Connecting state and local government leaders

A look at how state pay floors will compare to cost of living in each U.S. state next year.

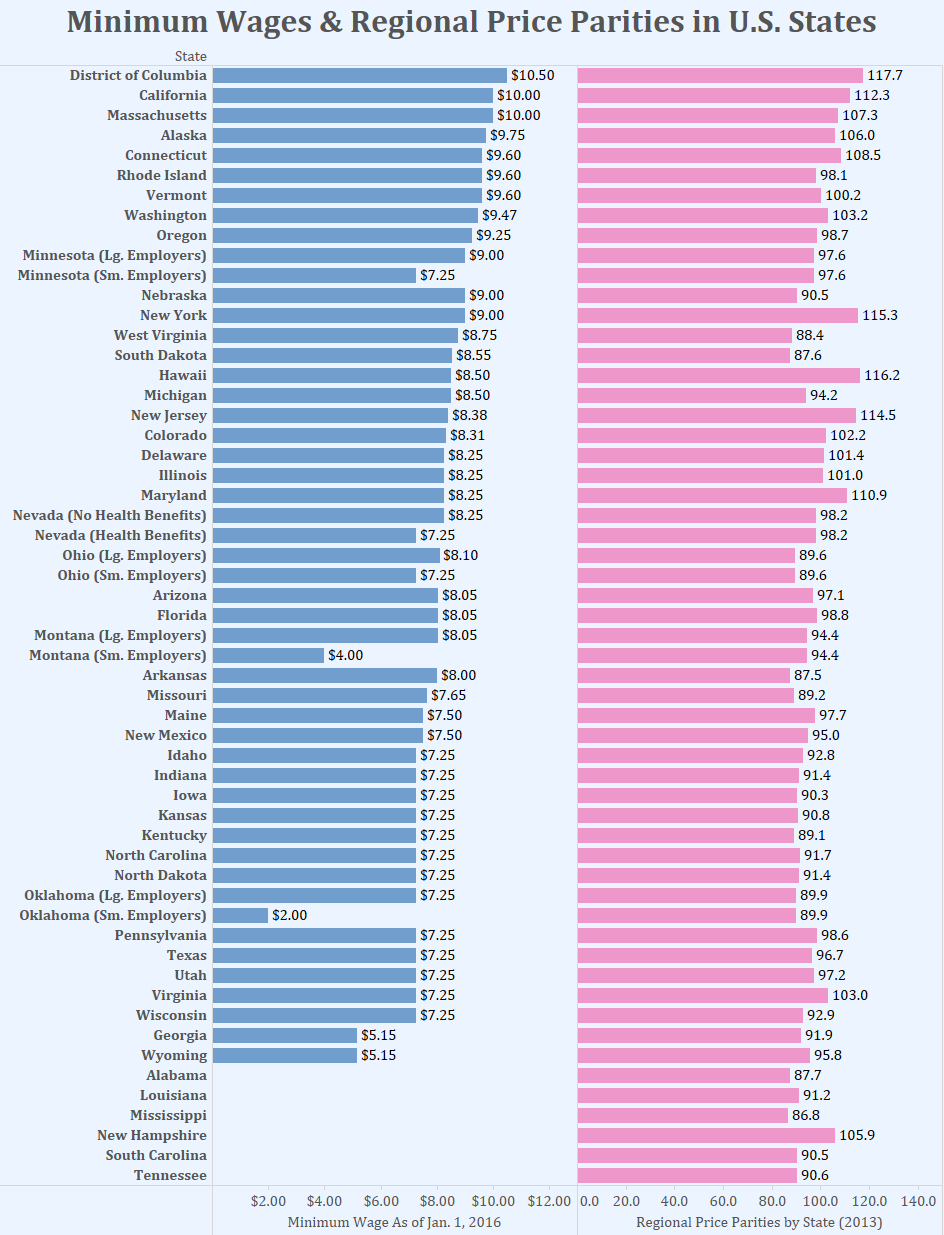

With their pay floors set at $10 per hour, California and Massachusetts are poised to begin 2016 with the highest state minimum wages in the U.S., according to information published online by the National Conference of State Legislatures.

In Washington, D.C., meanwhile, the minimum wage will be slightly higher at $10.50 per hour. The federal minimum wage is currently set at $7.25, but there are some exemptions that allow certain workers, such as those that receive tips or work on small farms, to be paid less.

Across the U.S., 29 states and the District of Columbia will have minimum wages set higher than the federal pay floor on Jan. 1, according to NCSL.

Five states, based on the information NCSL has published, have not put their own minimum wage laws in place. These states include: Alabama, Louisiana, Mississippi, South Carolina and Tennessee. New Hampshire repealed its minimum wage law in 2011, deferring to the federal minimum wage.

The chart below ranks states according to what their hourly minimum wages are set to be on Jan. 1, 2016. It does not show minimum wages for cities, only states.

To offer a window into the cost of living in each state, the chart also displays what are known as “regional price parities.” These figures are for 2013 but were published by the U.S. Bureau of Economic Analysis in July of this year.

Regional price parities offer a way to measure differences in the price levels of goods and services between states. According to the Bureau of Economic Analysis, they are expressed as a percentage of the overall national price level for the U.S. each year, which is equal to 100.

So, for example, Hawaii’s regional price parity was the highest of any state in 2013 at 116.2. This means prices for goods and services there were estimated to be approximately 16 percent higher than the U.S. average.

Including the regional price parities in the chart is meant to give some sense of the purchasing power of the various minimum wages in states across the U.S.

Footnotes: Minnesota - For large employers with an annual sales volume of $500,000 or more, the minimum wage is currently $9.00; for small employers, those with an annual sales volume of less than $500,000, the minimum wage is $7.25.

Nevada - $8.25 without health benefits; $7.25 with health benefits.

Ohio - $7:25 for employers grossing $283,000 or less Montana - The $4.00 rate applies to businesses with gross annual sales of $110,000 or less; $8.05 applies to all others.

Oklahoma - Employers of ten or more full time employees at any one location and employers with annual gross sales over $100,000, irrespective of number of full time employees, are subject to federal minimum wage; all others are subject to state minimum wage of $2.00.

(Photo by a katz / Shutterstock.com)

Bill Lucia is a Reporter at Government Executive's Route Fifty.

NEXT STORY: Calif. to Take on Gig Economy Labor Rights; Mo. Lawmakers Aim to Punish Student Athlete Protesters