Connecting state and local government leaders

The more important question is how ride services factor into cities’ goals for mobility. A new analysis of New York City shows why.

At 11 p.m. on a Thursday in February, two friends in Brooklyn are preparing for a trip home from Park Slope to Bed-Stuy. They’re both new in town, and they study their Google Maps options closely: Taking the subway means a 15-minute walk to a station on the F line, where their train coming in from Manhattan had been delayed 20 minutes. Then they’d have to transfer to the C, with a likely wait time of 10 or 15 minutes. To travel three miles, this could be an hour-long adventure.

The friends could probably walk in the same amount of time, or pedal home in 20 minutes using bike-share, but the weather is freezing. They check Lyft: Splitting a pooled ride with one another (and perhaps an extra stranger) means paying $7 for a roughly 25-minute trip in a sweetly overheated sedan, directly to their doors. The choice is very clear.

Do stories like these explain the declining passenger base of transit agencies across the U.S.? Amid the rise of transportation network companies (TNCs) like Uber and Lyft, this logic goes, travelers will pay extra for a lot of added convenience, leaving transit options—which leave a lot to be desired—to waste.

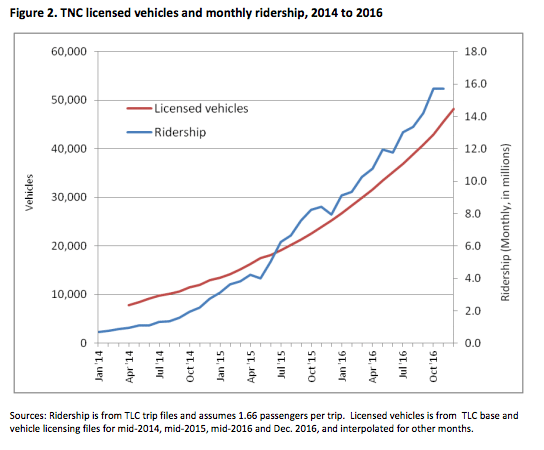

According to a New York Times article explaining 2016’s historic dip in New York City’s subway ridership, TNCs including Uber, Lyft, and smaller competitors saw ridership triple in the Big Apple, increasing to about 16 million passengers in October 2016 from roughly 5 million in June 2015. It seems sensical to connect those steep gains to a transit system longing for passengers. In recent years years, researchers have wondered whether Uber and its ilk bolster or undermine the use of buses and trains. Looking at the trends in New York City, ride-sharing services may appear to be transit foes.

But a new report released Monday by the transit consultant and former senior city transportation official Bruce Schaller paints a more complicated picture of the relationship between transit and TNCs in New York City. As the Big Apple’s population swells, TNCs are clearly attracting more and more riders, at more times of day and in different kinds of scenarios. Street traffic is worsening, and the number of vehicle-miles traveled is growing—which could mean emissions are on the rise, too.

But what are the trade-offs? Sometimes, in areas where TNCs and transit appear to be competing for the same customers, it can be also be interpreted as the new mode “complementing” the old. It’s worth asking, too, to what extent TNCs are “stealing” riders, as opposed to flailing public transportation services more or less surrendering them. Perhaps rather than asking whether the Ubers and Lyfts of the world are friends or foes to transit, it’s time to ask how well TNCs are helping cities meet their goals for successful transportation systems. That’s where things get interesting.

Ride, Ride Again

Schaller’s research is the source of that tripling ridership figure cited by the New York Times last week; the new report makes “a detailed analysis of the growth of app-based ride services in New York City, their impacts on traffic, travel patterns and vehicle mileage since 2013, and implications for policy makers,” Schaller writes.

Schaller knows New York well, but that’s not the only reason he focused on the city for this analysis. It’s really the only place in the U.S. with as much data on TNCs, taxicabs and other for-hire vehicles in New York City: think electronic taxi and TNC trip logs, weekly for-hire vehicle trip volumes, and vehicle mileage readings.

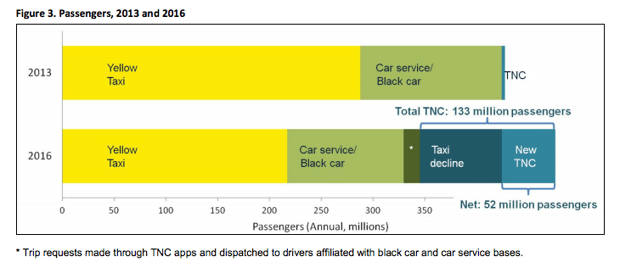

Those numbers show an incredible rate of growth in TNC ridership. In a report published in January 2016 for Mayor Bill de Blasio that pointed blame for congestion away from Uber, Schaller had suggested that gains in TNC passengers up until that point more or less reflected fed-up taxi riders switching to ride-hailing services. Now it appears that in addition to displacing those passengers, TNCs may be eating into other modes of transportation. Between 2013 and 2016, Schaller shows that the ride service industry (including TNCs and taxis) netted 52 million passengers between 2013 and 2016, reflecting large declines for taxis and even bigger gains for TNCs.

