Connecting state and local government leaders

This is particularly a problem in California, where catastrophic wildfires in 2018 caused more than $9 billion in losses to insured property.

This story was originally published by Stateline, an initiative of The Pew Charitable Trusts.

BOULDER, Colo. — A few months after Chris Cook and his family moved from California into a four-bedroom house nestled among ponderosa pines in the foothills here, they got a letter saying their home insurance policy had been canceled.

The insurer, Allstate, had concluded—after an assessor visited the property—that the house was too likely to be destroyed by a wildfire. Cook, a tech executive and recent transplant from the San Francisco Bay Area, said his reaction was something like, “Wait, what?!”

Mortgage companies require homes to be insured, so the cancellation put Cook’s financing at risk. He worried that getting another major insurer to sign off on the home would be more challenging after one had turned him down.

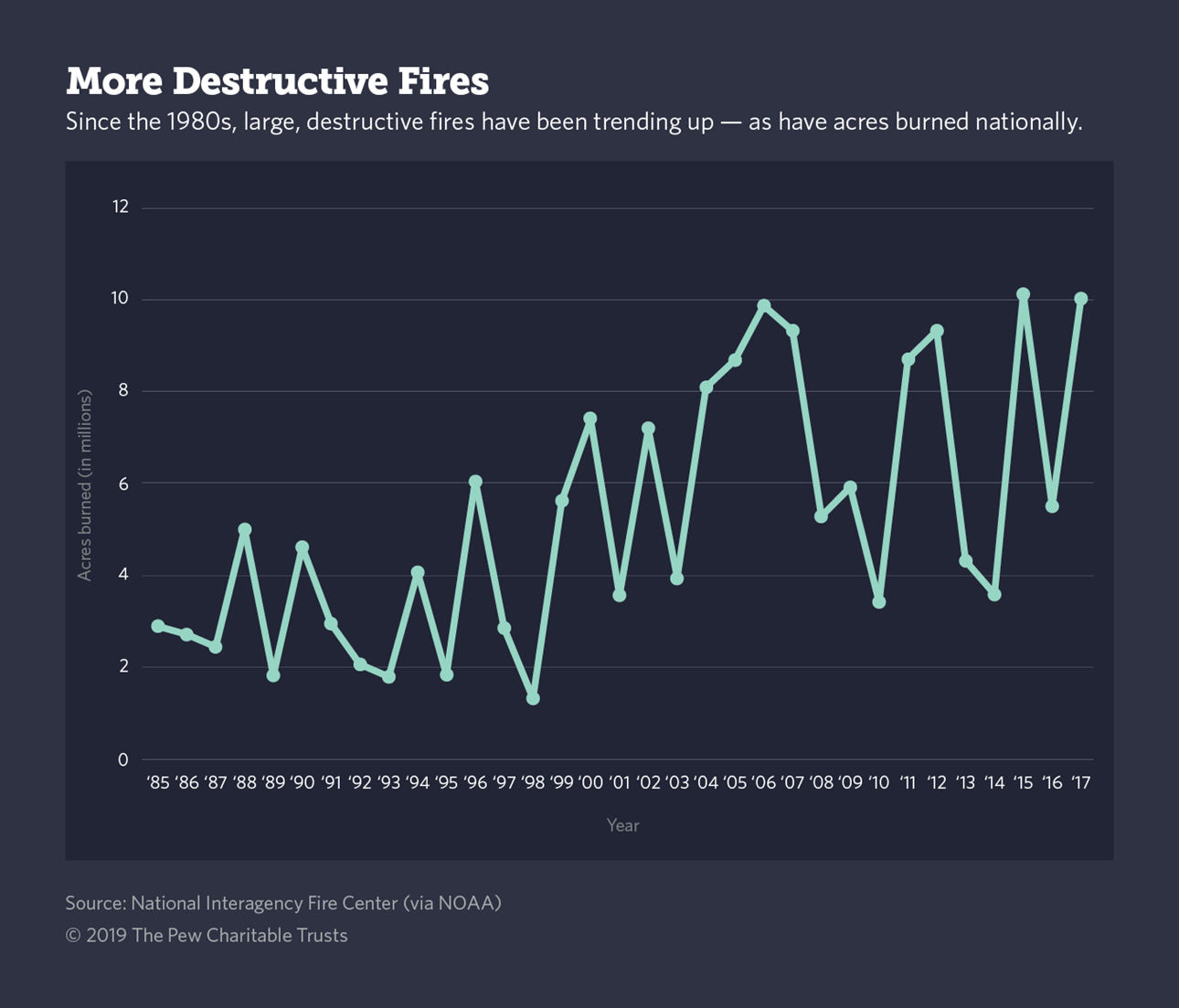

He’s not alone. As more and deadlier fires sweep through Western states, it’s becoming harder to get home insurance on a property surrounded by forest, reachable only by backroads, or on slopes where a wildfire is likely to run.

While most homeowners in fire-prone places can still get a policy, insurers often make coverage conditional on homeowners managing trees and undergrowth. And some might get denied by several insurers before finding one willing to take on the risk.

States and counties are beginning to step up their efforts to help homeowners make their properties as safe as possible.

The challenge is most acute in California, where catastrophic wildfires in 2018 caused more than $9 billion in losses to insured property, according to the state Department of Insurance. The Camp Fire that blazed through the town of Paradise and destroyed nearly 14,000 homes drove a small, local insurer into insolvency.

California’s insurance department doesn’t have hard numbers on how many homes have been denied insurance because companies aren’t required to report that information, said press secretary Nancy Kincaid.

But since 2014, more than 15,000 homes in medium or extreme fire-risk areas have turned to the state’s lender of last resort, the California Fair Access to Insurance Requirements Plan, which insurance companies created to serve people unable to find coverage elsewhere. Premiums also are rising in high-risk areas, Kincaid said.

