Connecting state and local government leaders

Nine states have laws to stop unexpected, out-of-network medical bills.

This story was originally published by Stateline, an initiative of The Pew Charitable Trusts.

Jamie Hansen got a text from her 15-year-old son Ryan last summer from band camp at a mountain resort in Canada. His hip was hurting and he was having trouble breathing.

She chalked it up to nerves—Ryan wasn’t used to being away from her. But he worsened over the next couple of days, so she decided to make the 20-hour round-trip drive from their home in southern Washington state to retrieve him.

Their doctor sent them to the emergency room at the local hospital. Ryan’s heart was racing and he was dehydrated, so he was quickly transferred by ambulance to a hospital with more specialized pediatric services, Randall Children’s Hospital, in Portland, Oregon, more than half an hour away.

Hansen knew that Randall’s health system wasn’t in her insurance company’s network of providers, which she fretted might result in fees that wouldn’t be covered. But the first hospital told her not to worry, since this was an emergency and there were no pediatric specialists closer to home.

After a five-day stay, including four days in a pediatric intensive care unit, or ICU, during which Ryan was treated for a pilonidal cyst and apparently unrelated infections in his hip and near his heart, he was pronounced well enough to return home.

A week later, the bills began arriving: from Randall, from the pediatric specialists, from the ambulance company. Because Hansen’s insurance carrier wouldn’t pay the out-of-network fees, those were now Hansen’s responsibility.

“All told, I was looking at over $110,000 out of my own pocket,” she said. That was money Hansen, who supports herself and Ryan on her late husband’s retirement income, did not have. (Her story was first reported by KGW, an NBC-affiliated station in Portland, Oregon.)

Now the Washington state legislature is considering a bill that would have protected Hansen from such surprise, out-of-network bills.

"Barring something cataclysmic happening, we’re going to have this on the books in Washington this year,” said state Insurance Commissioner Mike Kreidler, a Democrat, in an interview with Stateline.

