With West Coast States Blocking Coal Export Projects, Proponents Keep Pushing

The former Oakland Army Base pier at left and the Port of Oakland at lower right in Oakland, Calif., as seen in February 2016. A developer is seeking to build a bulk cargo terminal that would handle coal and other goods at the former Army base site. AP Photo/Eric Risberg, File

Connecting state and local government leaders

Environmental and public health concerns have doomed some proposals. But the volatile economics of sending coal overseas calls into question how much it can help struggling mines.

Big segments of the West Coast are presenting a dead end for U.S. coal mines seeking to ship their product to countries in Asia, where it would be burned to fuel power plants.

With U.S. coal consumption declining for more than a decade now, some in the industry and in states with sizable coal deposits, like Wyoming and Utah, see export markets as a possible way to diversify and boost sales.

But building new infrastructure that would allow coal companies to actually ship their product overseas has proven to be difficult, as states like Washington and Oregon have blocked the development of coal exporting facilities.

The projects pit public health and environmental concerns raised by people in coastal areas against the profit motives of investors and the economic future of coal-producing communities.

So far, the coastal objections have won out. But, despite repeated setbacks and failures, interest in the export facilities is still smoldering.

In California, the backers of a proposed bulk cargo terminal in Oakland are fighting the city in court over regulations that local lawmakers there adopted barring coal shipments at the site.

The terminals are getting attention in Congress as well, where U.S. Sen. John Barrasso, a Republican from Wyoming—the nation’s top coal-producing state—is leading a charge to revamp a permitting process that has been used to stop some of the proposed projects.

Wyoming’s coal industry has seen a downturn in recent months, with bankruptcies, mine closures and layoffs. That’s a big deal in a state where the coal sector can account for roughly three of ten jobs in some counties and provides a significant stream of tax revenue.

With coal export facilities in the western U.S., coal is typically shipped from inland mines by rail to terminals where it is then loaded onto boats that will ferry it across the Pacific Ocean.

Coal exports are up from where they were a little over a decade ago. The U.S. in 2018 exported about 54 million short tons of “steam” or “thermal” coal, the kind that is used to fuel power plants and that dominates production in western states. That’s up from 26 million short tons in 2007.

But in Washington and Oregon alone in recent years, plans for about a half-dozen projects to ship coal have fallen apart, abandoned by their sponsors and denied key permits.

“It’s really a bleak situation for the coal guys,” said Eric de Place, who works on energy policy at the Sightline Institute, a Seattle-based environmental think tank.

Opposition from environmental groups and residents concerned about cutting carbon emissions globally, and preventing air pollution from diesel locomotives and coal dust locally, have contributed to killing the projects.

Experts say, however, that market conditions are changing as well, in ways that make it tougher now than in past years for certain U.S. coal producers to turn a profit in Asia—where India, Japan and South Korea imported the most American coal last year.

This means the terminals can look like increasingly speculative bets for investors, and raises doubts about how much they would help Wyoming in particular, according to some analysts.

Plans for export projects swelled around the 2011 to 2013 time frame after prices on the international market for coal climbed, and China’s appetite for the fossil fuel grew.

Clark Williams-Derry, with The Institute for Energy Economics and Financial Analysis, said that for a few years the coal industry “convinced itself that this temporary bubble” in prices and Chinese demand was a new normal. But the upswing eventually peaked and fell.

Williams-Derry said he now sees the outlook for U.S. coal exports from western states as poor. “There are people who are still interested,” he said. “But they're not putting much money into it.”

‘Always Looking For New Markets’

A company that has plans to operate the Oakland terminal wants to ship coal from Utah, as well as other bulk goods from the site.

Utah’s coal is known for burning hotter than coal mined in Wyoming and other parts of the western U.S., producing more energy per ton. As a premium product, it tends to fetch higher prices, making it more attractive for businesses shipping coal overseas.

This gives the Oakland project a possible edge over some other export terminal ventures. The proposed terminal is also notable because it is one of the only ones left pending on the Pacific Coast where western mines could gain new access to ship coal to Asia.