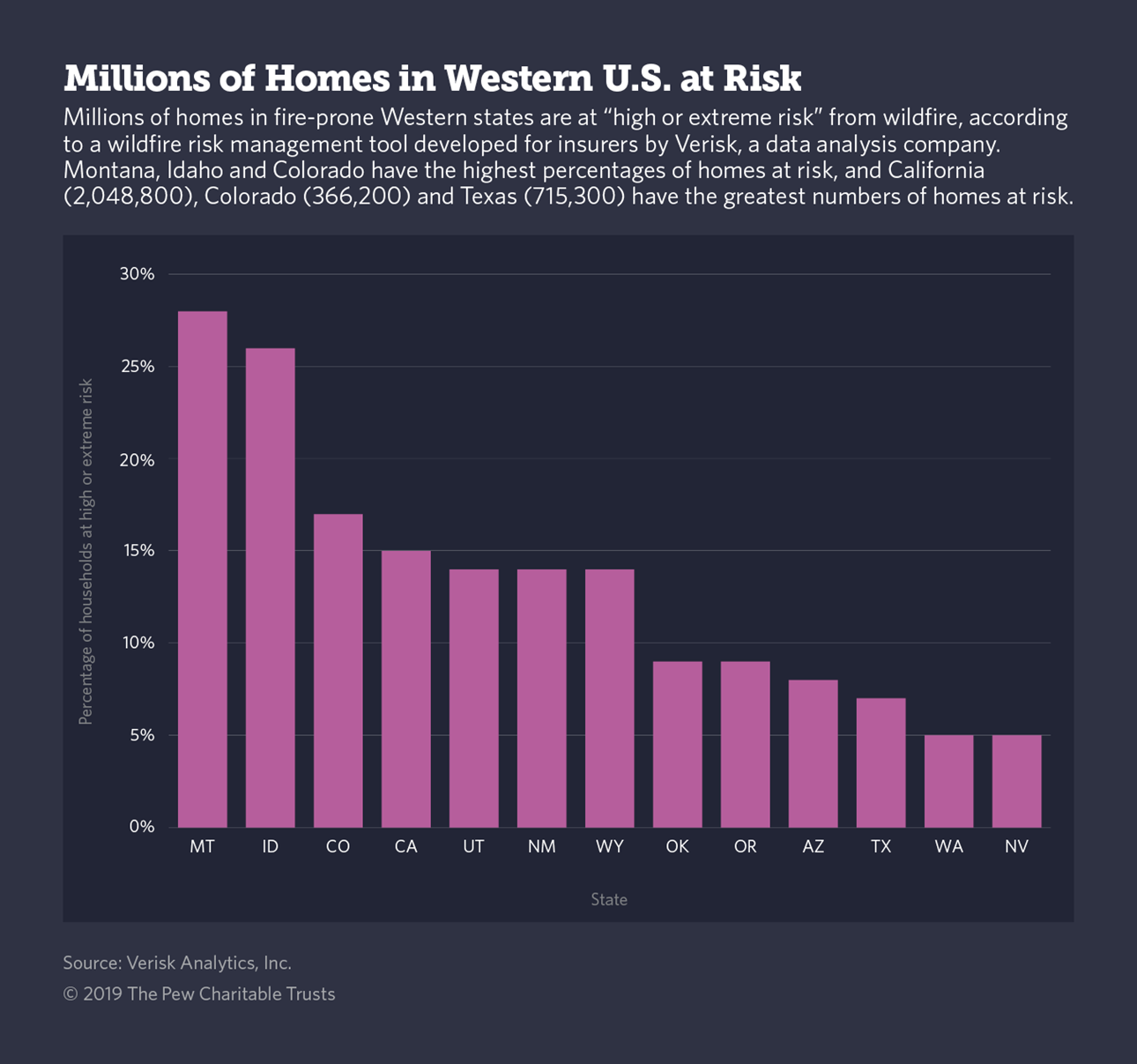

Scientists expect wildfire danger to increase as the climate changes, according to the latest federal climate report. Meanwhile, more people than ever live in forested areas, with millions of homes threatened in California, Colorado and Texas, according to Verisk Analytics, a company that models wildfire risk for insurers.

“The [California] commissioner remains concerned,” Kincaid said, “that between climate change, and drought, and the way and where we built homes, that we’re going to see a growing trend of non-renewals.”

Homeowners can reduce risk, however, by removing fire hazards. In Boulder, Cook’s broker told him that he likely could get Allstate’s underwriters to reconsider if he worked with a nationally regarded Boulder County program to remove problem trees and brush.

The program, Wildfire Partners, helps people create what foresters call “defensible space” around their homes by lopping off low tree limbs, removing leaves from gutters, and taking other steps that make it harder for fire to travel.

The program’s coordinator, Jim Webster, wants homeowners ultimately to think of mitigation as another form of home maintenance, he said. “It’s becoming more and more standard, and the expectation of living in the wildland-urban interface.”

Insuring Homes in a Fire-Prone Place

Insurance companies now use satellite data to assess fire risk at a given location. Verisk’s FireLine tool, for instance, weighs factors such as topography, vegetation, wind patterns and accessibility—because homes are safer if it’s easier for firefighters to get there.

When a potential customer calls Truett Forrest, a State Farm agent in the mountain town of Pagosa Springs, Colorado, he plugs their address into his company’s wildfire risk rating tool. The algorithm puts the home in one of three categories: no concerns, high risk or extreme risk.

Forrest estimates that about 10 to 15 percent of properties land in the third category, a classification that means State Farm won’t provide insurance.

“It doesn’t matter if they cut every tree and bush on their property, we would not insure it because of where it sits,” he said.

Houses judged to be at high risk—the second category—can get insurance if the owners take steps to protect their property, such as clearing brush and taking piles of firewood off their deck.

“For most homeowners, it’s affordable,” said Bill Trimarco, the Archuleta County coordinator for Wildfire Adapted Partnership, a nonprofit that helps property owners in Pagosa Springs, the county seat, plan and pay for wildfire mitigation work.

