Connecting state and local government leaders

Taxing big business means more money for health care and social assistance, but the city’s economist says it could also mean fewer jobs and a smaller economy if companies move or open elsewhere—which could sting in a recession.

San Francisco’s decision to tax big business to pay for homeless services presents an economic tradeoff that will benefit the health care, social assistance and public sectors at the expense of overall jobs and gross domestic product, according to the city’s chief economist.

Proposition C was approved by 61 percent of voters in November, and Ted Egan, who works out of the controller’s office in San Francisco, estimates it will raise anywhere from $250 to $300 million annually, depending on tax base growth. That money is meant to pay for services to reduce homelessness—housing, mental health care, shelters and rental assistance among the services the city could provide.

The largest, single business tax increase in San Francisco history, the 0.5 percent levy only applies to businesses with more than $50 million in local gross receipts and to corporate headquarters already paying the city’s administrative office tax. That’s only between 300 and 400 businesses among the more than 13,000 already paying a gross receipts tax, according to the city Office of Economic Analysis.

Egan calls the plan “narrowly based” as a result, but it faces legal challenges that could stall the funding for years.

Homelessness has risen sharply in major West Coast cities, and moderately in San Francisco, despite declining nationally the last five years, Egan said.

“One of the things [the cities] have in common … is a juxtaposition, a proximity between areas that are very economically dynamic and areas that are not,” he said Wednesday during a Regional Economic Models, Inc. webinar.

San Francisco spent $380 million on homeless services in fiscal year 2017-18, and a point-in-time count of the homeless population in March revealed about 7,000 people without shelter.

The new tax represents a 28 to 33 percent increase in business tax revenues, 50 percent of which must be spent on permanent housing—from rental assistance to acquisition of units for support. The proposition also called for spending 25 percent on mental health services; 15 percent on eviction and short-term homelessness prevention; and 10 percent on homeless shelters.

With the money, the city Department of Homelessness and Supportive Housing has said it could provide about 5,000 new permanent housing openings, rapidly rehouse 3,000 homeless people and prevent 30,000 more from going homeless in the first place.

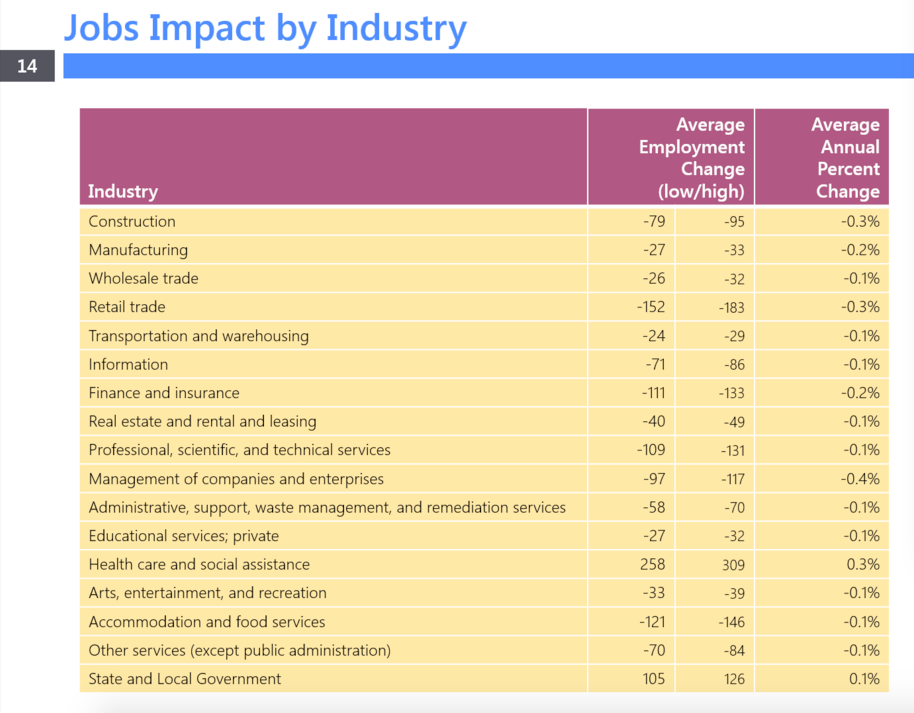

On the flip side, the new tax will incentivize some businesses to move or add jobs outside San Francisco for a net average annual loss of 725 to 875 jobs and $200 million to $240 million in GDP during the next two decades, according to Egan’s office. That’s an average loss of 0.1 percent jobs and 0.1 percent GDP a year, which could hurt the city in an economic downturn.