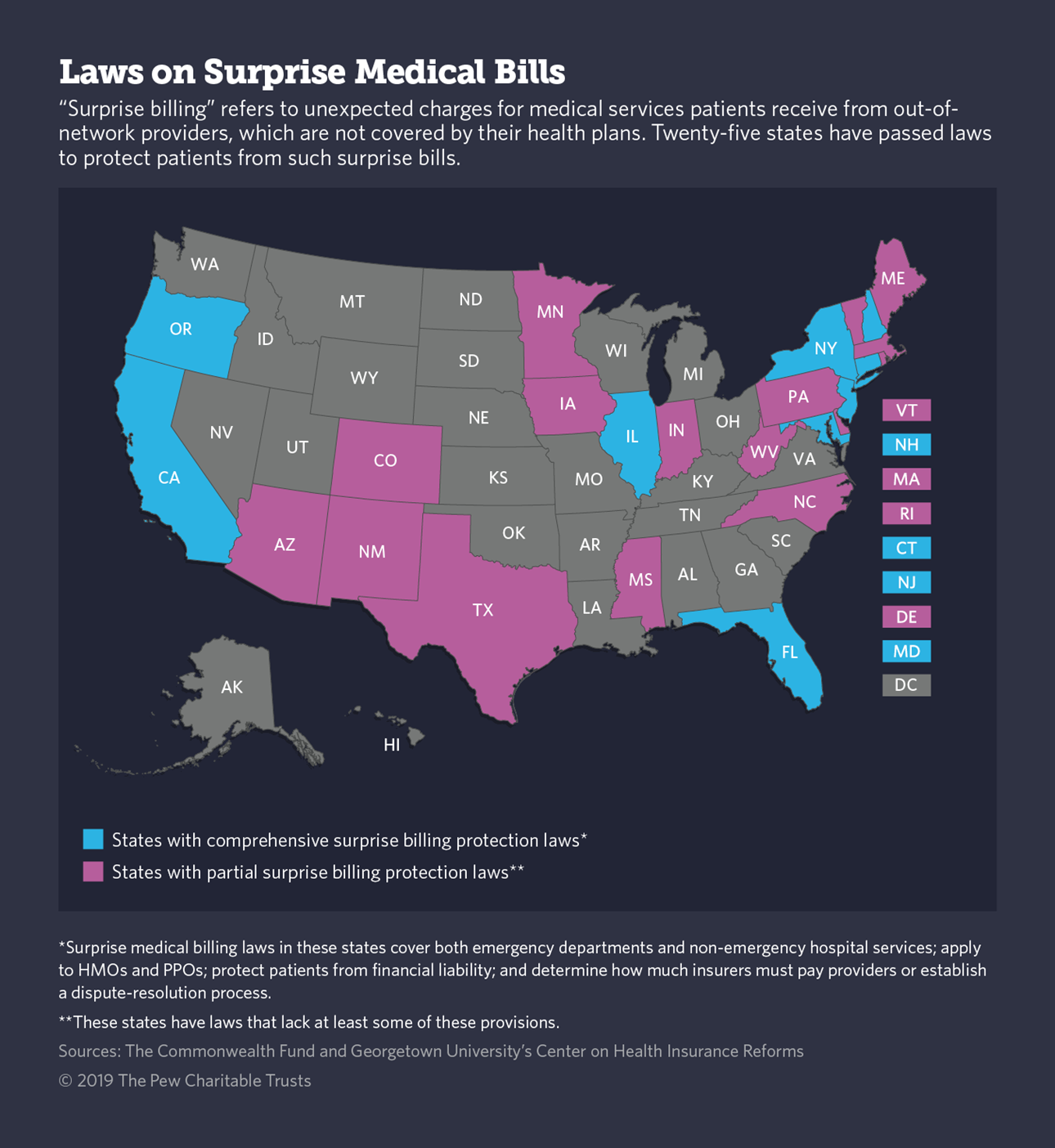

At least 25 states now have laws protecting patients from surprise out-of-network bills, usually for emergency care they received at hospitals or ambulatory surgical centers. At least 20 states are considering legislation this year, according to the National Academy for State Health Policy.

While states have provided protections for consumers with commercial health insurance plans, the laws do not apply to self-insured employer-sponsored health plans, which cover 61% of privately insured employees, according to the Kaiser Family Foundation.

When self-insured, companies pay medical claims themselves rather than paying premiums to an insurance carrier to do so. Self-insurance plans are regulated by the federal government, not the states, and no federal law prohibits surprise medical billing in self-insured plans.

That may change.

This week, Congress held a hearing to consider federal legislation that would prohibit surprise medical billing in self-insured plans. Congressional Republicans and Democrats have denounced surprise medical billing. Insurance companies and medical providers, meanwhile, often blame each other for so-called surprise or balance billing.

Origins in the 1980s

In-network means that a provider has contracted with a health plan to provide services for an established price. Providers generally accept lower in-network fees with the expectation that being in-network will mean seeing more patients.

Out-of-network providers are free to charge what they want. Typically, a health plan will pay an out-of-network provider the same amount it pays in-network providers, and the patient is responsible for paying the rest.

The state laws aim to protect patients who do not or cannot know if a person treating them is in their health plan’s provider network.

“It’s fundamentally unfair that people get bills for services they had no role in selecting,” said New Jersey’s Assembly Speaker, Democrat Craig Coughlin, who shepherded a balance billing law through his legislature last year.

Balance billing most often arises in emergency situations — an ambulance speeds a patient having a heart attack to the nearest emergency room, which happens to be an out-of-network hospital. Or an obstetrician in mid-delivery decides to call in a neonatal cardiologist who is not in-network for that patient.

In those cases, the patient has little or no opportunity of choosing the provider.

The practice, said California Democratic state Sen. Scott Wiener, who is sponsoring legislation on emergency room balance billing, “is fundamentally unfair to consumers. It can drive people into bankruptcy and upend their lives.”