Frenemies Forever

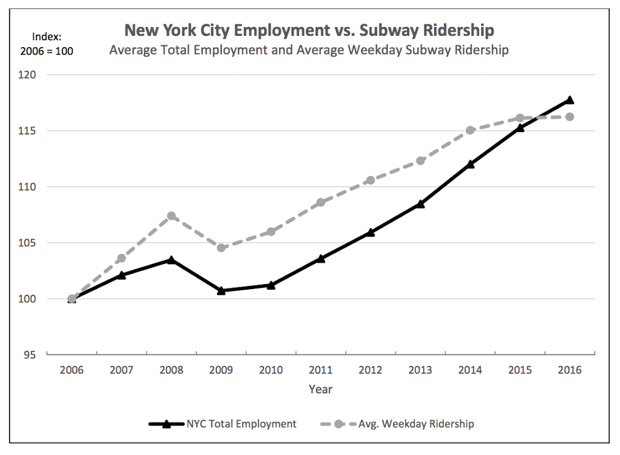

Public documents from the MTA show that New York City job growth has overtaken transit ridership—people are using other ways to get to work every day. “From 1990 to 2014,” Schaller writes, “the subway and bus system absorbed all or nearly all the growth of travel in the city generated by increases in population and economic activity.” That is no longer the case, thanks in part to the emergence of the Uber kind, he writes: “In 2015 and to an even greater extent in 2016, growth in taxi and for-hire ridership outpaced growth in transit ridership and is now the leading source of growth in non-auto travel in New York City.”

From what other modes are TNCs luring New Yorkers? We know there’s been a long-term decline in bus ridership, and the MTA recently posted its first decline in subway ridership since 2009. Even in this analysis of the best data available (which isn’t nearly as good as what could be available, given how much Uber and Lyft have kept under wraps, like robust data on pickup locations, times, and driver deadheading), it’s hard to distinguish transit-cannibalism by TNCs from transit-complementariness. But the best clues lie in Schaller’s analysis of where and when the biggest gains in Uber/Lyft trips are happening.

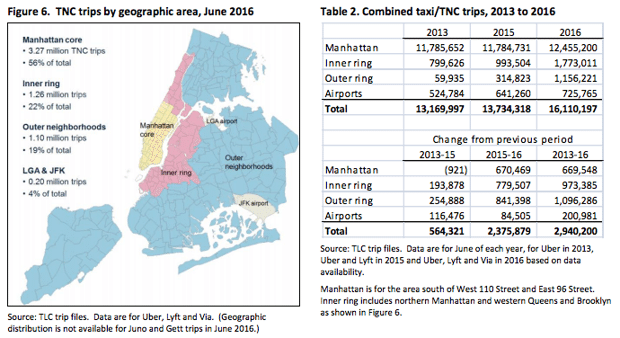

Schaller finds that, while dense, busy Manhattan has the highest volume of TNC trips, most of the growth between 2013 and 2016 has occurred in other boroughs—areas with less subway and bus access, and in particular, notoriously underserved by traditional cab companies. Schaller’s analysis shows that Uber and Lyft rides are definitely displacing taxi trips in these areas, but it’s harder to say whether they’re substituting transit rides or complementing them—i.e., providing a “first/last mile solution,” and connecting them to transit stations more easily. Probably, it’s both.

In congested Manhattan, gains in TNC use betweeen 2013 and 2016 were also substantial. There, the effect of added ride-hailing cars on the road would be felt the heaviest. Schaller analyzes the times at which TNC use has grown most to draw out shifts in travel choices:

Trip growth… has been concentrated during the morning and evening peak periods, when yellow cab shift changes produced a shortage of cab availability, and late evenings and weekends when passengers may prefer the comfort and convenience of TNCs over yellow cabs or transit services.

Again, it appears that ride-hailing services are growing as a result of folks moving away from yellow taxis at times that cabs are least convenient, and, to some extent, away from Manhattan’s thicket of subway and bus options at times that transit is least convenient. In super pedestrian-friendly Manhattan, inexpensive “pooled” trips might also be tempting tired walkers and cyclists into backseats at times.

TNCs: friend or enemy to transit? The best data available seems to suggest that they’re both. The next question, then, is how do they fit into the larger picture of what good transportation means in New York City?

Who’s Cramping Whose Style?

Everyone hates sitting in traffic. Congestion is a waste of time and money, it hurts bus performance, and it’s worsening in New York City. Since 2013, as the local economy and population have increased, daytime speeds in Manhattan’s core business district have fallen by 11 percent.