“In a recession, this would be a more painful recession,” Egan said.

Health care, social assistance and state and local government are the only industries projected to gain jobs as a result of the new tax. Even industries with fewer businesses affected by the measure would generally lose jobs due to a “multiplier effect,” he added.

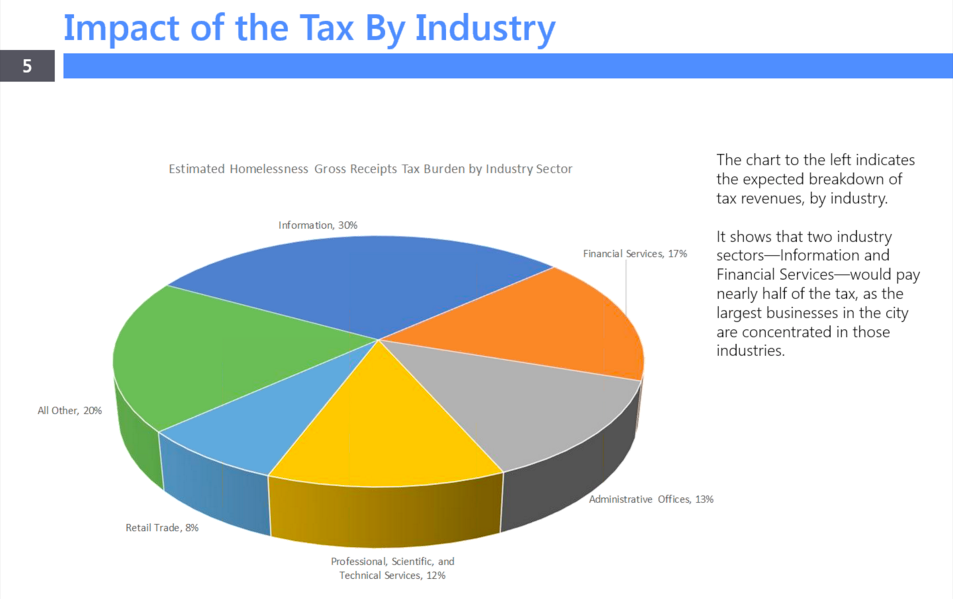

Information and financial services sectors would pay the bulk of the tax, 47 percent, while adding in administrative offices; professional, scientific and technical services; and retail trade accounts for 80 percent of all revenues.

Hotel rates and home values will likely increase with an increase in homeless services, Egan said, but the exact amount isn’t clear.

“It’s not likely that we’re scaring tourists away because of homelessness,” he said.

San Francisco’s tax comes on the heels of income tax cuts at the federal level, and those cuts likely outweigh the effect of the new tax for most businesses, Egan added.

San Francisco, Los Angeles and Oakland already have substantial business taxes as a result of California Proposition 13 limiting property tax rates in the 1970s, and the new tax will likely create an even more volatile revenue stream than a broad-based tax would have, Egan said.

Mayor London Breed opposed the measure before the November election, but has since embraced spending on homeless, saying the voters showed that they want the issue prioritized. The mayor, for example, has proposed spending $181 million in excess revenue San Francisco will receive from the state Educational Revenue Augmentation Fund on homeless services. That program diverts a portion of local property tax revenues for public school systems in every California county, with the city and county of San Francisco receiving $414.7 million during the last two fiscal years.

“Although I had concerns with the underlying policy, I agree with the overall goal: We need to get people off the streets and housed,” Breed said of the ballot measure in her December meeting with the San Francisco Board of Supervisors, reported the San Francisco Chronicle. “With the one-time funding that was recently announced, we have an opportunity to take bold action while we wait for more funding to potentially become available.”

But others, including three incoming members of the board of supervisors, have said they want the money spent on other issues as well. San Francisco Unified School District Superintendent Vincent Matthews wants $60 million of the money to mostly cover teacher wage increases. SFUSD needs the money because of a legal challenge to the parcel tax expected to raise $50 million annually for public education.

Other supervisors want to see a portion of the funds spent on energy independence or child care, with $54 million already dedicated to youth services and the government’s rainy day fund.

Dave Nyczepir is a News Editor at Route Fifty and is based in Washington, D.C.

NEXT STORY: The States That Give and Get the Most Federal Dollars