Connecting state and local government leaders

In Colorado and Washington, residents this fall voted to either constrain state tax revenues or cut fees, even as Democratic lawmakers argue the money is needed to support education and transportation programs.

Colorado voters during the past two elections have made clear that while they’re willing to back Democratic candidates, they’re reluctant to give them greater taxing power to help carry out their agendas.

That’s even as progressives argue that funding is falling short in areas like education and transportation. Last month, Coloradans kept up the pattern, rejecting a ballot measure that would have relaxed limits on the amount of tax collections that the state government can keep.

Further west, residents in another left-leaning state, Washington, also voted in November to crimp government revenues. Voters approved a ballot initiative to cap the cost of vehicle registration fees, or “car tabs,” which help pay for transit and other transportation programs.

“I think you could say it’s an anti-tax vote, clearly,” said Rep. Jake Fey, a Tacoma-area Democrat who chairs the Washington state House Transportation Committee.

In both places, the election results show how there can be limits to the appetite people have for paying more money for public services and infrastructure—even when a majority of a state’s voters are willing to support Democrats who tend to embrace more progressive platforms, which often involve bigger government.

The measures also highlight the complications and uncertainty that can arise when making tax policy at the ballot box, as well as some unique facets of each state’s tax structure.

In both states—each home to booming cities, generally healthy economies and growing populations—there are rumblings in the wake of this fall’s election about future tax debates.

Advocacy groups in Colorado are signaling that they will push to get new initiatives on the 2020 ballot. In Washington, some argue that the registration fee battle underscores how the state’s tax structure, which does not have an income tax, is in need of broader reforms.

“Washington has a deeply regressive state and local tax code, and we just do not have progressive levers to pull when it comes to financing important things that people have repeatedly shown that they do care about,” said Andy Nicholas, a senior fellow with the Washington State Budget and Policy Center.

“People do want the investments, but are feeling that we need a more balanced overall tax system, which would involve higher taxes on people at the top,” he added.

‘Get What We Pay For’

In Washington and Colorado, Democrats hold “trifectas,” controlling both chambers of the state legislature and the governor’s office. In each place, Democratic lawmakers describe a tension between the recent tax votes and securing funding for the types of budget priorities their party supports.

“We always should be looking at trying to do more with less,” said Colorado House Speaker KC Becker, who has served in the legislature since 2013. “But I think voters are putting the state of Colorado on an unsustainable path.”

Becker acknowledges Colorado’s budget has grown over the past two or three decades—the state reported about $35 billion in total revenue during the 2018 fiscal year, up from around $19.5 billion in 2007. But she pointed out that the state’s population has grown also, and she makes a case that revenues have not kept up with rising costs for things like construction and public colleges and universities.

“In Colorado right now, we have the no. 1 economy in the country, but we’re 48th in the nation in how we fund higher ed, or K-12, or transportation,” she added. “That doesn’t make any sense.”

State Sen. Steve Hobbs chairs the Washington state Senate Transportation Committee. When he spoke to Route Fifty last month he was mulling how to deal with about $478 million in lost revenue that the car tab initiative threatened to suck from the state budget in just 18 months. (A judge has since temporarily halted implementation of the initiative while a legal challenge is considered.)

“It's fine if you don’t like the taxes, I mean we live in a democracy,” said Hobbs. “If the will of the people is not to do taxes, that’s fine, we just have to reduce the services.”

Hobbs lamented how a voter given the option to cut the cost of their car registration might not consider how the money helps fund programs like bus service for people with disabilities.

“You’re not really thinking about ‘well, my neighbor down the street, who’s a paraplegic, needs DART,’” he said, using the acronym for the Dial-A-Ride-Transportation service.

Becker noted what she sees as the inherent difficulties when it comes to building support among voters for pro-tax ballot measures. “These are big issues that are hard to digest, hard to turn into a bumper sticker, and hard to convince people about,” she said.

People may also have doubts that their tax dollars will be put to good use. That’s something Becker also recognized. “In most levels of government, in most any state, there is a distrust of how someone else is spending your money,” she said. “I do think that that’s a hurdle.”

Skeptics of greater government spending see the tax debate through a different lens.

Amy Oliver Cooke campaigned against the tax measure that failed in Colorado in November, which was called Proposition CC. She described it as a “forever tax increase” and “a blank check.” The way Cooke sees it, Coloradans have been sending a clear message on taxes.

Voters in Colorado, she said, have shot down about a half-dozen statewide tax increases in recent years. “They’re just not interested in going there,” Cooke added. “I don’t know how many times voters have to tell state government: ‘You have to live within your means.’”