Based on his analysis of vehicle mileage data and average stop times, Schaller estimates that the growth of TNCs from 2013 to 2016 added an additional seven percent to existing miles by all vehicles driven in Manhattan, western Brooklyn and Queens (the most congested “inner ring” boroughs). That is bound to have a sizable effect on traffic, he writes:

The 2008 report of the New York State Congestion Mitigation Commission found that congestion pricing would have reduced VMT by 6 percent in the Manhattan CBD and improved average speeds by 7 percent. The amount of stop-and-go traffic would have declined far more quickly, with a 20 to 30 percent decrease in the amount of time motorists spend in stop-and-go traffic conditions. The same dynamic would be expected in the opposite direction—a single-digit increase in traffic volumes would translate to much larger increases in severe traffic congestion experienced by motor vehicles.

Schaller notes that while Uber and Lyft’s heavily promoted “pool” options may take some extra cars off the road, they won’t mitigate their contribution to extra mileage, since they’re still luring more people away from transit, walking, and biking in certain areas and at certain times of day.

Sounds bad! On the other hand, we’ve already learned that much of the growth in TNC use is happening on nights and weekends, when traffic abates somewhat. Added mileage certainly isn’t good for the environment, but maybe the extra TNCs aren’t being felt as much in terms of traffic as one would think, since they’re mostly away from rush hour. For now.

Think Outside The (Blocked) Box

What does it all mean? Should New York City maintain the status quo, allowing TNCs to “fill” transit gaps, despite their likely, though debatable, impacts on traffic? This gets to the heart of what might be a more important question: Maybe it’s time to stop asking whether Uber/Lyft are “good” or “bad” for transit, walking, and biking. Time to ask, instead, how well they they serve a city’s vision for how it wants to move.

For all of its warnings, many of Schaller’s findings show how TNCs are filling “gaps” New York’s transportation networks: where taxis are hard to come by, and when subway and bus service sucks, Uber and Lyft are there to help make connections. A growing number of cities with lackluster transit options are using the same reasoning to harness ride-sharing services as a substitute to public buses, sometimes even subsidizing fares.

But as Henry Grabar at Slate has eloquently shown, such logic can turn into a cycle of transportation self-defeatism. Poor transit service (especially on buses) can lead to falling ridership, which can lead to cities relying on TNCs, which can lead to less investment in transit, which can lead to falling ridership. Even with its robust networks of subways and buses, New York City shouldn’t consider itself immune to this outcome; transit quality is declining, and passengers are disappearing. Its bus system has been hemorrhaging riders for years, due to deathly slow speeds and unreliable arrival times—which is partly the result of growing congestion. The subway system’s recent ridership loss has been happening on weekends, when ongoing subway repairs are generating particularly agonizing delays. (Slightly less agonizing delays are also in abundance on during the week.)

Meanwhile, more folks are returning to the driver’s seat, nationwide, due to low oil prices and economic gains; agencies like the MTA have to combat those forces, too. A city official could examine Schaller’s research and conclude that TNCs are helping New Yorkers more than they are hurting: they are probably taking some people out of their own cars, and they don’t seem to be causing too many people to migrate away from their core transit-reliant commutes. She may be right—for now. But getting complacent, and allowing the quality of transit service to stagnate or decline, could help TNCs creep up their market share. That could worsen congestion more noticeably down the line, and make surface transit suffer even more.

Schaller and others do have a number of suggestions for what New York and other cities can do. First, transportation officials should work double-time to make transit more appealing: That could mean more bus and bike lanes that are actually enforced; adjusting traffic signal timing to give priority to buses; ramping up off-board fare collectors and other speedier payment technologies; and installing more countdown clocks to give passengers a clue about wait times. Also: implement a road pricing scheme, carefully targeted to cut congestion at peak times. Making TNCs pay more for the streets they use should send customers a price signal to use transit, instead.

Susan Shaheen, the UC Berkeley transportation and shared mobility expert, points out that pricing strategies would also need to reduce demand for single occupant vehicles in general, which “we often don’t mention in an analysis of shared mobility services,” she writes by email. David King, a transportation and urban planning scholar at Arizona State University, adds that cities should require far more detailed trip data from TNCs (New York City made headway on this in February), or else they’ll keep struggling for clarity on these complicated dynamics.

Even with the best numbers, researchers and policymakers may never fully understand the dynamic relationships that cause people to migrate from one transportation mode to another; riders are humans, not robots, and they make decisions based on countless micro-subjectivities that might never show up in “data.” It is clear, though, that New York City once supported years of population and economic growth on the strength of its transit system, and now, vehicles are assuming a growing support role. Say what you will about Uber’s particular business model, but shared ride services are here to stay—eventually, perhaps, in the form of autonomous vehicles. But no technology has changed this equation yet: Faster trip times, less congestion, safer streets, and cleaner air for its citizens requires fewer cars on the road. And reducing car reliance means investing in public transportation.

Laura Bliss is a staff writer at CityLab, where this article was originally published.

NEXT STORY: Cool, cable-free data centers via laser data transmission