The terminal would be a welcome development in Utah coal country. Brian Somers, president of the Utah Mining Association, did not comment on the Oakland project, but did note that exports are a growing part of the coal mining industry in the state.

“We are always looking for new markets, and to export more, and so having access to more efficient export terminals would be incredibly helpful,” Somers said.

Utah officials have charted a plan that could provide up to $53 million in state funding to help finance the project, which is expected to cost hundreds of millions of dollars in total to build.

Coal production in Utah in 2018 slipped to a 33-year low, and stood at about 13.8 million short tons, valued at $454 million, according to the state. With domestic demand for the state’s coal near historic lows, about 4.6 million short tons—roughly one-third—of that total was sent to Asia.

Much of the coal exported from Utah passes through facilities in Richmond, California. But the Richmond site has now come under scrutiny. The City Council there is set to consider an ordinance on Dec. 3 that calls for phasing out the shipment and storage of coal in the city.

Officials more than 600 miles inland are watching the debates in California about exporting coal.

Casey Hopes is a commissioner in Carbon County, Utah. “Carbon County has a long history of being an energy producing county, not just coal, but we have some natural gas reserves as well,” he said. “The shifting away from coal, it’s been a major impact.”

Hopes explained that two mines in the county are among the biggest taxpayers.

“It's not just the coal mines, most of the businesses in our community were built on being support businesses,” he said. “We're in the process of trying to diversify our economy, but until that happens we have to try and keep what little tax base we have.”

Jobs are a concern as well.

Carbon County has about 20,000 residents, with around 8,800 people employed there last year. About 600 of those jobs were in mining, down from about 975 back in 2008, state figures show. Last year, mining jobs in the county paid about $6,800 per month on average.

While Hopes didn’t want to get into specifics about the coal export terminal in Oakland, asked about whether he thought it would help the county, he said: “Absolutely.”

But Dan Kalb, an Oakland city councilman who supported legislation that blocked coal shipments at the proposed cargo terminal, pushed back at the suggestion that preventing facilities like this is harming rural economies in states like Utah.

“You don’t do something that’s destructive because somebody can get paid for it,” he said. “We don’t have any obligation to some company, or set of companies, in Utah to help them make a bunch of money.”

Kalb pointed out that discussions about moving away from coal towards cleaner energy sources have gone on for years now. “People need to take responsibility for their lack of action in making that transition,” he added. “And sometimes you’ve got to force people to make a transition.”

