Connecting state and local government leaders

New research shows that the heaviest losses affected a diverse set of states, ranging from Vermont to Texas.

Growth in the U.S. trade deficit with China has eroded an estimated 3.4 million American jobs over the past 16 years and also explains almost entirely why manufacturing employment has not fully rebounded in the wake of the Great Recession, new research asserts.

The report out Tuesday from the left-leaning Economic Policy Institute describes how, since China joined the World Trade Organization in 2001, U.S. imports from the country have surged, while U.S. exports to China have lagged in comparison.

Overall, the U.S. goods trade deficit with China grew to $375 billion in 2017, from $83 billion in 2001, according to the report.

Robert Scott, the report’s lead author, says that the biggest drivers of the growing trade gap with China have been currency manipulation and currency “misalignment”—a term that has to do with situations where private capital pushes up demand for the dollar.

Scott believes international currencies need to be “rebalanced,” with the value of the dollar falling by about 30 percent, in order to help narrow the nation’s yawning trade deficit with China.

“I think it would lead to the creation of millions of new manufacturing jobs in the United States,” he told reporters by phone on Tuesday.

In general, as the dollar loses value, it makes U.S. goods less expensive and therefore more attractive to purchasers abroad. At the same time, foreign goods would be pricier in the U.S., which would typically increase demand for domestic products.

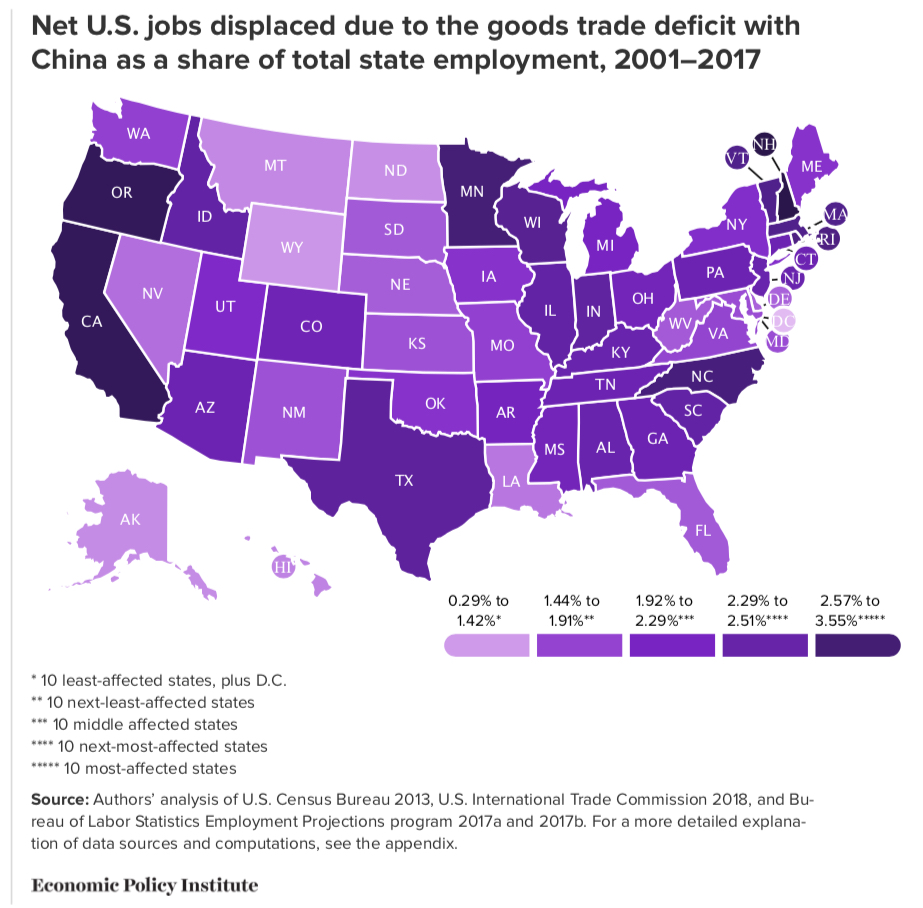

All 50 states have lost jobs due to the widening trade gap with China, the EPI report says.

But the 10 states that were worst-hit include: New Hampshire, Oregon, California, Minnesota, North Carolina, Rhode Island, Massachusetts, Vermont, Wisconsin and Texas. Job losses ranged from 2.57 percent of state employment in Texas, to 3.55 percent in New Hampshire.

Nearly three-quarters of the job losses between 2001 and 2017 due to the trade deficit, about 2.5 million, were in manufacturing—involving the production of goods like electronics, clothing and textiles.

Meanwhile, the report says the U.S. has missed opportunities to add manufacturing jobs in exporting segments of the American economy, like transportation equipment, agriculture, computer parts, chemicals, machinery and foods and beverages.

As for the tariffs that President Trump has imposed on Chinese goods, Scott Paul, president of the Alliance for American Manufacturing, said they could possibly be used going forward to pressure China into reducing unfair trade practices, or to address other related trade issues. But he said that this hasn’t happened yet.

Scott, the researcher, said the tariffs have raised the profile of trade with China on the national policy agenda and that tariffs on steel and aluminum had some notable effects. But he characterized a more recent round of tariffs on Chinese goods as a tactic without a strategy.

“I don't think the tariffs alone are going to solve our trade problems with China,” he said.

The 1985 “Plaza Accord” is a notable past example of an internationally coordinated intervention into currency markets, which involved the U.S. devaluing its currency. The U.S., along with West Germany, France, Japan and the United Kingdom, agreed to that pact.

Were the dollar’s value to fall, it could force up interest rates, a concern for the U.S. government given its annual budget deficits and outstanding debt, now around $21 trillion.

But Scott argues that while the higher interest rates could dampen the economy, the lower value of the dollar could also increase the output of manufactured products and provide an offsetting stimulus.

Scott also noted that multinational corporations like Walmart and Apple can benefit from the “implicit subsidies” that result from manipulated or misaligned currencies.

The Treasury Department, he explained, has historically taken a lead role managing U.S. currency policy. While Trump has complained about China’s currency practices, his administration has not acted to formally label the nation as a currency manipulator.

"Every economist in town knows that China and other countries have been manipulating for many, many years,” Scott said.

Since entering the WTO in 2001, the EPI report says that “China has moved rapidly ‘upscale,’ from low-tech, low-skill, labor-intensive industries such as apparel, footwear, and basic electronics to more capital- and skills-intensive industries such as computers, electrical machinery, and motor vehicle parts.”

The country has seen rapid economic growth in recent years. But the report argues it’s unsustainable and suggests, among other things, that China needs to rework its economy so it’s less dependent on exports and more dependent on domestic demand.

Bill Lucia is a Senior Reporter for Government Executive's Route Fifty and is based in Washington, D.C.

NEXT STORY: A New Look at Seattle's Minimum Wage Hike