Balance billing has been around since the 1980s, when HMOs were formed and created their own networks of medical providers. It has become more common as insurance carriers have narrowed their provider networks in an effort to keep their costs down.

“My consumer services team has been getting these calls for some time, but they have increased in volume,” said Jessica Altman, the Pennsylvania insurance commissioner who is backing comprehensive, bipartisan legislation expected to be introduced soon in the state legislature.

The insurance industry says patients should be protected from surprise balance bills, but casts the blame for them on out-of-network medical specialists who charge “unjustifiably high” fees.

“The problem of surprise medical bills tends to be concentrated among certain medical specialties where providers are likely to charge substantially more than their peers in other specialties and not accept private insurance,” America’s Health Insurance Plans, the lobbying arm of commercial health insurance companies, said in a statement submitted to Congress this week for its hearing.

While many states have passed balance billing laws, only nine have adopted a comprehensive package of measures, Jack Hoadley, a researcher at Georgetown’s Health Policy Institute, testified this week before a U.S. House Education and Labor subcommittee on health.

Hoadley said a comprehensive law should cover both emergency departments and nonemergency hospital services; apply to HMOs and PPOs (preferred provider organizations); protect patients from financial liability; and determine how much insurers must pay out-of-network providers or establish a dispute-resolution process between insurers and providers.

“The point is that patients shouldn’t have to pay additional amounts because of situations that were out of their control,” Hoadley said in an interview with Stateline a week before his testimony.

Carriers vs. Providers

The issue that has been hardest for states to resolve, Hoadley said, is devising a formula for out-of-network prices or a process for resolving disputes. Some states with balance billing laws have been unable to settle on a system that satisfies both insurance carriers and medical providers.

“The problem comes with what the reimbursement should be,” said Altman, the Pennsylvania insurance commissioner. “The payers don’t want to overpay; the providers don’t want insufficient reimbursement. It’s hard to find a solution that is mutually agreeable to both sides.”

The issue has stymied balance billing efforts in places such as Georgia, Pennsylvania, Virginia and Washington.

Some of the states that have laws have tied out-of-network prices to Medicare, either adopting Medicare prices directly or using a formula based on the Medicare rate. Other states use databases of average prices for medical services in each geographic area.

In Georgia, legislators are negotiating over balance bill legislation. As elsewhere, the hang-up has been over out-of-network fees.

Rutledge Forney, president of the Medical Association of Georgia, said her group wants to peg out-of-network fees to average prices for medical services in geographic areas as collected in an independent database.

She opposes the counterproposal from insurance carriers to use Medicare rates as the basis for determining out-of-network fees, which she described as “way under the going rate.”

The Georgia Association of Health Plans could not be reached for comment.

America’s Health Insurance Plans said it supports prohibiting medical providers from balance billing. In terms of out-of-network fees, it supports using rates paid by carriers in a geographic area or using Medicare rates as a benchmark.

In Washington state, Kreidler, the insurance commissioner, said doctors killed balance billing efforts in the past with their objections to using Medicare as a benchmark.

For the moment, he said, all sides have agreed to what he calls the “Solomonic solution” of using an independent database to set the out-of-network prices, followed by a procedure of binding arbitration between a provider and a carrier.

“If you don’t like it, challenge it and go to binding arbitration,” he said. “So it’s at your own peril.”

Hansen testified at the Washington state Capitol on behalf of the balance bill.

Eventually, Randall Children’s Hospital’s parent company, Legacy Health, agreed to reduce Hansen’s bill from about $97,000 to $24,000, and she has refinanced a second mortgage on her house to pay it. That’s better than her original plan, which was to sell the house.

“Luckily, I had enough credit, I could do it,” she said. “A lot of people wouldn’t be able to.”

Best of all, Ryan, now a sophomore in high school, is back to normal. Next summer, he’s headed back to Canada for some Scottish drumming at band camp, this time for the entire two weeks.

NEXT STORY: What Happens to Community Bonds When a Neighborhood Gentrifies