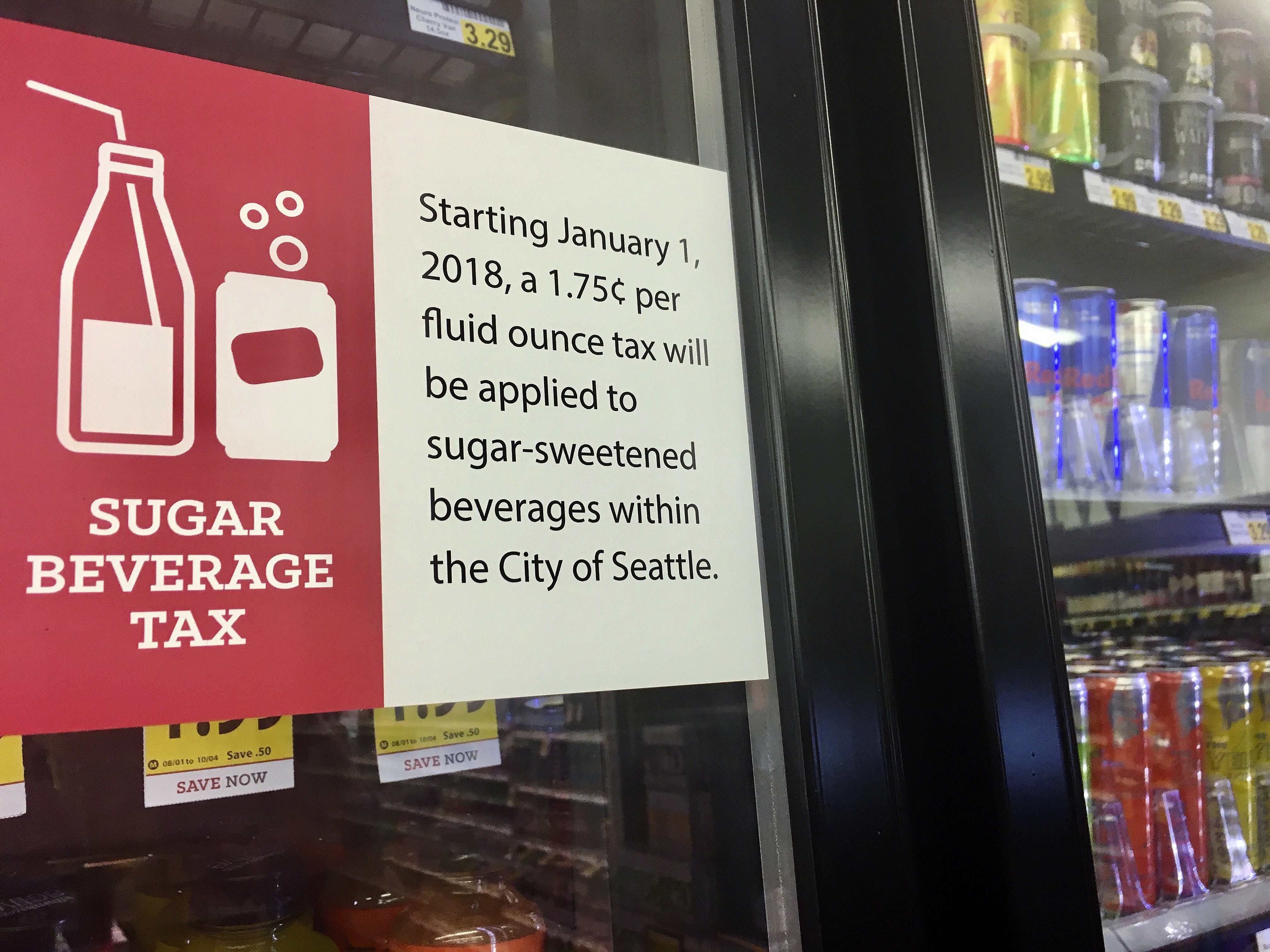

It emerged after Seattle imposed a tax on sweetened drinks that went into effect in January. The initiative is drafted in a way that would let the city’s law stand as is, but it would not allow for the tax to be raised or expanded in scope going forward.

