Connecting state and local government leaders

The goal: reduce vaping among young people.

This article originally appeared on Stateline, an initiative of the Pew Charitable Trusts.

With young people taking up electronic cigarettes in epidemic numbers, numerous states are slapping hefty taxes on vaping products and raising the legal age to purchase them to 21.

The twin actions are designed to reduce vaping among young people and to bring in revenue for the states.

The moves have taken on added urgency since reports that dozens of young people who used vaping products have been hospitalized for respiratory problems in states including California, Illinois, Minnesota and Wisconsin. Doctors who have reported the illnesses to their public health departments aren’t sure exactly what caused the problems.

E-cigarettes are battery-powered devices that heat up liquids containing nicotine or other substances, creating water vapor that is inhaled. Their popularity has skyrocketed with the advent of small, cheap vaping devices widely available in many kinds of stores.

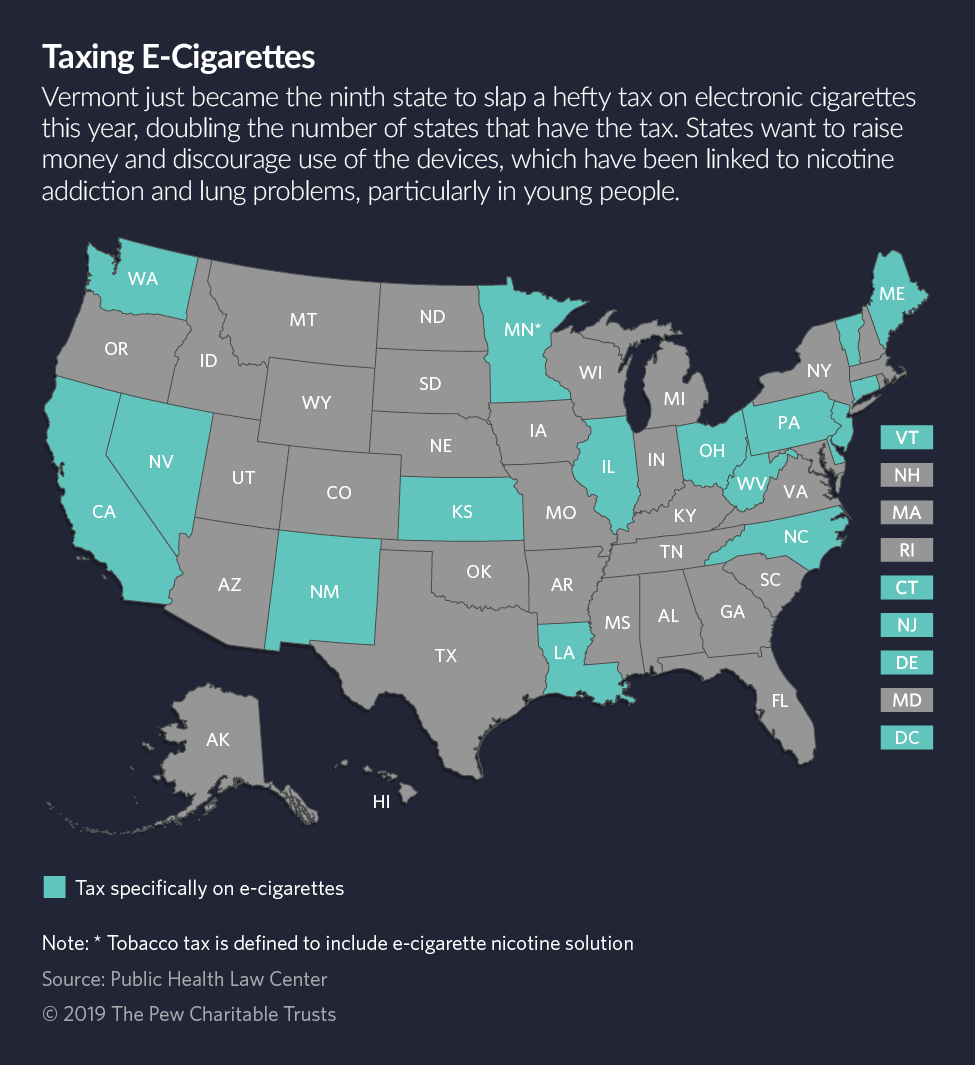

Like the jump in vaping’s popularity, state taxes and regulations have ratcheted up recently. Of the 17 states and the District of Columbia that have specific taxes on vaping products, half implemented them in 2019, according to the Public Health Law Center at the Mitchell Hamline School of Law, which researches the links between public policy and health. The District of Columbia and 17 states (not all of the states are the ones that have raised taxes) have the 21-year-old vaping age limit.

San Francisco in June became the first U.S. city to outright ban sales of vaping products, but an industry-backed initiative that would overturn the ban has qualified for the November ballot.

“Vaping has a similar effect [to cigarettes] and it’s on the rise,” Illinois Gov. J.B. Pritzker told Stateline earlier this month. “I have teenagers in high school, they tell me, I can see it. It’s an enormous problem. We know there are adverse health effects of vaping.”

Pritzker in June signed a budget including a new 14.5% tax on vaping products, which went into effect July 1. The Illinois budget also set the legal age for buying traditional and e-cigarettes at 21.

“It’s about deterrence. It’s not a big money maker, though it will bring in some revenue,” Pritzker said.

Illinois estimates revenue of $15 million in fiscal 2020 from its e-cigarette tax. That money, along with funds from a tax increase on traditional cigarettes from $1.98 to $2.98 per pack, will help pay for the state’s Medicaid program, Pritzker said.