Trimarco estimates that treating a 150-foot radius around a house typically costs less than $2,500. That’s “less than a new heater, if it broke.” At least one insurer, USAA, gives discounts to homeowners who live in a Firewise USA community.

The designation from the nonprofit National Fire Protection Association affirms residents have reduced their fire risk. There are 1,500 Firewise communities nationally, according to the association.

But mitigation is time-consuming and somewhat subjective, some experts say. Many variables determine why one house burns and another doesn’t.

Homeowners can end up getting advice from an expert like Trimarco that contradicts that of an assessor sent by their insurer to look at the property. They also might hear different things from the same insurer over time, as risk models and underwriting standards evolve.

Forrest said his own home was formerly classified by State Farm as an extreme fire risk. The company doesn’t drop current customers in very risky areas, but if Forrest had sold the home, the new buyer likely would have been denied State Farm insurance. His home is now classified as high risk, he said, thanks to a 2017 update to the company’s risk analysis software.

The Wildfire Partners Approach

Since 1993, Boulder County has required everyone who builds a house on the western side of the county—where the city ends and the Rocky Mountains begin—to do wildfire mitigation work. After the 2010 Fourmile Canyon Fire tore through 169 homes in the foothills, county land use officials decided they needed to step up mitigation efforts.

They created the Wildfire Partners program in 2014 in response, to clear up confusion about mitigation best practices and push more homeowners to take part.

The Wildfire Partners program is staffed by forestry and fire protection experts and advised by insurance companies, including Allstate, that have pledged to accept certificates earned by families who complete work on their property.

The program has two employees and several contractors, and is funded by a mix of county money and about $2.6 million in state and federal grants. It’s open to residents who are required to participate and those who are not. Close to 1,900 homeowners have received advice so far.

After Cook got the letter ending his insurance, he called Wildfire Partners for help. Within a week a specialist was at his house, walking around the house and the forested mountainside behind it, pointing out problems.

“I was prepared for—‘Oh, you’ll have to clear-cut everything,’” Cook said. He was advised, instead, to keep a healthy distance between trees and cut back saplings and brush pressing up against them, which both reduces the chance of a dangerous fire and allows the savanna-like grassland among the pines to flourish.

The specialist later sent Cook a to-do list—mostly cutting back long grass that was creeping up to his back patio and removing some nearby bushes and trees—which Cook hired the local fire protection district to complete. The work cost $1,100 but Cook paid only $500, thanks to a subsidy from Wildfire Partners. The program paid for the visit from the specialist, too.

When the work was done, Cook received a certificate of completion and submitted it to Allstate. It had taken weeks of stress, peppered by threatening letters to him from his mortgage lender, but thanks to the certificate his insurance was reinstated.

Without Wildfire Partners, “I’m not sure what the answer would have been,” he said, standing on his back patio one sunny morning as his two dogs snuffled in the pine woodland beyond. Maybe he would have had to hire an expert to give the insurance company a second opinion, he said. Or get an expensive insurance policy from a bottom-tier company.

Cook’s mortgage broker didn’t respond to Stateline’s requests for comment.

Tanya Robinson, a communications consultant for Allstate, said in a statement that generally, the insurer requires defensible space to be created and managed in high-risk areas. The company uses the Colorado State Forest Service’s guidelines to identify issues, and the customer needs to address those issues to continue their coverage, she said.

Planning for the Future

Some researchers who study businesses’ response to climate change say insurers should be doing much more to prevent people from living in areas where fire danger is severe. “At some point, insurance companies have to adapt. It has to happen,” said Andrew Hoffman, a professor of sustainable enterprise at the University of Michigan’s Ross School of Business.

And some policymakers say the government should be cracking down. Given the intensity of recent fires in California and the likelihood that such blazes will continue to tear through communities, localities should consider banning home construction in some areas, California’s top firefighter told the Associated Press last month.