Top contributors to the “Yes! To Affordable Groceries” campaign backing the measure include Coca-Cola Co. ($9.6 million), PepsiCo, Inc. ($7.2 million) and Dr. Pepper Snapple Group, Inc. ($3 million).

Contributions reported for the campaign were about $20.2 million, through Oct. 15.

Oregon’s measure would amend the state’s constitution to prohibit many state or local taxes on groceries. It would shield grocers from a number of business levies and comes two years after a failed ballot measure that would have increased a tax for large corporations.

AARP Oregon, which advocates for seniors, is one of the groups opposed to the current grocery tax ballot item—Measure 103.

"If this measure really was just saying, it’s crystal clear, ‘we're never going to tax groceries in Oregon,’ then AARP may actually support it. Because we do not support a tax on groceries,” said Jon Bartholomew, government relations director for the group.

“Taxing groceries as a whole,” Bartholomew added, “I’ve not heard anything about people trying to do that.”

He says he thinks the initiative’s patrons are trying to sell it as a prohibition on grocery taxes, but are actually trying to avoid possible corporate tax increases that they could face.

Advocates for the initiative disagree. “We're just saying: ‘future taxes cannot be applied to the sales of groceries,’” said Dan Floyd, a spokesman for the “yes” campaign for Measure 103.

Seattle’s Sugary Drink Tax

Seattle’s tax on sugary drinks is not a sales tax, but rather a “privilege tax.” It’s assessed at a rate of 1.75 cents per fluid ounce and applies to the distributors who sell the drinks to retailers.

The rationale behind taxing beverages like soda is that the drinks can increase health risks related to obesity and diseases like diabetes. Seattle joined a handful of other cities that have imposed similar taxes, including Boulder, Colorado and Philadelphia.

The movement to cut back on soda consumption—and raise local revenue—through sugary beverage taxes has sparked state legislative battles in Arizona, Michigan and California in the past couple years.

All three states have banned cities from imposing new sales taxes on those drinks, although no local laws had been previously enacted in either Arizona or Michigan. Under the California law, the four cities with soda taxes on the books will be allowed to keep them.

Research is underway, but not yet available, looking at how the Seattle law is affecting consumer behavior. Recent studies measuring what happened after Philadelphia’s tax went into effect in 2017 showed that adult consumption did drop after prices increased.

In terms of revenue in Seattle, during the first half of this year, the city collected about $10.6 million from the tax, according to its Department of Finance and Administrative Services.

Candice Bock, government relations director for the Association of Washington Cities, which does not have a stance on the ballot proposal, says Seattle is the only city in the state with a sugary drink tax, and that the AWC is not aware of others now seriously considering the policy. Bock also pointed out that Washington’s tax code includes exemptions from sales tax for many grocery items.

‘Loophole’

Jim Desler, a spokesman for the campaign backing the proposal, the Keep Groceries Affordable Act of 2018, says Seattle’s sugary beverage tax exposed a “loophole” in state law that allows local governments to tax food and drinks. The initiative, he said, seeks to close it.

“It's about fairness and affordability,” he said.

Desler also argues that Washington, a state with no income tax, has a regressive tax structure—meaning people who earn less shoulder a proportionally greater tax burden than those who earn more.

“Leaving any opportunity, even the possibility, for local governments to impose these taxes,” he said, “will not only perpetuate this regressive system, but will only make matters worse.”

If approved by the voters, the measure would prevent local governments from imposing new taxes on grocery items—including the manufacture, distribution and sale of those goods. It would also prohibit localities from raising existing grocery taxes. The law would apply to taxes and fees imposed or changed on or after Jan. 15, 2018. Alcohol, and marijuana and tobacco products are not covered by the measure.

Desler acknowledges there are no major proposals on the table in Washington state to tax grocery foods and drinks. “We’ll concede that this is a proactive measure,” he said.