Lisa Weil, executive director of Great Education Colorado, a group that pushes for school funding, counters that Colorado has been living within its means, and that “the outcomes are not really acceptable to a state that has the kind of resources that we have.”

Weil says four-day school weeks in most school districts in the state, unfilled teacher jobs, and lagging teacher salaries are examples of how the state’s education system is falling behind.

“We get what we pay for,” she said, adding that Colorado has low income and property taxes compared to other states. “We've had one of the strongest economies in the nation for a decade,” she said. “We're unable to invest the benefits of that growth into the next generation.”

‘It’s a Unique Thing’

For nearly 30 years, Colorado has had a policy in place that is designed to restrain government spending at both the state and local level. It’s a constitutional amendment that voters in the state passed in 1992, known as the Taxpayer's Bill of Rights, or “TABOR.”

If the state wants to raise tax rates, under TABOR they need to get voter approval. But that’s not all. TABOR also effectively caps how much tax revenue the state can keep from existing taxes it collects, adjusting this level annually based on a formula that factors in inflation and population growth. To retain revenues above these levels, the state also needs approval from voters.

Without this blessing, the state has to refund the extra revenues to taxpayers, and has several methods to do so. Between 1996 and 2018, the state’s refund obligations totaled about $3.5 billion.

“It’s a unique thing that every single tax policy decision has to go to the voters,” said Scott Wasserman, who is president of The Bell Policy Center, a Denver-based progressive think tank.

Becker, the Democratic House speaker, said that the idea that Colorado does not have permission to use all of the tax revenue it is already collecting can be confusing for people, especially newcomers to the state. “I hope no state ever repeats what we’ve done here,” she added.

