Connecting state and local government leaders

The case for rules tied to revenue volatility.

This story was originally published by The Pew Charitable Trusts' states’ fiscal health project.

Budget stabilization funds can help states manage revenue volatility by allowing them to set aside money that can be used during difficult financial times. Policymakers use the funds to smooth budgets over multiple years and across difference phases of the business cycle. That ensures governments have the resources needed to fund important priorities, no matter how the economy turns.

Undeniably, setting aside money for future needs requires trade-offs. In many states, leaders have emphasized the need to rebuild savings in the years following the Great Recession, but each dollar directed to reserves is a dollar that cannot be spent on public programs, tax reductions, paying down debt, or unfunded retirement costs. Policymakers often struggle with decisions about when to make deposits and how large they should be.

At the same time, the various savings strategies provide differing benefits, with some more effective than others. For instance, one of the most common triggers is a budget surplus, which allows states to set aside money when there is extra at the end of the fiscal year. This method may be straightforward, but the contributions are often the last—and frequently the lowest—priority in the budget process because of their timing. In addition, surpluses occur for multiple reasons, sometimes clouding whether the time is right to save. The debate in Ohio over funding the state’s rainy day fund illustrates common challenges.

Ohio case study: Saving tied to surpluses

Sixteen states, including Ohio, decide how much to set aside based on end-of-year surpluses. In July 2018, the administration of Governor John Kasich, a Republican, announced a budget surplus of $657 million and transferred all of it into the state’s rainy day fund. The deposit brought the fund to $2.7 billion. The total had been just 89 cents in 2011 because policymakers had withdrawn about $1 billion to balance the state’s budget at a time when revenues had dropped significantly because of the recession.

But state and local leaders challenged Kasich’s decision. In recent years, Ohio’s local governments have received less state aid than before the recession that technically started in 2007 and ended in 2009. From 2008 to 2016, state aid to local governments dropped 19.6 percent. Facing their own budget challenges, some local officials questioned Gov. Kasich’s decision to direct state surplus to savings.

At the heart of the debate is the question of how to spend surplus dollars, as well as how the surplus came to exist in the first place. Some argue reductions in state aid to localities contributed to the surplus. Others counter that reserves are important to safeguard the state’s fiscal health, pointing to the need for cuts during the recession to demonstrate what happens without sufficient savings. Even with July’s deposit, the state may not have enough in its rainy day fund to weather a downturn, according to a September analysis by Moody’s Analytics.

These longer-range decisions can become more clear for state leaders if they periodically re-examine when and how to deposit money in their rainy day fund. For example, Connecticut, Illinois, Minnesota, Montana, Nebraska, North Carolina, Oregon, Utah, and Wyoming have performed formal studies of their revenue fluctuations since the Great Recession to inform reserve policy. In Ohio, however, state leaders wait to see if the state has a surplus before deciding whether to set revenues aside as savings. Although this is fairly common, it often leads to public debate about how to handle surplus money and its origins.

Linking to volatility ensures saving when appropriate

Increasingly, states are tying their deposits to reserves or rainy day funds directly to revenue volatility. By linking these policies to volatility, states can set aside extraordinary or unexpected revenue increases, saving more in high-growth years and less in leaner ones. This allows policymakers to identify periods when revenue collections are increasing at unsustainable rates and put those funds in reserve to use during downturns. The strategy differs from saving based on a surplus, since surpluses may occur even without strong revenue performance.

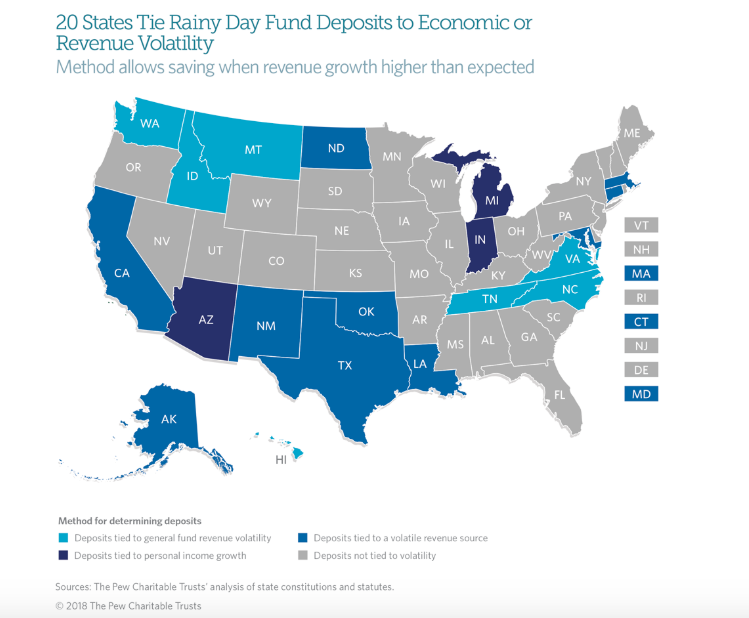

Entering 2019, 20 states have some rule in law for tying rainy day fund deposits to volatility, though each state approaches this its own way. For example, Virginia links deposits to general fund revenue growth that is above average levels, Massachusetts captures excess capital gains collections, and Texas sets aside oil and gas revenue above a certain level. Connecting rainy day fund deposits to observed volatility means money is being put aside when conditions are good—a reliable and responsible approach. Because each state’s economic and fiscal characteristics are unique, the ideal rules vary from state to state, but capturing unexpected growth for a rainy day will help states regardless of how dramatically their revenue may fluctuate.

As policymakers reflect on what type of deposit rules may be best for their state, they need to keep in mind their unique economic and revenue conditions. Tying deposits to volatility enables states to better find the balance between important state priorities and saving.

Mary Murphy is project director, Airlie Loiaconi is an associate, and Steve Bailey is an associate manager with The Pew Charitable Trusts’ states’ fiscal health project.

NEXT STORY: Minnesota’s ‘Remarkable Recovery From the Shambles’