Connecting state and local government leaders

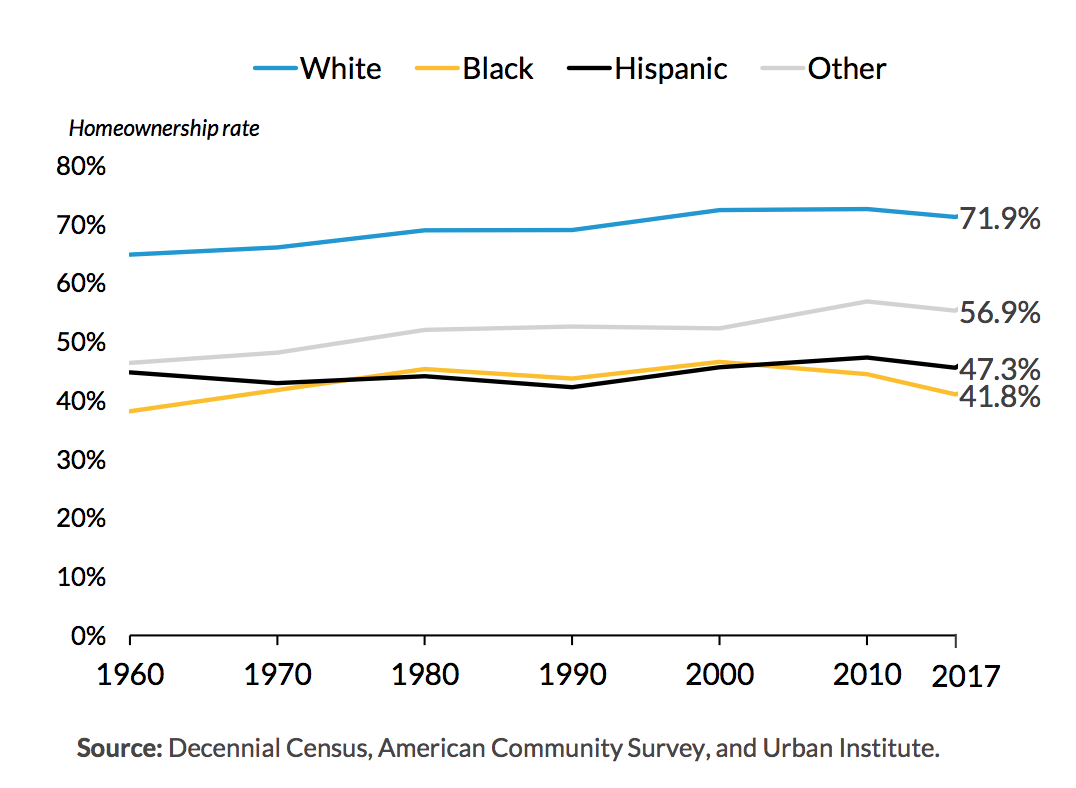

The gap between white and black homeownership has also remained largely the same since the 1960s, despite economic and political gains that African Americans have achieved since then.

African Americans have long struggled with fair access to housing. Although the Fair Housing Act in 1968 was supposed to end discriminatory practices, there are still myriad challenges that lie in wait for black homebuyers who seek to purchase affordable residences in neighborhoods with convenient access to transportation, grocery stores, schools, and other amenities.

How those challenges persist to today has been illuminated by reports this week that show the black homeownership rate fell consistently from its peak of 49.1% in 2004, to a 50-year low of 41.8% in 2017.

Though the percentage change may not seem like much, it translates into some very big numbers. “If the homeownership rate was the same as it was in 2000, there would be 770,000 more black homeowners today,” said Jung Hyun Choi, a research associate at the Urban Institute. “Black homeownership has simply not recovered since the [2008] crisis, compared to other groups,” she said, speaking at an event about the white-black homeownership gap on Tuesday.

Why the gap has persisted both so steadfastly and for so long is still a matter of debate among researchers. Some posit that so-called “credit worthiness” contributes most substantially, including Jaya Dey, a senior economist for Freddie Mac. Credit worthiness determines an applicant’s readiness for a mortgage, and factors that influence the rating include past bankruptcies, delinquencies, and foreclosures, as well as an applicant’s income and credit score. “Lots of minorities are considered ‘mortgage weak’ simply because they don’t use credit or don’t trust banks,” explained Dey. “Only 19% of African Americans are mortgage ready, compared to 34% of whites.”

Others, including Choi, said demographic differences between racial groups also play a role. “Marital composition, FICO score distribution, income distribution, and age distribution are the four key factors that explain a large proportion of black-white homeownership gap,” she said. Factors like education, which one might expect to influence homeownership, don’t play as significant of a role—black college graduates are actually less likely to own homes than whites without a college education.

