Connecting state and local government leaders

Six years ago and millions of dollars since, Oregon launched the first state-sponsored retirement program for private sector workers. Today, 19 states have launched or plan to launch their own savings programs.

You're reading Route Fifty's Public Finance Update. To get the latest on state and local budgets, taxes and other financial matters, you can subscribe here to get this update in your inbox twice each month. You can find a full archive of these newsletters here.

Welcome back to Route Fifty’s Public Finance Update! I’m Liz Farmer, and this week I’m writing about state-sponsored retirement plans for private sector workers and what we’ve learned so far.

Nearly half of employees in the U.S.—roughly 57 million people—work for an employer that does not offer a traditional pension or a retirement savings plan. Before states launched savings programs, only a small percentage of those workers had saved on their own, and those savings were generally paltry. According to the National Institute on Retirement Security, the median retirement account balance in 2015 was $2,500 for all working-age households and $14,500 for near-retirement households.

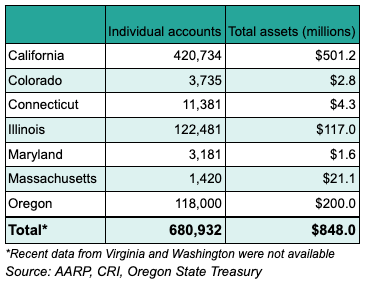

Six years ago this month, Oregon became the first state to offer a retirement plan, OregonSaves, to full- and part-time workers who didn’t have access to one through their employer. Since then, eight more states—California, Colorado, Connecticut, Illinois, Maryland, Massachusetts, Virginia and Washington—have opened plans, and another 10 have passed enabling legislation. The plans are free for participating employers and self-funded through retirement account fees.

As state plans have become available to more workers through phased-in enrollment periods beginning with the largest employers, retirement savings have started to improve.

When all nine states complete rolling out retirement plans to all eligible employers, it’s estimated they will serve roughly one-quarter of private sector workers across the country. In California alone, the plans could cover more than 7 million people.

Not only are these plans boosting retirement security, but research also shows that they are ultimately helping states’ bottom lines. A study by the Pew Charitable Trusts and eConsult Solutions found that retirement savings shortfalls could “lead to increased pressure on public assistance programs, reduced tax revenue and decreased household spending by retirees, while at the same time shifting a growing fiscal burden to a shrinking population of working-age taxpayers.”

All told, the study estimates that insufficient household retirement savings will ultimately cost states more than $334 billion over the next two decades.

Beyond lessening the financial burden on states, retirement security also means that older Americans will be contributing to economic growth, notes David C. John, senior policy advisor at the AARP Public Policy Institute.

“The more we have a population that is ready with significant retirement assets, the more likely they are to … go to restaurants, travel and spend money on things other than necessities,” he said. “So both situations—the demand on services and helping the state economy—are definitely a positive to future taxpayers.”

Keeping It Simple

With six years under its belt, there are plenty of lessons to glean from OregonSaves when it comes to setting up and running the program.

The most significant lesson learned, according to Oregon State Treasurer Tobias Read, is the simpler, the better. “You don’t need to make it complicated,” he said. “Keep the experience for your savers as light a touch as possible.”

As the first out of the gate, OregonSaves learned that lesson early on, and other states have taken note. For example, Oregon’s program rolled out in six phases (one each year) from large employers on down. After six years, the state is now starting to enroll their smallest businesses, and Read said that in retrospect, they didn’t need to space out enrollment that much.

Most states now, he said, are rolling their plans out in three phases, which helps the plans grow more quickly. And as assets and participants increase, individual administrative costs decrease.

John of the AARP Public Policy Institute notes that Oregon and California originally had an additional savings account feature in their plans that they eventually dropped. Under the feature, the first $1,000 a worker saved went into an “emergency” account meant to cover unexpected costs. But in a low interest rate environment, that emergency account wasn’t earning much in investment returns, and it was an extra administrative expense. Moreover, because the retirement savings accounts are Roth IRAs, savers can withdraw funds for emergency purposes from those accounts without a penalty.

“Now that money just goes into the target date fund,” John said, “which is more cost effective and, frankly, is a better and less complicated solution.”

The Knock-On Effect

Another lesson learned stems from a best practice.

In Oregon, eligible workers are automatically enrolled at a preset savings rate: typically 3% to 5% of earnings are deducted from paychecks unless individuals opt out. That’s based on research that says autoenrollment makes people 15 times more likely to save for retirement.

But this “nudge theory” has extended beyond individuals. John and Read both said that, anecdotally, they’ve seen growth in private sector employers offering their own retirement plans. Read predicts that some employers may see OregonSaves as a starting point but eventually offer their own plan as business grows.

“We are just putting people in a position to do what’s in their best interest,” said Read. “And what we’ve seen is not only is this doable, but people need it and want it.”

NEXT STORY: Win the audit: How agencies can prepare for financial audits