Connecting state and local government leaders

New research warns that the nation’s worst-off retirement plans for state and local government workers “face the risk of running out of assets in the foreseeable future" if there's a slow recovery.

The nation’s 20 most financially troubled state and local government pension plans could see their funding levels fall to precariously low levels if the economy has a sluggish recovery from the downturn that the coronavirus outbreak has caused, new research finds.

Most public pension systems will take a near-term financial hit due to the dramatic slump that the virus has brought on. But despite this setback, they should be able to weather the rough patch with little risk of not being able to cover benefits in the coming years, according to a research brief from the Center for State and Local Government Excellence and the Boston College Center for Retirement Research.

But for the worst-funded plans, the outlook the researchers present is potentially more dire. “Plans with extremely low-funded ratios in 2020 may still face the risk of running out of assets in the foreseeable future if markets are slow to recover,” the brief says.

The researchers modeled two scenarios. One where there’s a faster recovery, with markets climbing steadily towards their previous peak between 2021 and 2023. In the other, a less optimistic scenario, this same degree of recovery takes until 2025.

In 2020, the researchers estimate that the ratio of assets to liabilities for about 200 major state and local pension plans will dip to 69.5% from 71% in 2019. Under the faster recovery scenario the ratio is down at 62.7% in 2025. Under the slower one it will be 55.5% by that time.

“Even if markets do not fully recover until 2025, most plans will emerge with enough assets to pay benefits indefinitely,” the brief adds.

That said, the funded ratios for the 20 worst-off plans aren’t looking so hot even now and will only get worse as the economy struggles.

The way pension plans generally function is that workers and their employers make contributions that go into a fund, which is invested into stocks and other assets. Ideally the investments make a good return and help pay the cost of benefits and keep the fund solvent.

A common problem with troubled public pension systems is that state and local government employers shorted their contributions over the years. But past financial downturns and overly optimistic assumptions about investment returns are issues as well.

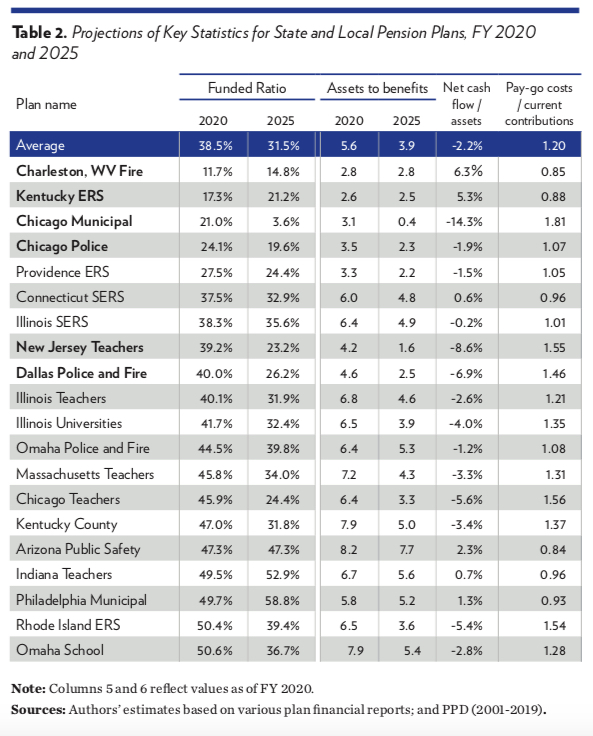

For the 20 worst-funded plans described in the report, the average funded ratio—a measure of how well a fund's assets stack up against its obligations—is estimated to be just 38.5%. If the slower economic recovery scenario unfolds, the figure is reduced to 31.5% by 2025.

The researchers also found that under the pessimistic recovery scenario, these 20 plans by 2025 would, on average, have assets equal to about four years of owed benefits.

Some of the most deeply troubled plans, like those for teachers in Chicago and New Jersey, could see assets sink so they are equal to less than two years of benefits.

Plans for Charleston, West Virginia firefighters, Kentucky state employees, Chicago police, Dallas police and firefighters and local workers in Providence, Rhode Island could all end up with less than three years of benefit payments saved as assets, the report says.

The researchers point out that if any of these fragile pension plans were to burn through all of their assets in the years soon after 2025, the expense to pay benefits using funds outside of a pension plan would be significantly higher than today’s costs.

In some cases, these “pay-as-you-go” costs are more than 50% higher than current contributions, according to the report.

“These sobering statistics highlight the precarious position of the worst-off plans, how plans with extremely negative cash flows face the possibility of exhausting their pension assets soon, and the high cost of pay-go funding if these plans do exhaust their assets,” the report adds.

When looking at the overall group of around 200 pension plans, the authors of the report note that the slide in the plans due to the downturn will drive up the “actuarial determined contributions” that government employers are expected to make to keep the plans healthy.

This contribution rate could rise from around 19.7% of payroll, on average, this year, to either 25.1% in 2025 under the faster recovery scenario, or 29.1% under the slower recovery scenario, based on estimates in the report.

Any added cost pressure to keep up with full pension contributions would come on top of the revenue losses and extra expenses that states and localities are facing due to the virus.

A full copy of the report can be found here.

Bill Lucia is a Senior Reporter for Route Fifty and is based in Olympia, Washington.

NEXT STORY: House Democrats Offer Coronavirus Package with $1 Trillion for State and Local Governments