Controversy on the Waterfront

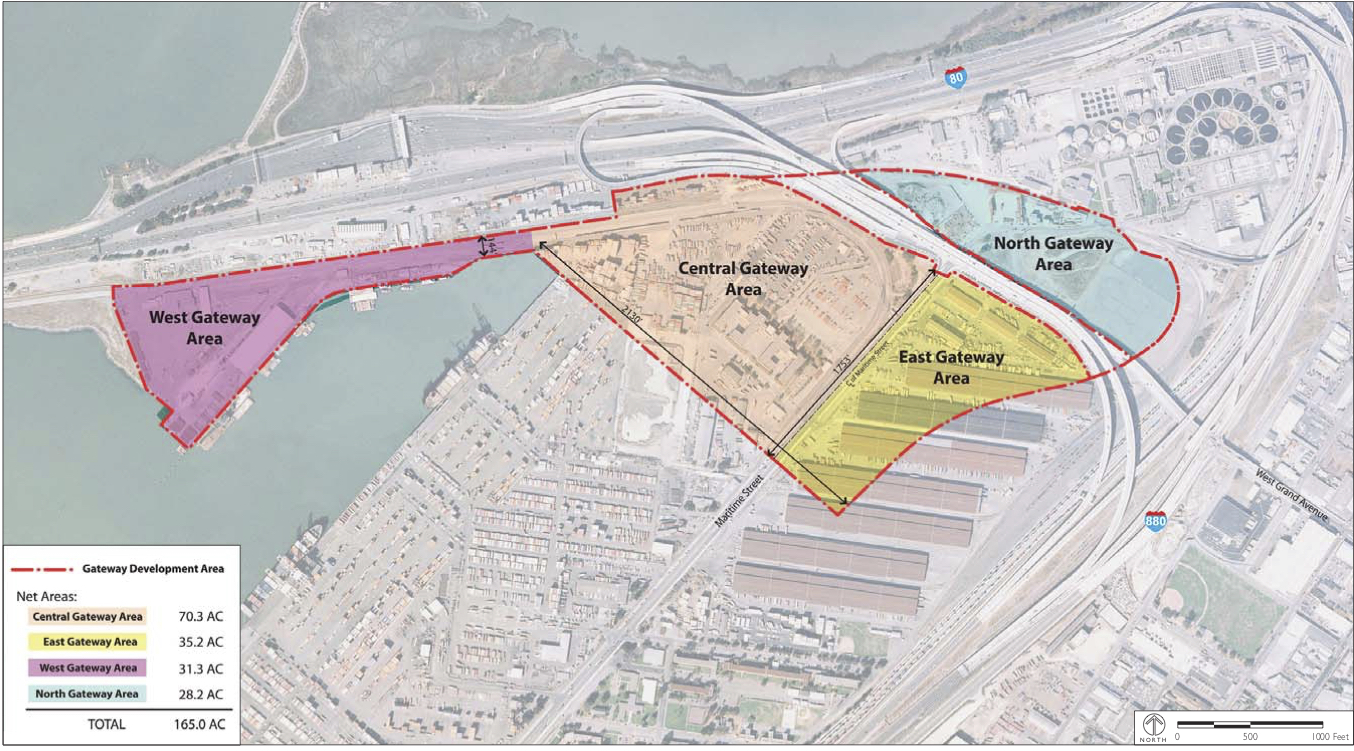

It was in 2012 when Oakland entered into an agreement with a developer to create a bulk cargo terminal on the site of a decommissioned Army base on the city’s waterfront. The site is in West Oakland, near the Bay Bridge, a tangle of freeways, and the city’s port.

It’s a part of the city where there are historically higher rates of childhood asthma and long-running concerns about air pollution.

Margaret Gordon, co-director of the West Oakland Environmental Indicators Project, said that air pollution from the port in Oakland did decline over the past decade after the state set tougher emissions regulations for heavy trucks.

But she added: “We still have children between the ages of zero and five being admitted to emergency hospitals for respiratory-type problems.”

When word got out that the developer planned to ship coal through the terminal, it led to a local backlash. The city council responded by enacting a pair of measures in 2016 barring coal operations at the site.

The company spearheading the project, Oakland Bulk and Oversized Terminal, or OBOT, fired back that same year with a lawsuit. OBOT is led by Phil Tagami, a well known California developer.

Two environmental groups, the Sierra Club and San Francisco Baykeeper, later intervened on the city’s side in the case, which went before a federal judge in San Francisco.

Oakland’s deal with the developer largely prevented it from imposing new regulations on the planned cargo facility after the two sides agreed to move ahead with the project.

But there was a provision that allowed the city to set new regulations affecting the site, if failing to do so would pose a “substantial danger” to residents’ health and safety. An additional caveat is that the city’s conclusion this danger exists must be supported by “substantial evidence.”

Whether Oakland lawmakers adhered to these guidelines is central to breach of contract claims OBOT leveled in its lawsuit.

A federal judge last May ruled in the developer’s favor in a part of the case dealing with the breach of contract claims. Oakland appealed that decision to the U.S. 9th Circuit Court of Appeals, where a panel of judges heard arguments in the case last week.

"We're talking about a city's fundamental police powers,” said Jessica Yarnall Loarie, a senior attorney with the Sierra Club who has worked on the case. “Oakland is exercising its police powers.”

“Oakland rightfully saw,” she added, “that coal does pose a danger to health and safety.”

But David Smith, a lawyer for Tagami, called that the process the city used to come up with the coal restrictions “a sham.”