Another criticism he levels against Seattle’s sugary drink tax is that retailers can opt to offset its expense by raising prices on other goods. In other words, a distributor ups the price of soda in response to the tax, the price hike is passed to a retailer, and the retail store owner then might decide to raise the price of, say, bread to make up for it.

“You have a targeted item,” Desler said, “but that spreads to other items in the grocery cart.”

While the bulk of the money backing the ballot measure is from drink makers, supporters also include the Teamsters, the Korean-American Grocers Association of Washington, the Washington Farm Bureau and the Seattle Metropolitan Chamber of Commerce.

Prem Singh, a Seattle convenience store owner who is part of the coalition endorsing the measure, said in a recent letter published in The Seattle Times that the city had not done enough outreach to businesses before implementing the sugary drink tax.

“Confronted with razor-thin margins, I have had to increase prices across my shelves to stay afloat,” Singh added.

Local Control

Vic Colman is campaign manager for the Washington Healthy Kids Coalition, a group that opposes the measure. He calls the initiative a “pretty transparent ploy” by the soda industry to preempt localities from imposing sugary beverage taxes, by convincing voters that the taxes are a slippery slope toward taxing of other grocery store items.

“The message they're pushing is: ‘They're coming for your groceries next,’” Colman said.

His campaign operation lacks the financial horsepower the “yes” effort has, with only about $23,100 in contributions, according to campaign finance reports filed through Oct. 22.

Colman stressed that he does not see the ballot initiative as a referendum on soda taxes. “You can be opposed to the idea of sin taxes, and sugary drink taxes, and still not like this particular initiative,” he said. “What folks are actually voting on is local control.”

“I mean that's what the initiative is legally about,” he added, “taking away the control of cities … to come up with revenue ideas.”

This aspect of the measure does not sit well with Spokane City Council member Kate Burke, who opposes the initiative. She says she would not currently support a soda tax, due to concerns about how it would affect lower-income residents, but that her position on this could change if there were to be broader reforms to the state’s tax system.

There was some discussion about the possibility of taxing sweetened drinks in Spokane, she said, prior to her joining the council in 2017.

“I think it should be left up to the municipalities and the elected officials,” she said as she discussed the possibility of the tax. “Eventually, it could be a good choice for some cities.”

Desler counters that the ballot initiative gives voters direct power over sugary drink taxes. “The people, not the politicians will decide whether this is the right thing to do,” he said.

Public polling on the initiative is limited. But a recent survey of 405 registered state voters, by the news website Crosscut and the pollster Elway, found that only 31 percent of respondents said they would vote for the initiative, while 51 percent said they would vote against it.

Colman said some voters he talks to are confused about the purpose of the measure and whether they’re voting on some sort of tax.

As for the fairness of soda and sugary drink taxes, Colman recognizes that they can be regressive.

“You cannot argue that. People with less means will be paying more,” he said. But he also suggested that diabetes is a “regressive disease,” that disproportionately affects low-income communities. “We have a risky product here that we’re trying to deal with.”

‘Trying to Scare People’

The Oregon proposition takes a broader approach. Measure 103 would add a new section to Oregon’s constitution saying that neither the state, nor local governments there could adopt taxes or fees on the sale, purchase or distribution of groceries.

It defines “groceries” as any raw or processed food or drinks meant for human consumption.

The initiative states that it would not extend to net income taxes on businesses, and like the Washington state measure, it does not cover booze, tobacco products or marijuana, which is legally sold in both states. It would apply to tax policies approved on or after Oct. 1, 2017.

Local taxes on sugary drinks are among those that would be barred if the measure passes.

Juan Carlos Ordóñez, communications director for the Oregon Center for Public Policy, points to broader debates about corporate tax policy in the state as important context for understanding the initiative.

As it stands in Oregon, corporations doing business in the state pay either a “minimum tax” that ranges from $150 to $100,000 based on Oregon sales, or an income-based levy of 6.6 percent on taxable income up to $1 million and 7.6 percent above that.