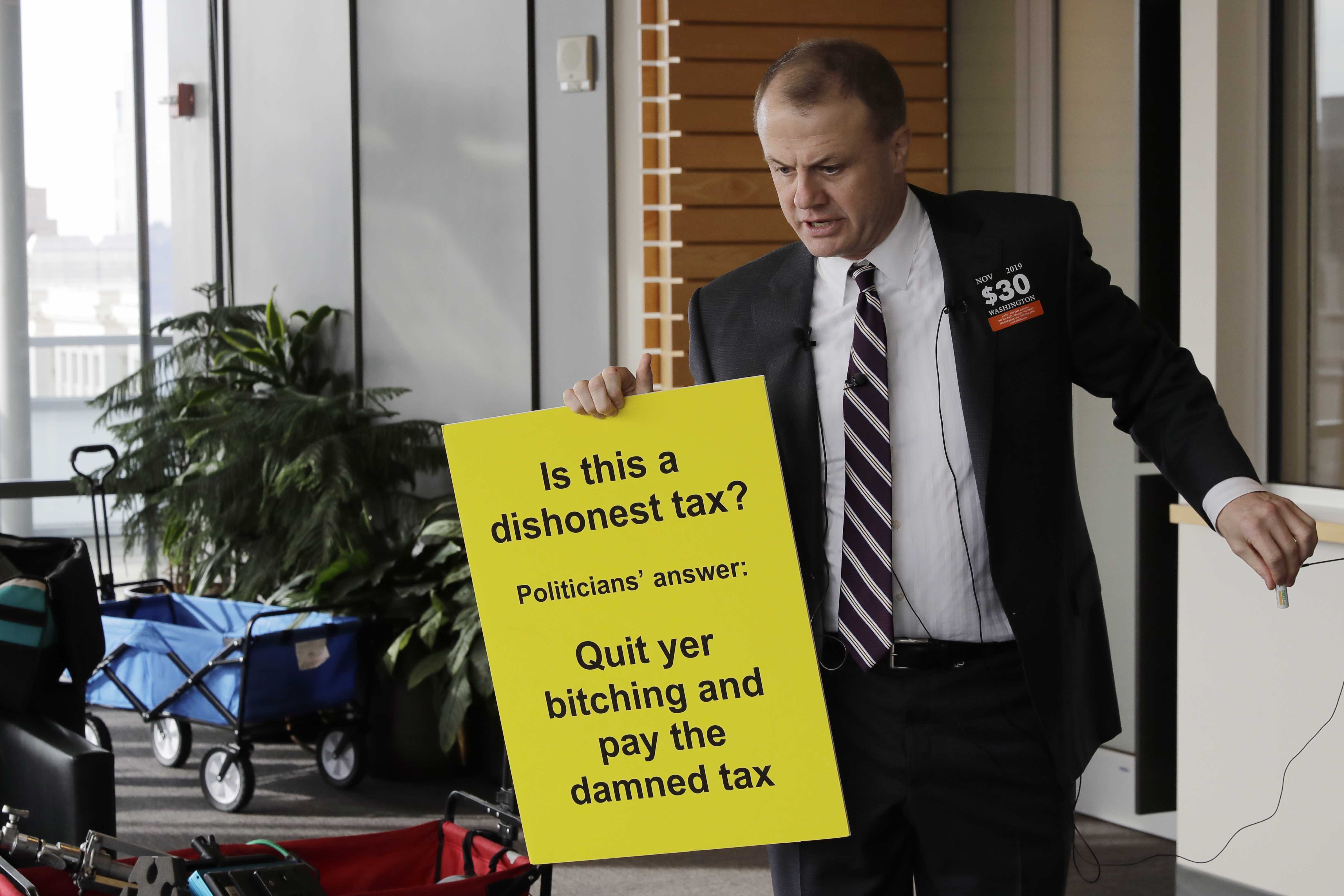

But Jon Caldara, president of the Independence Institute, a libertarian think tank in Denver, describes TABOR as rooted in the idea that voters get to have a say over spending decisions. “Government can grow as large as they like,” he said. “All they have to do is ask first.”

As for the notion that tax revenues aren’t keeping up with the state’s needs, Caldara doesn’t buy it. “That’s insane,” he said. “State government has grown by leaps and bounds.”

Proposition CC would have allowed the state to keep revenue it collects above the TABOR spending caps, and called for using this money for education and transportation. The proposal emerged earlier this year from the legislature, where Becker was a lead sponsor of it. Voters rejected the measure 54% to 46%, with 838,282 people in the 5.7 million-person state opposed.

This vote came about a year after Colorado Democrats celebrated what some called a “blue wave” in the state in the 2018 midterm elections.

The party gained two seats in the state Senate, capturing a majority in that chamber for the first time since 2014, while also expanding the Democratic majority in the House and holding onto the governor’s office with the election of Gov. Jared Polis.

But mirroring this year’s result with Prop. CC, voters also rejected a measure intended to raise new money for public schools. Amendment 73 aimed to trade the state’s current "flat" income tax rate of 4.63%, for a graduated system with brackets for individuals earning over $150,000 annually, where higher earners would pay more. It also would have increased the corporate income tax rate.

Coloradans that year also opposed a measure that would have raised the state sales tax to cover the repayment of up to $6 billion of borrowing for transportation. With transportation funding, Becker notes the state’s gas tax is 22 cents a gallon, the same as it was in 1991.

Closer Look at the Washington Vote

There are some caveats with the Washington vote on the car tab measure that make it harder to interpret compared to the string of rejected tax proposals in Colorado. The measure, Initiative 976, was designed to limit vehicle registration fees that many motorists pay to $30 annually. The state and some local governments collect the fees and use the revenue to pay for transportation costs.

Up until now, the fees have varied in price based on location, with car owners in the Puget Sound region around Seattle paying sometimes hundreds of dollars as part of a plan—backed by voters in 2016—to expand a light rail system and make other transit upgrades. In other places, people may pay less, but the basic fee is $30, with an additional charge based on vehicle weight that ranges from $25 to $72.

State Sen. Curtis King, a Republican who is the ranking member on the Senate Transportation Committee, said that all of the vehicle registration expenses can add up, particularly for people living in the area with the light rail project, which is run by Sound Transit.

“You’re getting hit pretty hard for somebody that just owns a car,” said King, whose district covers rural areas in south central Washington.

“People were just saying: ‘how much do you expect from us,’ and ‘we’re tired of it,’” King added, referring to the I-976 vote.

Even so, in King County, where Seattle is located and where many motorists are paying some of the highest fees in the state, nearly 60 percent of voters rejected the limitations on the fees. In other words, a majority of voters there appeared willing to pay more for transit and other transportation programs.

“People that were actually paying the taxes for the investments voted to uphold them,” said Nicholas, with the Washington State Budget and Policy Center. “That’s an important angle,” he added, noting that it doesn't perfectly fit into the frame of people shunning higher taxation.

But it’s also true that three counties neighboring King—Skagit, Snohomish and Pierce—all backed I-976, with 53%, 58% and 65% of the vote respectively. Unlike other, more conservative parts of the state that voted for the measure, each of these counties leans blue and has voted for Democrats during the past three presidential elections.

There’s a sense among some observers that the strong support for I-976 in Pierce County was due at least in part to backlash over the 2016 vote on raising taxes and fees to pay for the Sound Transit expansion. Voters in Pierce County opposed that measure.

Rep. Andrew Barkis, the top Republican on the House transportation panel, whose district includes part of Pierce County, said that some residents in the area are paying considerable fees and taxes for the Sound Transit program, but at this point aren’t seeing the benefits.