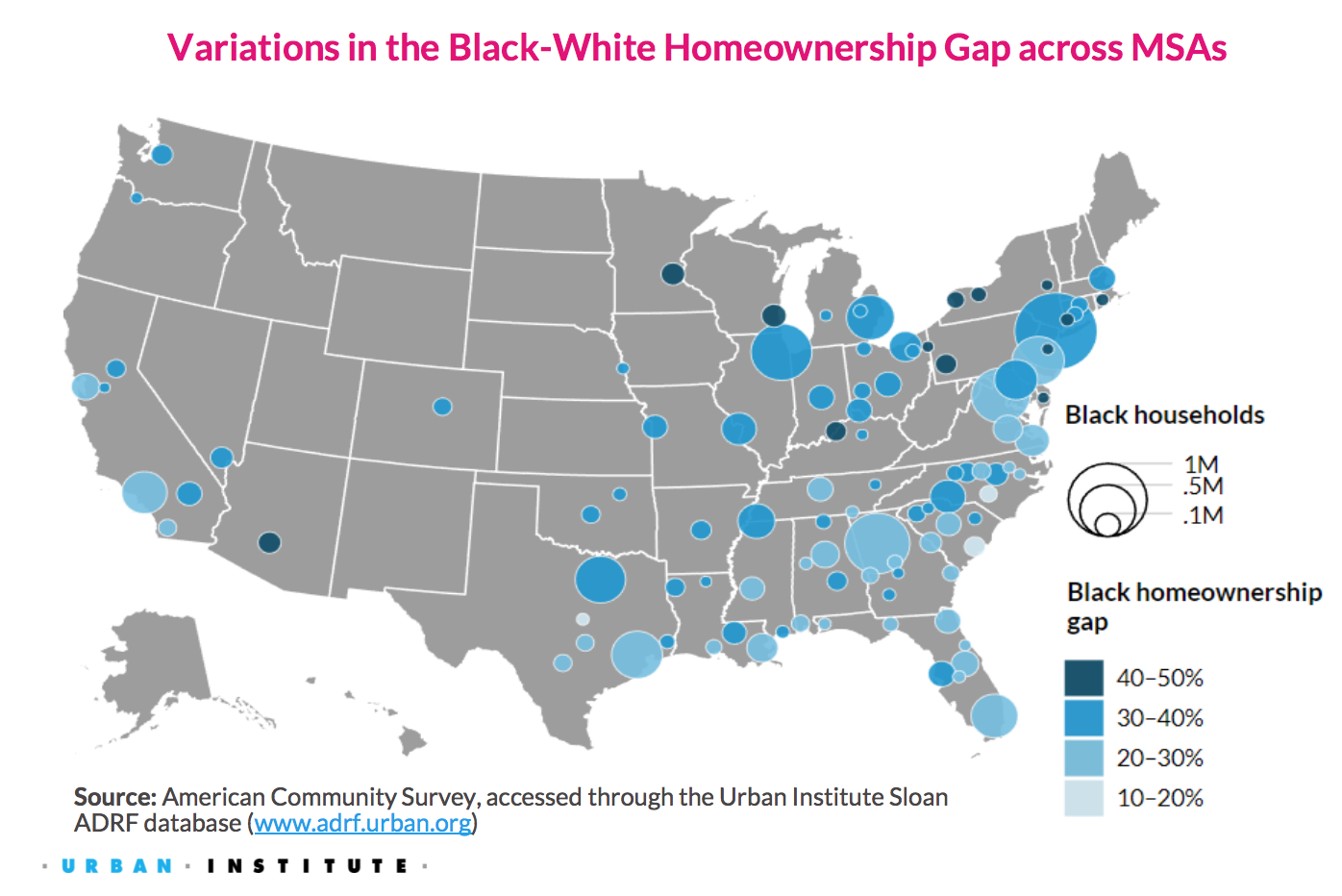

The distribution of the gap isn’t even across the country, either. In 2017, the gap between the white rate of homeownership and the black rate of homeownership ranged from 51% in Minneapolis to 15% in Charleston, South Carolina. Of the 31 cities in the country with over 100,000 black households, only four (Orlando, Nashville, Boston, and Columbia, South Carolina) have seen an increase in the rate of black homeownership since the beginning of the Great Recession in 2008. In cities where homeownership generally declined since then, the dropoff was much steeper for African Americans.

Alanna McCargo, the vice president of the Housing Finance Policy Center at the Urban Institute, pointed out that these findings mean that cities with vastly different housing markets need to take an active role in closing the gap. “This is not just a national housing crisis,” she said. “This is a local housing crisis. In addition to federal attention, a specific focus on these race disparity issues will be needed at the local level.”

Cities may want to focus in particular on younger generations now, as the white-black homeownership gap seems like it will persist among millennials without intervention. For young people, though, a new challenge has arisen with the increase in student debt. “There’s an intergenerational aspect to student debt, as white students get more support from their parents paying for college, which reduces their debt, and then they get help with their debt loans,” Choi said. “Young black students don’t have the opportunity to reach out to their parents in times of difficulty, so they are more likely to default on their student debt. That’s negatively impacting the black young adult homeownership rate.”

But there may not be much that localities can do in the absence of serious changes made at the federal level and in the lending sector. Researchers suggested re-evaluating the enforcement of various federal policies, including the Fair Housing Act and the Credit Reinvestment Act. The way that mortgage readiness and credit worthiness are calculated by companies may also need to be updated to recognize the cultural differences between communities, such as varying trust in banks and differing familial structures.

If localities and the federal government are able to work together on solutions, researchers are optimistic that narrowing or closing the white-black homeownership rate could create a wave of positive effects. “The housing gap explains most of the wealth gap between white and black families,” said Susan Wachter, a professor of real estate and finance at the University of Pennsylvania. “And owning a home hedges against future rent increases, which, in a time of rampant gentrification, matters more than ever.”

Emma Coleman is the assistant editor for Route Fifty.

NEXT STORY: Why Local Governments Are Considering Balloon Release Bans