“We’ve got to continue to raise the bar on what we’re doing, and local land use planning decisions have to be part of that discussion,” said Ken Pimlott, director of the state Department of Forestry and Fire Protection. He also suggested updating wildfire warning systems and making buildings more fireproof, particularly those that may shelter evacuees after a disaster.

Colorado Gov. John Hickenlooper, a Democrat, in 2013 convened a task force on wildfire insurance. The group of local, state and federal officials and representatives from the insurance, mortgage and homebuilding industries recommended that the state rate homes’ wildfire risk from 1 to 10.

It also suggested sharing that information with insurers and homebuyers, creating a statewide mitigation program, and charging a fee to homeowners in high-risk areas.

Homebuilders opposed the risk rating idea, arguing that it was tantamount to placing a “scarlet letter” on a home and that it was unnecessary, said Ted Leighty, CEO of the Colorado Association of Homebuilders. “We don’t necessarily think a rating needs to happen from the government. It’s already happening, through insurance underwriting.”

But policymakers also face pressure from residents, homebuilders and insurers who don’t want to disrupt the property market or leave some people trapped in uninsurable homes.

“When you put a number 10 on a house, it can change the game. In a lot of cases, it could make property un-sellable,” Amie Mayhew, then the head of the Colorado Association of Homebuilders, told the Denver Post after the task force released its report.

The task force recommendations didn’t result in any legislation, although Hickenlooper in 2013 did sign a separate bill that addressed insurance issues such as replacement coverage in a bid to help disaster survivors. Meanwhile, about half of Coloradans now live close to or within areas at risk of wildfire, according to the state Forest Service’s latest assessment. That’s 2.9 million people.

In California, advocates for property owners are pressuring lawmakers to help people find and keep their insurance, but want to avoid shaking a market that still works for most people.

“We are trying not to use the word crisis, because we’re trying to keep the insurance industry calm,” said Amy Bach, executive director of United Policyholders, a group that advocates for consumers.

California lawmakers have in recent years passed a slew of legislation intended to help homeowners. A law passed in September prohibits insurers from canceling policies for one year after a declaration of a state of emergency solely because a residence is in or near the emergency zone.

The state since 2005 has required homeowners in high-risk areas to maintain a 100-foot defensible space around their homes. Since 2008 it has required them to use fire-resistant methods, such as installing vents that won’t trap embers, in new home construction.

But the new building codes don’t apply to existing homes, said Yana Valachovic, a forest adviser at the University of California cooperative extension in Humboldt. And the defensible space rules don’t focus enough on landscaping immediately around a home, she said.

Grassroots efforts such as Wildfire Partners are a better approach than top-down state regulations, its director Webster said, because communities all face slightly different situations.

For instance, the individual home certification model doesn’t work in places where homes are packed tightly together, he said. In those cases, what neighbors do to address risk matters, and it makes more sense for the entire development to work on mitigation together.

Defensible space isn’t guaranteed to stop a fire from consuming a home, particularly if that blaze is a fast-moving inferno like the one that swept through Paradise. But many communities across the West are hoping that a more coordinated approach to mitigation will help reduce their risk.

One other Colorado county and a six-county region in the state have programs like Wildfire Partners, and Trimarco’s group in Pagosa Springs would like to set up something similar in Southwest Colorado. Webster is now getting calls and emails from officials in California who want to learn more about the program.

Carole Walker, executive director of the Rocky Mountain Insurance Information Association, a Colorado-based industry group, says she’s talked to local leaders who want to replicate the program but can’t afford to.

Homeowners, local governments, and state and federal governments have a role to play in encouraging and funding the work, she said. “It’s a dangerous situation. It needs to be addressed, from a public safety standpoint.”

While some homeowners resist the idea that they need to cut down trees on their property, many are happy to spend a little extra money to keep their families safe. “I’m glad we had to go through the process,” Cook said, “because I know a lot more about how to keep things prepped.”

NEXT STORY: GOP AGs Weigh in Against States in Census Case Before Supreme Court