More generally though, Barkis said he believes people are tired of the “ever-excessive amount of taxation” in the Washington state, something he refers to as “the piling on effect.”

‘You Just Don't Have General Revenue Streams’

Nicholas, with the liberal budget group, suggested that there is a feeling among many Washington residents that “they’re being nickeled and dimed” by state and local government taxes and fees. But, from his perspective, this is a symptom of the state’s “backwards tax code.”

If you track state tax revenues over time in Washington, Nicholas said, they’ve been falling as a share of the economy, from about 7% back in the mid-1990s, to around 5% today.

Local governments have picked up slack to cover costs, in some cases by resorting to policies like higher car tab fees or raising sales taxes, Nicholas said. In addition, he noted that the state tax code has all sorts of “hidden” taxes baked into the price of goods and services.

“You just don’t have general revenue streams,” Nicholas said. “We’re continually having to go back and do these special levies.”

“A good case could be made that you need broader based, progressive statewide options,” he added.

The Washington State Budget and Policy Center is promoting two proposals that are aimed at revamping the state’s tax code, with an eye toward making it less burdensome for low earners, while extracting more cash from those who are wealthier.

One is a statewide tax on capital gains—the profits people earn from things like stocks, hedge funds and bonds. The other is a sort of state-level version of the federal earned income tax credit, designed to provide a tax rebate to people at the lower end of the earnings ladder.

“I do think in the next couple of years we stand a good chance of getting both of those policies,” Nicholas said. He added that he believes as attention on income inequality grows, the public is likely to become increasingly open to the idea of progressive tax options.

But if history is a guide, any sort of income tax proposal in Washington is apt to be a tough sell.

Voters there have been asked on 11 occasions between 1932 and 2010 to adopt a state personal income tax or corporate income tax, according to the secretary of state's office. Only the first vote was successful, but it was tossed out in 1933 by the state Supreme Court.

Republicans, meanwhile, are unconvinced that I-976 was a sign that people are seeking new forms taxation. “Talk to the people who voted for this, they’re not unhappy about the type of taxes,” said Barkis. “They’re unhappy about having to pay what they’re paying.”

“It’s just more taxes, more taxes, more taxes,” said King, the Republican state Senator. “We’ve got to learn how to prioritize," he added. "We’ve got to learn what we can afford and can’t afford.”

But King also stressed that the state's transportation budget relies on separate revenue streams than the operating budget. Noting that the operating budget has seen recent strong revenue growth, he's expressed an interest in gradually shifting tax dollars from car and truck sales over to the transportation side of the ledger.

Looking to 2020 in Colorado

Becker said in late November that she didn’t know yet what the best move is next for people who support changing Colorado’s TABOR so that the state can collect or keep additional revenues. She said that she does not expect action on this front in the legislature next year.

People will probably try to put something TABOR-related on the ballot, she said. But Becker added: “My conclusion is that it doesn’t matter what we propose, it’s going to be very hard to pass.”

Wasserman said that, from his perspective, the 2020 election cycle “feels like exactly the moment we’d want to be talking about what a modest graduated income tax would look like in Colorado.” The Bell Policy Center is still in the “exploratory phase” of working toward a measure like this, Wasserman said.

He highlighted how Amendment 73, the 2018 Colorado education funding measure that called for a bracketed income tax, got about 46% of the vote—shy of the 55% it would have needed to pass, but an improvement over how similar tax measures have done previously.

For instance, an income tax proposal to fund education in 2013 won just 36% of the vote.

Weil, with Great Education Colorado, was one of the leaders of the Amendment 73 campaign. She credits some of the traction that the initiative got to a diverse coalition that lined up behind it, and promoting the measure at the school district level.

“To make sure that people had buy in into how the dollars are going to be spent,” she added.

There’s interest in 2020 proposals in Colorado on the more conservative side of the tax debate as well. Both Cooke and Caldara complained about how the state Supreme Court had ruled in ways that they say leaves the door open for lawmakers to skirt the spirit of TABOR by imposing “fees” instead of taxes.

“I think those of us who love our Taxpayer's Bill of Rights and do support it, we’ll be looking at something to do with fees. I don’t know what,” Cooke said. “But there’s likely to be something on the ballot.”

Cooke also predicted that TABOR critics will float a full repeal of the framework. But she didn’t seem worried.

“I hope like heck that they put full repeal on the ballot, it will get absolutely destroyed,” she said. “Voters in this state like our Taxpayer's Bill of Rights, and they like it a lot.”

Bill Lucia is a Senior Reporter for Route Fifty and is based in Olympia, Washington.

NEXT STORY: Some States Move Toward Financial Aid Based on Need Rather Than Merit