Connecting state and local government leaders

A new study suggests looking at peaks in financial cycles.

It’s notoriously hard to guess when an economic downturn is imminent. One of the few consistently reliable recession alarm bells is what’s called a “yield-curve inversion,” when yields for short-term bonds jump above those on long-term bonds.

But a new study pinpoints an even more accurate indicator: peaks in financial cycles.

Since the early 1980s, the reversal of financial booms—and not central bank tightening to control inflation—has triggered recessions more often than not, according to a paper by Claudio Borio, head of the Bank for International Settlements, a group that monitors global financial institutions. Financial flows move in cycles: from boom periods, when easy money begets more easy money, driving up asset prices until something prompts investors en masse to doubt those values. The subsequent collapse wipes out wealth, ripping holes in corporate and household balance balance sheets in a way that can deepen and prolong ordinary end-of-business-cycle contractions.

This means trends in debt and other financial-cycle indicators, like property prices, should be watched because recent history shows “even if inflation did not raise its ugly head, a downturn could take place,” said Borio in remarks announcing this and other BIS research.

He and his co-authors didn’t analyze what their framework implies about the current risk of recession, or where in the financial cycle we now find ourselves. However, Borio did offer some clues in his speech.

Recent market gyrations, he said, reflect a new stage in the process that began a few years back, with the end of the extraordinarily loose money created by the Federal Reserve and other major central banks to combat the 2008 financial crisis.

Extricating ourselves from these “unprecedented” conditions “was bound to be challenging especially in light of trade tensions and political uncertainty,” said Borio. “The recent bump is likely to be just one in a series.”

But before we get into the details, let’s revisit the supposed logic behind the yield-curve inversion’s prophetic powers. First off, yields on long-term bonds tend to be higher because they “tie up your money for longer and their interest payments may not keep up with inflation,” as Quartz’s Allison Schrager explains. More generally, the longer the period of time until the bond comes due, the greater the risk that investors might lose money—and the higher the interest payments investors demand as compensation.

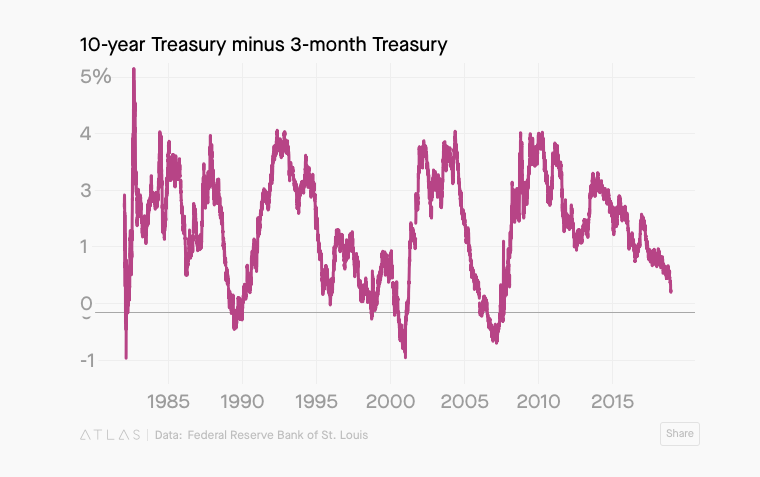

This is why, when the yield on, say, a 10-year bond dips below that for one-year bond, you know something weird is going on. And indeed, downturns have surfaced within two years of a yield-curve inversion in every U.S. recession since 1955 except one, according to an analysis by the St. Louis Federal Reserve.

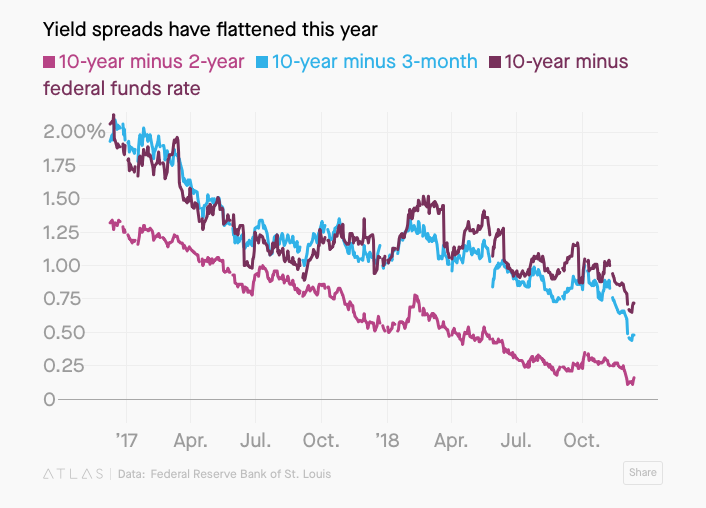

Yield curve inversion has been a hot topic of late because spreads have gotten quite narrow at various points this year; some intermediate durations have even briefly inverted.

However, as Schrager points out, no one really knows why this relationship exists. And it doesn’t seem to hold up well for other countries.

So what did BIS find? The group’s economists looked at the interaction between credit and prices of assets like property and stocks. This interplay tends to be cyclical because it’s self-reinforcing. That is, an increasing abundance of credit drives up asset prices; that rise in collateral value encourages even more lending. This process keeps whipping up more and more froth until, suddenly, the interaction reverses. Credit disappears, liquidity seizes up, and borrowing costs rise, pulling the cycle into the bust phase. The slowdown of business activity throws the economy into a recession, exacerbated by how the financial panic strains the banking system and drives values lower than they should be.

The BIS analysis examined financial-cycle proxies alongside the yield curve—that is, the difference between the 10-year government bond yield and the three-month money-market rate—in 16 advanced and nine emerging market economies since 1985. These proxies include a composite of financial indicators of medium-term changes in credit and property prices. The authors also looked at the debt service ratio, which measures the share of national income going to pay interest and amortization.

For advanced economies, the financial-cycle proxies proved better than the yield curve at predicting recessions one and two years away. In addition, unlike the term spread, the financial-cycle proxies anticipated recessions at a statistically significant level even three years before the downturn hit. (The same pattern played out in the emerging-market analysis, though both financial proxies and the yield curve were informative mainly at the one-year horizon.)

Again, the paper didn’t attempt to predict when the next US contraction would begin. However, the research does offer some useful framing for how to think about the changing nature of recessions—or, more specifically, their triggers.

A half-century or so ago, recessions and expansions followed the business cycle. Downturns hit when the economy overheated, and the flare-up in inflation caused the central bank to raise interest rates.

Since the early 1980s, however, that’s been changing. Thanks to a shift in central-banking priorities and the deflationary effects of globalization—in particular, China’s integration into the world economy—inflation has been stubbornly low, a phenomenon known as the “Great Moderation.” At the same time, as financial markets have liberalized around the world, global capital flows have swelled to flood-like proportions.

This helps explain why financial cycles tend to build more slowly—and therefore have a longer lifetime—than business cycles. Even as financial imbalances swelled, central banks declined to tighten because inflation remained in check—allowing debt and asset bubbles to grow even bigger. In fact, some business contractions have hit while financial expansions were still underway. Those are usually shallow. Take, for instance, the U.S. recession of the early 2000s, which occurred while the financial cycle was still on the way up. It kept building for another half-decade or so, peaking in 2008. And we all know what happened next.

Gwynn Guilford is a reporter for Quartz, which originally published this article.

NEXT STORY: Data Show Sluggish Economic Output in Smaller Counties