Connecting state and local government leaders

States with delinquency hotspots should reconsider harsh vehicle repossession policies and improve consumer protections, said one Urban Institute researcher.

People’s ability to pay off auto loans varies significantly depending on where they live, according to a recent Urban Institute analysis.

In many places, personal vehicles are a necessity, allowing residents to participate in the economy, from commuting to picking up and dropping off children at daycare or school.

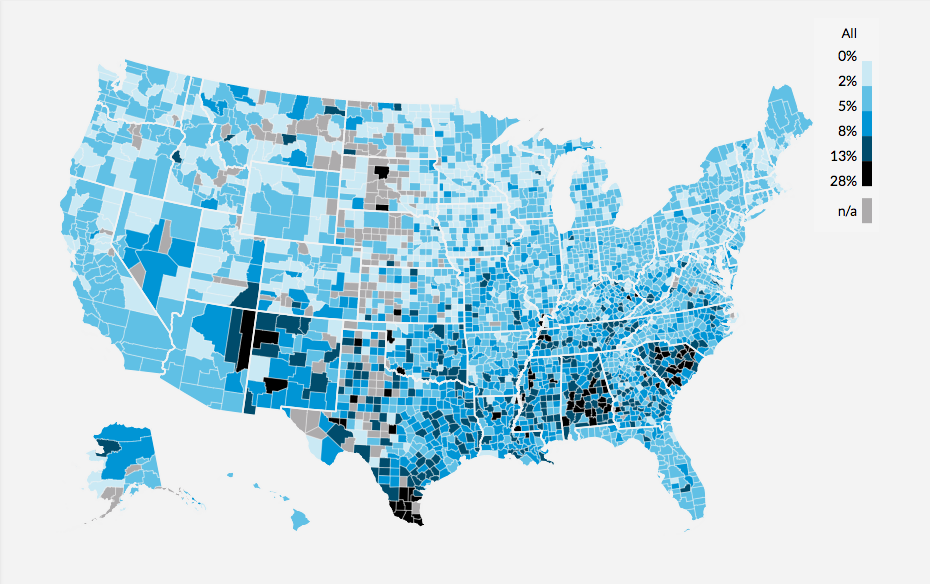

Nationally the auto loan delinquency rate, where lendees are more than 60 days late on a payment, is 4 percent on average. But that figure fluctuates depending on the location, from 1 percent in Wright County, Minnesota, to 27 percent in Willacy County, Texas, according to the Debt in America interactive map.

Hotspots of people having trouble making payments—states averaging a 7 percent delinquency rate or more—tend to be in the South: Alabama, South Carolina, Louisiana, Mississippi, and Texas, as well as New Mexico in the Southwest. Meanwhile Maine, Massachusetts, Minnesota, Montana, Nebraska, New Hampshire, North Dakota, Oregon, South Dakota, Utah, Washington, and Wyoming all had less than 2 percent delinquency.

The Urban Institute also found that auto loan delinquency among white Americans ran slightly below the national average at 3 percent, compared to 7 percent among nonwhites—possibly indicating predatory practices aimed at minorities.

In places with high rates of car repossession and delinquent loans, policymakers at the state and local level should examine whether they are doing what they can to help consumers, said Signe-Mary McKernan, vice president of the institute’s Center on Labor, Human Services, and Population.

“It’s probably a good time to take a look at what are the state rules and policies in place and what protections localities have for consumers,” she told Route Fifty.

State deficiency policies—dictating what happens when a borrower can no longer afford to make payments—may favor lenders. Longer loan terms tend to come with more add-on costs to consumers and may be pushed on low-income counties, McKernan said.

States can also require that repossession and resale of vehicles be done in a manner that helps eliminate debt. The Federal Trade Commission has a vehicle repossession guide for consumers.

McKernan recommends states support emergency savings by creating incentives for low-income residents, like an earned income tax credit saver’s bonus. Families with a savings cushion between $250 and $750 are less likely to miss a car or housing payment after a job loss, she said.

“No matter where you are on the income spectrum, you can save,” McKernan said.

Local governments can also try to integrate financial savings interventions for housing, employment or community college into tax preparation.

McKernan advises lendees to contact their creditor if they’re late on a payment to see if they can get their payment date changed and, if so, to get that change in writing.

In some cases, she said that people should think twice about getting a car, as falling behind on payments can end up having bigger financial repercussions.

“Consumers can end up owing a lot more on their car loan if it’s repossessed,” McKernan said. “Consider different options before owning a vehicle.”

Dave Nyczepir is a News Editor at Government Executive’s Route Fifty and is based in Washington, D.C.

NEXT STORY: Kentucky Governor Gives Short Notice on Pension Special Session