He said a main reason OBOT went through the trouble of gaining special “vested rights” for the terminal site, as part of a 66-year deal, was so that a future city council could not adopt policies “on political whim” that would upend plans for how the facility would be developed and operated.

“When you build these things, you're building and making commitments for generations, because it takes tens of millions of dollars right up front, and basically the facility just needs to respond to what the market demand is,” Smith said.

Even if the city wins the appeal, the case could easily grind on longer. OBOT made other legal claims that the district court set aside while addressing the contract issues.

And the federal lawsuit is not the only one that the project is embroiled in.

Oakland moved last year to terminate its lease with OBOT on the grounds that the developer was failing to meet construction milestones. After this happened, the developer filed a separate lawsuit last December that is now playing out in state court.

Smith said that OBOT still wants to see the project through. “If we were going to walk away, we would've done it a long time ago," he said.

The uncertainty surrounding the Oakland project took on an added dimension in July of this year when a company that was going to sublease the site from OBOT to operate the bulk terminal entered Chapter 11 bankruptcy proceedings in a Kentucky federal court.

James Wolff, is the chief operating officer of that company, Insight Terminal Solutions. He said by phone last week that the reason for the bankruptcy is that the company has been unable to get permits for the project from the city that would allow the terminal to be built.

“We called a pause, to say, ‘city, you've got to perform,’” he said.

Wolff emphasized that the terminal would not just handle coal. “It’s always been a multi-commodity terminal,” he said.

The site, he explained, has rail access to a huge swath of the western U.S., including places with significant deposits of iron ore and material used to make aluminum. Soda ash, fertilizer and grain are other possible goods it could handle, according to Wolff.

For now, though, Wolff said, Insight Terminal Solutions is still banking on plans to ship coal mined in Utah through the facility if it is built.

‘Nobody On The West Coast Wants This Coal’

ITS’ bankruptcy documents show that between October 2018 and July of this year, Wolff and John Siegel, executive chairman and CEO of the company, held meetings with influential government officials and community leaders about matters related to terminal project, as The Guardian recently reported.

Oakland City Council members, U.S. Transportation Secretary Elaine Chao, her husband Senate Majority Leader Mitch McConnell, and NFL star Marshawn Lynch are among the people that travel itinerary documents indicate that the two men met with.

But in spite of this and other efforts to build support for the project, some critics remain dead set against it. That’s despite assurances from ITS that the site will control coal dust using measures like covered rail cars, enclosed storage structures and other technology.

“I see no reason for us to back down,” Kalb said. “We’re going to do whatever we have to do within the law to make sure this thing never gets built.”

He explained that he’s open to the idea of a cargo facility at the site, just not one that handles coal. The reasons he’s so staunchly opposed to shipping the fossil fuel from Oakland, he said, have to do with both localized public health and safety concerns and climate change.

“Stopping these literally 10s of millions of tons of coal from being burnt, keeping it in the ground can be a big benefit,” he added. “As far as I can tell, nobody on the West Coast wants this coal.”

Gordon, with the West Oakland Environmental Indicators Project, is a leading voice on environmental and public health issues in Oakland. She said she wants to see the parcel of land used for something that creates jobs, just as long as it does not involve coal.

“We know that shipping coal and having the cumulative impact of diesel, simultaneously, is not good for residents’ health,” she said.

‘Blocking Wyoming Coal’

As the controversy over the Oakland terminal plays out, a related debate over permitting continues to percolate in Washington, D.C.

Barrasso, the Wyoming senator, along with other lawmakers and the Trump administration, have been pressing to change a Clean Water Act permitting process overseen by states.

That “Section 401 certification” process contributed to the derailment of a major coal export facility proposed in Washington state, on the Columbia River, known as the Millennium Bulk Terminals project. Natural gas pipelines have been held up by the Section 401 process as well.

As originally planned, the Millennium project would have been the largest coal export terminal in North America, according to Washington state. It would have also been positioned to possibly receive Wyoming coal.

While not technically dead, the terminal is now largely seen as a long shot at this late stage given its failure to win regulatory approvals, although its backers have filed at least five lawsuits against Washington state to revive the project.