Like Illinois, some states set their tax based on the wholesale price stores pay for vaping products, including Minnesota’s 95% tax and Vermont’s 92% tax. California’s tax is set at 65% of the retail price customers pay. Other states tax by the milliliter of liquid contained in the devices.

In virtually all states with a tax on traditional cigarettes, revenue from the taxes has declined with the falloff in smoking. The Tax Foundation, a conservative think tank based in Washington, D.C., reports that across almost all states, cigarette tax hikes produced a temporary bump in revenue, followed by lower collections in later years.

“States definitely view e-cigarette taxes as low-hanging fruit,” said Janelle Cammenga, policy analyst at the Tax Foundation. “Because some people view vaping as a public nuisance and because vapor products contain nicotine, an addictive substance, legislators can pitch the tax as a sin tax meant to reduce consumption.”

A 2018 surgeon general’s report said e-cigarettes have become, since 2014, the most commonly used tobacco product among American youth. E-cigarette use among U.S. middle and high school students increased 900% from 2011 to 2015, the report said.

Use declined for the first time from 2015 to 2017, but then rose again. It increased 78% among high school students, from 11.7% in 2017 to 20.8% in 2018. The recent uptick coincides with the soaring popularity of e-cigarettes made by Juul Labs Inc. and its imitators, which market small, handy refillable dispensers that look like large thumb-drives, along with nicotine-containing liquid cartridges.

Sales of Juul have skyrocketed, according to the CDC, growing from 2.2 million devices sold in 2016 to 16.2 million devices in 2017, giving Juul the greatest share of the U.S. e-cigarette market by December 2017. The use of Juul in schools, including in classrooms and bathrooms, is widespread, despite rules against it. Juul contains among the highest nicotine content of any e-cigarette, the CDC noted.

Since that report came out, Juul has mounted a “Tobacco 21” campaign, urging states to raise the legal age for buying tobacco products — including cigarettes and e-cigarettes — to 21. It also has abandoned flavored liquids, leaving the door open for competitors to swoop into that market. Juul says it also has beefed up its online sales barriers to young people, requiring Social Security numbers and an address to verify date of birth.

“Since JUUL Labs exists to help adult smokers switch from combustible cigarettes, we also believe the right approach to taxation would discourage the use of cigarettes, which are still the leading cause of preventable death, and incentivize and encourage adult smokers to switch to noncombustible alternatives,” Juul spokesman Ted Kwong said in an email.

Gregory Conley, president of the trade group American Vaping Association, likewise said vaping products cut into use of regular cigarettes by adults and reduce the “death and disease caused by cigarette smoking.” He said his organization would like to see states that raise the age to 21 grandfather in 18- to 20-year-olds who already are using e-cigarettes, but is not opposed to the Tobacco 21 efforts overall.

The vaping group is, however, opposed to increasing taxes on e-cigarettes. Doing so reduces the financial incentive to switch to vaping products, which Conley says are safer ways of ingesting nicotine.

But the surgeon general report said vaping is “not harmless,” especially for adolescents. Nicotine can harm the developing brain and impact learning, memory and attention as well as increasing the risk for future addictions.

The vaping group’s Conley said the idea of taxing ordinary cigarettes and e-cigarettes with the same levies “is complete nonsense,” because many vapers buy expensive refillable devices at vape shops and the tax can add tens of dollars to the price of a new unit.

State Fights

It was the youth trend in vaping that finally persuaded the Vermont legislature to approve taxes on e-cigarettes, according to Rep. George W. Till, a Democrat who sponsored the House version of the bill (the Senate version eventually passed). A similar bill failed last year.

“These things really aren’t a smoking cessation product; they are an attempt to hook people — particularly young people — on nicotine,” he said. He said medical literature shows that raising the price of tobacco products affects two groups, “people with no money and youth.”

He said Vermont’s 92% tax brings vaping products up to par with the cigarette tax, which is $3.08 per pack.

The bill passed nearly unanimously, with the half dozen lawmakers who objected doing so on anti-tax grounds.

But not all efforts to tax and regulate e-cigarettes recently have been as successful. In Montana, a series of bills to regulate e-cigarettes — to raise taxes, lift the legal age, and require the devices to be placed behind the counter with regular cigarettes, among other efforts — all failed this year.

State Rep. Mary Ann Dunwell, a Montana Democrat, pushed a bill that would have banned flavored nicotine vaping products, put other products behind the counter in stores and kept them out of vending machines. “Now, it’s with the candy,” she said. But her bill died after convenience store owners objected.

“The small convenience stores convinced the legislature that it would put them out of business,” Dunwell said in an interview.

Lyle Beckwith, a spokesman for the National Association of Convenience Stores, said small stores oppose increased taxes or regulations that put them at a competitive disadvantage with stores in nearby states or purchases on the internet, where regulations potentially can be evaded.

“If you own stores in New Jersey and New Jersey wants to raise the excise tax, it’s cheaper for customers to go to Pennsylvania or Delaware and they [store owners] are concerned about it,” he said. “They are losing business to that state and it’s not a level playing field.”

The association, which does not lobby on the state or local level, has supported federal legislation to raise the age for buying all tobacco products to 21 as well as legislation that would expand the federal Prevent All Cigarette Trafficking (PACT) Act to e-cigarettes. The PACT Act, which went into effect in 2010, regulates Internet purchases of cigarettes to make sure state and local taxes are collected and requires delivery services to check the age for purchasers before packages of cigarettes are delivered.

But Till, the Vermont legislator, says convenience stores are overstating the potential hit to their business of e-cigarette taxes or controls.

“My response is if your business plan requires you to addict young people to tobacco products, you need a different business plan, or you don’t deserve to stay in business,” he said.

Elaine S. Povich is a staff writer for Stateline.

NEXT STORY: Governors Are Losing the Space to Govern