Voters there in 2016 rejected ballot Measure 97, which would have imposed a new “gross receipts” tax of 2.5 percent for certain large corporations, on sales over $25 million.

Measure 97 would have raised an estimated $6.1 billion during the two-year budget cycle covering fiscal years 2017-19, according to the state’s Legislative Revenue Office. The initiative called for these tax collections to go to schools, health programs and senior services.

Money gushed into that contest. In the final days before Election Day, local news reports showed $12.8 million in spending by groups supporting the measure, and $23.6 million by those opposed to it. Ultimately 59 percent of voters rejected the initiative.

“While Measure 97 went down, there's still a discussion going on about a gross receipts tax,” Ordóñez said, adding that his group would like to see the corporate minimum tax increased.

Oregon doesn’t have a state sales tax and Ordóñez says that voters have shot down sales tax proposals multiple times over the years. “They're trying to scare people into thinking that somehow groceries are going to be taxed,” he said of Measure 103 boosters.

“No one in their right mind in Oregon would try to tax food,” he added.

‘That's a Hidden Sales Tax’

Floyd, the spokesman for the campaign backing Measure 103, says the proposal is “not an attempt by any means to get out of paying the taxes that we are already paying.”

The measure would not allow the state’s corporate minimum tax to be raised or lowered based on a company’s grocery sales, Floyd said. But he said it could possibly be adjusted based on other variables, like the square footage of a store, or the number of employees a business has.

He acknowledged that grocers would be shielded from gross receipts tax proposals like the one in Measure 97. “To us that's a hidden sales tax that does get passed to the consumer,” he said.

In Ordóñez’s view, there are academic debates to be had about how much of gross receipts taxes are passed on to consumers, “but ultimately it’s not a sales tax aimed at food.”

Floyd mentioned Measure 97, as well as other local tax proposals that have cropped up around the state in recent years, as reasons for why the grocers and others are backing the measure.

“Those battles for us are costly in time and money,” he said.

Contributions to the “Yes! Keep Our Groceries Tax Free!” campaign committee backing the measure totaled about $5.6 million through Oct. 26, with large sums from the American Beverage Association ($2.9 million), grocers Albertsons Safeway ($785,917) and Kroger ($770,917), and the Northwest Grocery Association ($393,000).

The campaign committee “Vote No on 103” has received at least $2.6 million in contributions.

Michael Bloomberg, the billionaire and former New York City mayor, recently contributed $1.5 million. Bloomberg spent heavily last year in support of now-repealed sugary drink tax in the Chicago area. Another $500,000 came from the Action Now Initiative, an advocacy organization started by the billionaires John and Laura Arnold.

The Oregon Education Association, the state’s largest public education employee union, has contributed about $650,000. In a statement against the measure, the American Federation of Teachers said it could lead to a state budget crisis and erode education funding.

Other Points of Contention

There are several areas of disagreement between supporters and opponents over how Measure 103 would be applied.

For example, Bartholomew, with AARP, and Ordóñez both raised the possibility that because the measure is written to cover the “distribution” of groceries it could extend to trucking firms that carry food. Floyd says a reason this isn’t the case is that the change in law would only apply to companies that undergo certain state food safety inspections that truckers aren’t subject to.

The AARP also has concerns about how the measure would affect hospitals and long-term care facilities. When those organizations bill patients and residents for services, there’s a state tax applied that goes toward covering the state’s Medicaid costs.

There are questions, according to Bartholomew, about whether the initiative would require food expenses to be deducted from these bills, thereby reducing the money that flows to Medicaid. He said he has not seen estimates for how much this possible reduction could be.

“If it was sincere,” Bartholomew said of the measure, “it would be written a lot more clearly.”

Bill Lucia is a Senior Reporter for Government Executive's Route Fifty and is based in Washington, D.C.

NEXT STORY: This Region’s Home Prices Are Being Hit Hard by SALT Deduction Changes