Failed plans for terminals in Oregon and Washington mean the shortest pathway to export coal from Wyoming to Asia would mainly be through Canadian ports in British Columbia. But the extra distance to those ports can result in higher railroad costs that chew into profit margins.

Barrasso has suggested repeatedly that Washington state abused its Section 401 authority to stymie coal exports. He did so again in a statement last week.

“Washington state is blocking Wyoming coal from being exported,” he said. “Their actions threaten American energy dominance and harms energy workers in Wyoming.”

Maia Bellon, who leads Washington’s Department of Ecology, has dismissed such criticism. In a letter to Barrasso last year, she said it was “frankly nonsense” to suggest her office denied the water quality permit to the Millennium project based on a philosophical opposition to the facility.

The reasons for the denial were simple, Bellon added: the project failed to meet water quality standards and “failed to provide any mitigation plan” for areas it would “devastate.”

On Tuesday, Wyoming Gov. Mark Gordon is scheduled to testify before the Senate Environment and Public Works Committee, which Barrasso chairs, about Section 401 certifications.

It’s a delicate issue for Republican governors, in fossil-fuel-rich western states, who may be both wary of ceding regulatory power to the federal government, but also eager to see new infrastructure built to transport coal and natural gas to new markets.

“The issue of coal export terminals on the West Coast being blocked is something that continues to concern Governor Gordon,” Michael Pearlman, Gordon’s communications director, said by email last week. “The ability to export our energy resources is critical to our economy.”

‘A Tough Year’

Barrasso’s crusade to revamp Section 401 permitting comes at a hard time for the coal industry in his home state.

In the past year or so, Wyoming has seen major coal mining bankruptcies—Westmoreland Coal Co., Cloud Peak Energy and Blackjewel. Utility PacifiCorp recently announced early closure plans for coal power plants, and over the past decade, the state's coal production fell by about a third.

“Coal’s had a tough year in Wyoming, let’s just put it that way,” said Robert Godby, director of the Energy Economics and Public Policies Center at the University of Wyoming.

He added that this wasn’t a total surprise for people like himself who monitor the state’s coal industry closely. “We’ve been talking about a downturn for awhile,” he said.

Last year, the Powder River Basin, a region in Wyoming and southeast Montana, where the bulk of the nation's coal comes from, produced about 324 million short tons of coal, down from nearly 496 million in 2008, federal data show. Godby said a problem in the basin today is overcapacity, where the same number of mines are chasing fewer and fewer customers.

“Margins are getting thinner, costs are going up, prices are coming down,” he said. “This is not a long-run sustainable outcome.”

Even if just the Millennium project, and another scuttled export facility about 90 miles north of Seattle had been built, they together might have handled 100 million tons of Powder River Basin coal exports.

“Theoretically it could have been a real boon to Wyoming,” Godby said.

But there’s more to it. Godby said it isn’t clear Wyoming companies would have ended up supplying the lion's share of the coal for the Millennium terminal. Instead, it’s very possible that Montana mines would have claimed much of the business, at least initially, he said.

He also said that the Oakland project, were it to come online, would be unlikely to provide much help to Wyoming coal. Its capacity would be relatively small compared to the amount of coal that the state produces, and the facility would probably be able to get plenty of coal from Utah, which is nearer to it by rail anyway.

Swings in sale prices for coal in Asia, competition from foreign mines and fluctuations in diesel fuel costs for trains that carry coal to ports, are just a few other reasons why expanding export facilities may not be enough to spur a big turnaround in the direction of Wyoming’s coal sector.

“If you think about it more in reality,” Godby said as he discussed the prospects of Wyoming coal exports, “it was always risky. Because the export market is incredibly volatile.” How climate policies will evolve adds another layer of uncertainty, he noted. “How long will coal be demanded,” he said. “And will demand start to decline?”

Bill Lucia is a Senior Reporter for Route Fifty and is based in Olympia, Washington

NEXT STORY: How Sacramento County connects and protects new vote centers