Connecting state and local government leaders

Since EV drivers zip past gas taxes, they don’t contribute to the federal fund for road maintenance. A new working paper tries to determine whether plug-ins should pay up.

More than 1 million electric cars are now zipping (quietly) around the United States. That’s still a tiny fraction of the nation’s 260 million-strong vehicle fleet, but EVs hit a sales record of 208,000 registrations in 2018. As more mass-market plug-in models hit the showrooms, more charging stations pop up, and the menace of “range anxiety” fades, new EV drivers are born every day.

But are all those Bolts, Volts, Leafs, and Teslas paying their fair share for the asphalt they drive on? The Highway Trust Fund, the federal government’s purse for road maintenance, depends on the 18 cents per gallon U.S. motorists pay in gasoline taxes. But it’s nearly insolvent, in part because Americans drive more fuel-efficient machines than before. So states like California, Washington, and Illinois are mulling a “mileage tax,” where drivers pay a fee based on the number of miles driven, rather than the amount of gas they burn. Oregon, where a pilot program asks participants to pay 1.7 cents per mile in lieu of paying a gas tax, is the example to follow.

Yet the question of getting plug-ins to pay up may be trickier than it seems. In a new working paper for the National Bureau of Economic Research, Lucas Davis, a professor of business and technology and a director of U.C. Berkeley’s Energy Institute, and James Sallee, a professor in the school’s department of agricultural and resource economics, estimate that while the U.S. does indeed forgo millions in tax revenue thanks to EVs, instituting a special tax on electric vehicles might produce unwanted side effects.

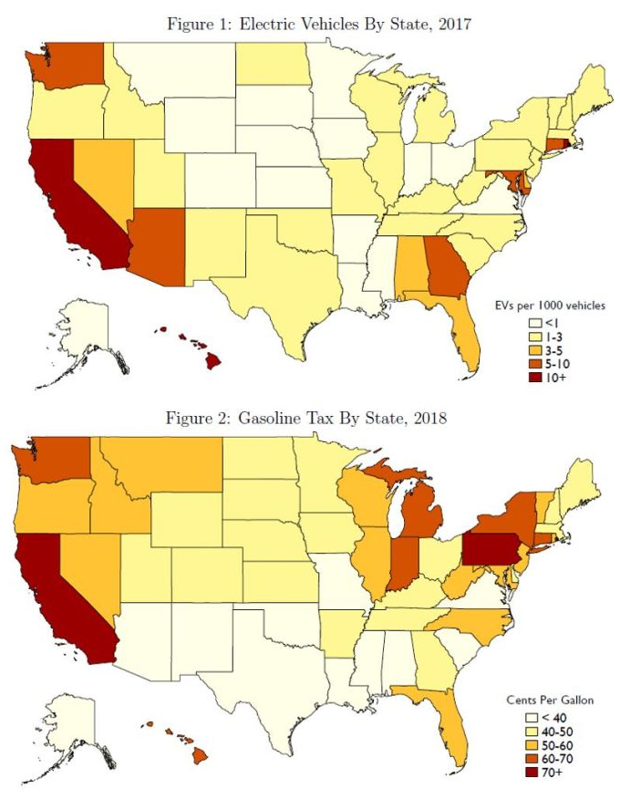

First: Just how much is the highway piggy bank losing because of the rise of EVs? Davis and Sallee estimate about $250 million a year, based on vehicle substitution trends and average miles driven. That’s a fairly modest hit, but per EV, it seems weightier: $318 annually, according to their estimates. This impact on tax revenues is concentrated in a small number of states where EVs are most popular and gas taxes are highest: In California, where 7.8 percent of all new car sales are hybrids or electric, the state is surrendering $90 million in annual revenue.

What’s more, Sallee and Davis estimate that two-thirds of those foregone resources comes from households that make more than $100,000 in annual income, since EVs tend to be more expensive to purchase than conventional cars and are disproportionately driven by more affluent people. This suggests that the under-taxation of zero-emissions cars has a “regressive” effect—it hurts poorer Americans more than rich folks.

So, should EV drivers cough up, and how much? Facing this question, the researchers consider some key economic tradeoffs. On the one hand, even though EVs help reduce carbon emissions and local air pollution, these virtuous vehicles still contribute to road congestion and collisions as much as anyone else. And we’ve seen that the federal coffers could use some support. Perhaps some tax is in order.

On the other hand, the price of gas does not begin to fairly account for all the “negative externalities” of driving to begin with. Even upwards of $4 gallon, fuel is ludicrously cheap compared to the overwhelming costs of the climate catastrophe its use is feeding. For reference, the researchers cite a prior study that calculated the social costs of greenhouse gas emissions and local air pollution to be $0.60 per gallon.

So, if EV drivers are being asked to pay, the fee should probably be lower than for those who use higher-emission cars. It might possibly even be negative, so that more consumers are incentivized to go electric.

Weighing all of these conflicting variables, and the fact that the impacts of vehicle emissions and lost tax revenue vary so much from state to state and city to city, the researchers conclude that it’s virtually impossible to determine the precise optimal fee for plug-ins. Even the question of whether the tax should be positive or negative is too tough to say, since consumers can be so fussy—too high a fee and they might drop the paperwork for the Leaf and start shopping for an Accord. But in the short-term, a mileage fee for EVs could be wise if it’s balanced with the kind of rebates and tax credits already offered by many states (and, for a short while longer, the federal government), the researchers write.

In the long run, however, a mileage fee for all vehicles is probably the best answer of all, the researchers conclude. Unlike the venerable gas tax, a mileage fee could vary by time and location, and it could be priced to account for more of the negative social impacts of driving.

Perhaps that’s the most useful takeaway of this paper. The gas tax—the baseline for how much driving “should” be taxed—is so vastly underpriced that trying to compute a fair way to layer additional fees on top of it becomes complicated, quickly. Even with their quirks, perhaps the biggest problem with electric vehicles is that they highlight how broken the economics of driving has become.

Laura Bliss is CityLab’s west coast bureau chief.

NEXT STORY: Why it’s so hard to predict how much funding 9/11 first responders need